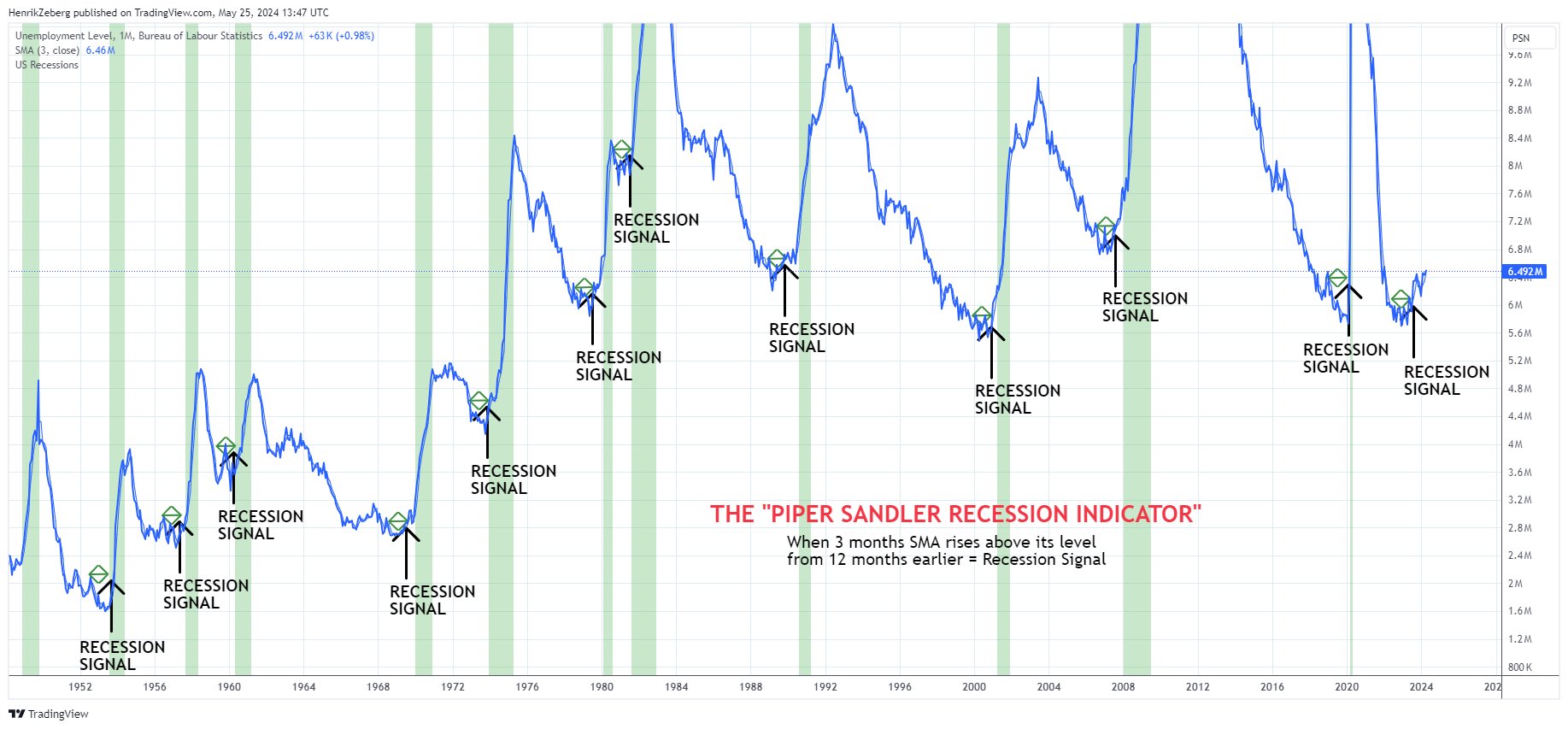

Macro economist Henrik Zeberg has drawn attention with the “PIPER SANDLER RULE” which he claims has accurately predicted recessions since the 1940s. According to Zeberg, this rule is currently signaling a recession, indicating upcoming economic problems. Zeberg pointed out the slow deterioration in the labor market and the pressure high interest payments exert on the real economy, which he said would put consumers in a difficult position.

Expectation of Severe Economic Recession

Henrik Zeberg predicted a severe recession on the horizon that could include crises in banking and pension funds. He opposed the idea that the Federal Reserve or liquidity injections could prevent the impending economic downturn. Zeberg emphasized that the real economy is in danger. Warning against optimistic rhetoric like “higher for longer” or the belief that the Fed will prevent a major recession, Zeberg stated that such approaches are hollow.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

However, Zeberg predicted that before the recession begins, markets will experience one last surge characterized by a “peak blow-off” phase in the business cycle. During this period, markets may reach new highs before the inevitable downturn. While there may be short-term gains, these could quickly disappear due to significant economic turmoil that follows.

Henrik Zeberg’s analysis highlighted the importance of paying attention to fundamental economic indicators rather than relying solely on central bank interventions or market sentiment. Zeberg argued that understanding the dynamics of the real economy is crucial for predicting and effectively navigating periods of economic decline.

How Might Bitcoin Behave in a Recession?

Bitcoin‘s behavior during economic recessions can be quite contradictory. This is because this cryptocurrency is seen as both an alternative to traditional financial instruments and a safe haven. Firstly, when economic uncertainty increases and inflation risks rise, demand for decentralized and limited-supply assets like Bitcoin may increase. In such a scenario, Bitcoin may become attractive for those looking to hedge against volatility in traditional markets.

On the other hand, recessions typically lead to financial distress, which can reduce overall investment capacity. In this case, investors might sell assets like Bitcoin to meet liquidity needs or offset losses in other areas of their portfolios. Additionally, during periods of economic uncertainty, risk appetite generally decreases, and investors tend to gravitate towards safer and more stable assets. This can lead to a decrease in demand for risky assets like Bitcoin, causing their prices to fall.

Türkçe

Türkçe Español

Español