Bitcoin  $118,204‘s price has once again surpassed $63,500, moving towards a critical level. A rise above $64,000 may soon be possible. According to technical analysts, consistent closes above $61,700 are what they aim for to signal impressive short-term bullishness. Analyst Carl has also shared the price chart for AVAX Coin, suggesting a major movement might be underway.

$118,204‘s price has once again surpassed $63,500, moving towards a critical level. A rise above $64,000 may soon be possible. According to technical analysts, consistent closes above $61,700 are what they aim for to signal impressive short-term bullishness. Analyst Carl has also shared the price chart for AVAX Coin, suggesting a major movement might be underway.

Avalanche (AVAX) Chart Insights

On September 9, analyst Carl noted that AVAX was below $24, expecting an impending rise. Now, AVAX has surpassed $26, and the ongoing increase in BTC price supports the continuation of this rally. This article will delve into the supportive stock market dynamics and the overall market sentiment in the second section.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

The targets set by the analyst sharing the above chart are $28, $33, and $41.3, followed by levels above $54 and $60. AVAX may attempt higher levels to break its 2024 record. Last month, the Avalanche team announced significant news in the RWA sector for trillion-dollar Franklin, along with the recently initiated AVAX trust by Grayscale during a period of market pessimism.

Will Cryptocurrencies Surge?

We have extensively covered details about the Fed, but The Kobeissi Letter suggests housing inflation may surprise the Fed due to rising home prices. Housing prices surged during 2020 and 2022, maintaining a significant position in inflation as prices increased by 50% over the last five years. The macroeconomic data source states;

“2020: Rates fall to 3%, housing prices soar due to strong demand.

2022: Rates reached the highest levels since 2001, leading to skyrocketing housing prices due to low supply.

2024: Rates are set to decrease with the largest cut since 2008; what will happen to housing prices?”

Historically, lower rates mean higher housing prices due to stronger demand. Now rates are falling, but does that mean prices will drop?”

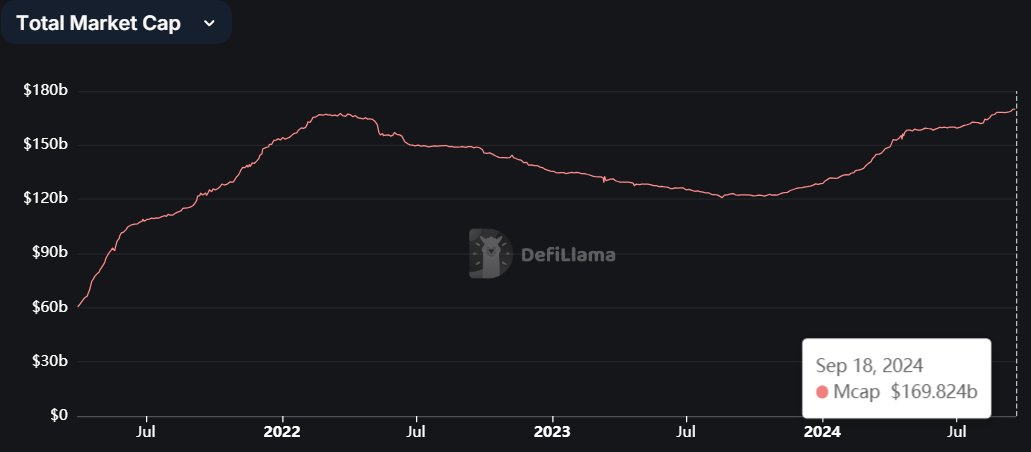

While the Fed is set to initiate a 50bp rate cut, it has indicated caution to avoid destabilizing the economy. Nonetheless, the potential for inflation to return should not be underestimated. Patrick Scott notes that the total value of stablecoins (excluding algo stablecoins) is nearing $170 billion, predicting that cryptocurrencies will rise.

His goal is to surpass $200 billion, and as liquidity entering cryptocurrencies increases, altcoins may reach the expected profit margins.

Türkçe

Türkçe Español

Español