Two senior crypto analysts at Bloomberg suggest that the likelihood of a spot Bitcoin (BTC) exchange-traded fund (ETF) being approved in the US has risen above 90%, while market participants on Polymarket have become more pessimistic, reducing the probabilities.

Statement from Bloomberg Analyst

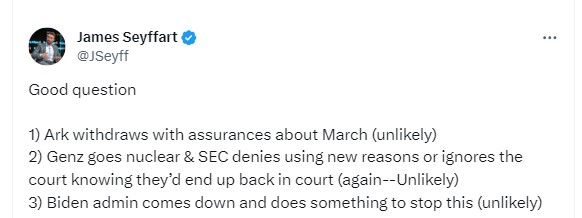

Bloomberg ETF analyst Eric Balchunas commented on the probability of the Securities and Exchange Commission (SEC) rejecting proposals after Friday’s update filings, saying in a post on Saturday:

At this point, I probably favor 5%. But you have to leave a small window open for these things.

The expert had previously estimated the odds at 90% in November, indicating that updated forms at the time showed providers were moving in the right direction. However, according to data from Polymarket, crypto market participants are more pessimistic about approval being granted before January 15. Participants have collectively invested about $500,000 betting on a delay or even rejection of approval, causing last week’s 90% rate to drop.

The ETF Process in Cryptocurrencies

A large part of the crypto markets is still expecting this week’s crucial decisions by the SEC to lead to the introduction of the first spot Bitcoin ETFs to professional investors in the country. A regulated proposal is expected to attract billions of dollars in Bitcoin demand, making it one of the most closely watched catalysts in the asset’s history.

Additionally, more than a dozen applicants hope to launch the first spot Bitcoin ETFs in the US. On Friday, several amended 19b-4 filings on behalf of issuers like BlackRock, Grayscale, and Fidelity joined last month’s amended S-1 filings, addressing feedback. While Bloomberg analysts have raised the probability of US spot Bitcoin ETF approval to over 90%, market participants are more pessimistic, focusing on the SEC decisions to be made this week.

Türkçe

Türkçe Español

Español