Bitcoin approached its highest level in two weeks on August 29th with the news that digital asset manager Grayscale won its case against US regulators. With this victory, Grayscale took an important step towards launching the first spot Bitcoin ETF in the US, creating a positive impact on the market.

SEC Behaved Capriciously with Bitcoin ETF Rejection

Data from TradingView shows that BTC/USD gained approximately $1,700 in value within 30 minutes in response to the court decision. The news disrupted the dull crypto market environment that had been continuing after the sudden losses in mid-August. The decision by the United States Court of Appeals for the District of Columbia Circuit stated that the Securities and Exchange Commission (SEC) was wrong in rejecting Grayscale’s application to launch an exchange-traded fund based on Bitcoin spot price.

“The rejection of Grayscale’s proposal was arbitrary and capricious because the SEC could not explain its differential treatment of similar products. Therefore, we accept Grayscale’s petition and overturn the decision.”

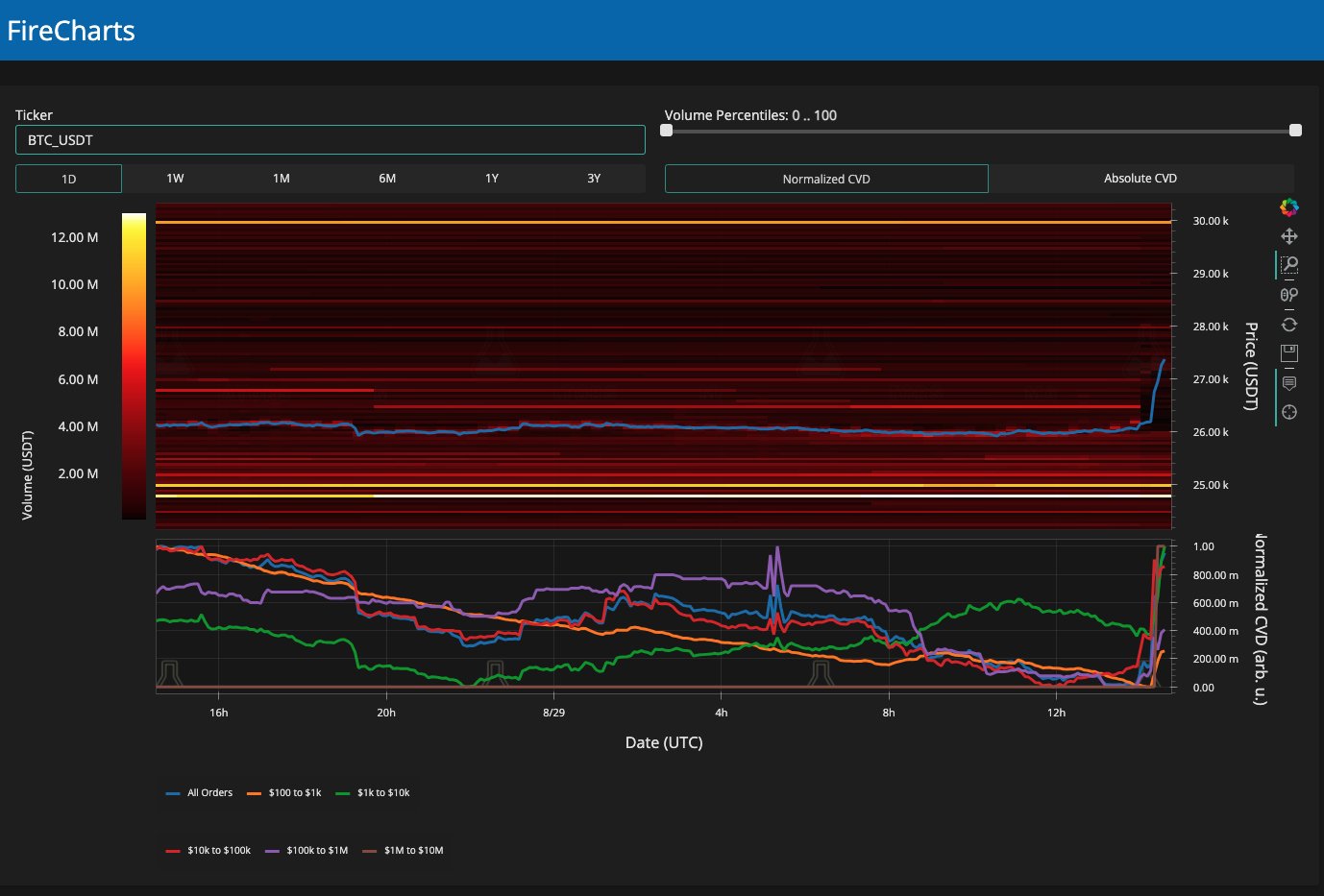

As a result, Grayscale joined the waiting list of companies that want to launch the first spot Bitcoin ETF in the US, as the SEC has not yet approved any applications. Data taken from Binance‘s BTC/USD order book, uploaded to the tracking source Material Indicators, included the rise encompassing all order classes that increased purchases in a liquidity-starved market.

Grayscale’s announcement was preceded by the following statement in an analysis:

“The 6-month view of order book data suggests that there is thin liquidity upwards for a retest of $30,000, which should be fairly easy, but we haven’t seen enough sensitivity yet to do that because the market is afraid of what will happen if BTC starts making lower lows.”

Analyst Announces “Bull Cycle” in BTC Price

Michaël van de Poppe, the founder and CEO of the trading company Eight, continued to respond to the court’s decision, claiming that it could have a positive impact on existing ETF applications, including the application of BlackRock, the world’s largest asset manager.

“It may sound strange, but we may be on the verge of the beginning of a bull cycle with this news.”

Grayscale’s legal battle with the SEC has been long and slow, and CEO Michael Sonnenshein was among those who insisted that the company would not rest until it is allowed to convert its current Bitcoin investment vehicle, Grayscale Bitcoin Trust (GBTC), into an ETF. Following the court’s decision, Sonnenshein thanked the company’s investors and supporters on X.

“We are grateful for your support and encouragement. Next up: our legal team actively reviewing the Court’s opinion.”

The GBTC share price increased over 17% during the day, reaching $20.60 at the time of writing.

Türkçe

Türkçe Español

Español