Bitcoin halving has taken place and we have not yet experienced the rapid declines that cryptocurrency investors feared. The largest spot Bitcoin ETF issuer, Grayscale, is making a new move. According to Bloomberg ETF analyst Eric, this move could provide a good alternative for investors. Here are the details.

Coming Soon: GBTC Mini Version

Grayscale Investments announced that a mini version of the Grayscale Bitcoin Trust (GBTC) exchange-traded fund will soon be launched. The new fund will allow investments at much more attractive rates than the current GBTC transaction fees. In fact, Grayscale also announced that it will have the lowest transaction fee among all spot Bitcoin ETFs.

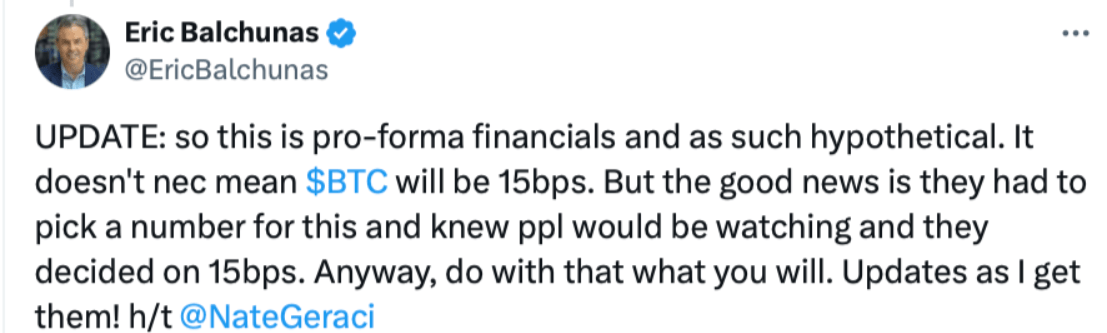

Bloomberg ETF analyst Eric Balchunas recently wrote in a social media post; Crypto Traders Are Rushing to This App – Here’s Why You Should Too

“These are pro-forma financials and therefore hypothetical.”

This means that investors should not get their hopes up based on details that are still open to revision on paper.

“The good thing is that they had to set a transaction fee. They settled on 15bps, which is interesting.”

Application documents submitted to the United States Securities and Exchange Commission state that the transaction fee for the Grayscale Bitcoin Mini Trust (BTC) has been set at 0.15%. For GBTC, these fees are 1.5%.

Will Cryptocurrencies Rise?

The loss of interest in the ETF channel was related to bankruptcies, macroeconomics, and regional tensions. However, we are slowly seeing these issues being resolved. On April 19, ETFs saw net inflows again. The latest step by GBTC can also be considered positive for demand in the ETF channel.

Apollo’s CEO Thomas Fahrer recently stated on his social media account that Grayscale needs to balance the major GBTC outflows by offering a “cheap” alternative.

“Since its launch, Grayscale has lost 315,000 BTC in outflows and they need to close this gap.”

Since the launch date on January 11, GBTC investors have made net sales of $16.73 billion. However, despite this, all spot Bitcoin ETFs have seen over $12 billion in net inflows. This means that a significant portion of investors did not completely abandon BTC with the GBTC sale. If the expected rapid rise period starts in the coming months, the FOMO in the ETF channel could yield impressive results.

Türkçe

Türkçe Español

Español