Crypto traders are emphasizing that the increase in M2 money supply is now a positive momentum signal for Bitcoin. The first positive turn in the M2 money supply since November 2022 suggests that recent Bitcoin sales may soon slow down, which is considered a sign that investors are seeking protection against inflation.

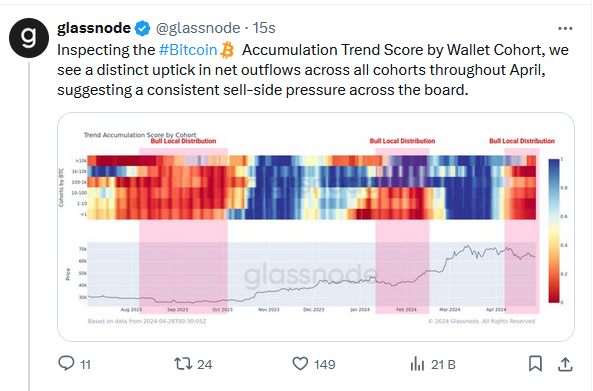

Glassnode Releases Report

Crypto analysis firm Glassnode reported on May 2 that there was a net outflow in Bitcoin throughout April, indicating consistent selling pressure. Meanwhile, Bitcoin’s price has fallen by 9.75% over the last 30 days, currently trading at $59,586.

M2 Money Supply, a measure of all cash and short-term bank deposits held nationwide, turned positive year-over-year as of May 1. This indicates a general increase in circulating money and is usually seen as a sign that investors are moving towards assets that perform better during high inflation periods.

Historically, Bitcoin and the cryptocurrency market have started to perform better than traditional financial markets with the increase in global M2 supply. This situation could mean a new rise in BTC and cryptocurrencies in the coming period.

Predictions for Bitcoin Begin to Surface

The positive change in M2 money supply has also led crypto traders to speculate on Bitcoin prices, as the supply had been in a negative zone since November 2022. Professional trader and finance writer Oliver L. Velez offered an optimistic outlook to his 49,800 followers on May 2, stating that M2 Money Supply was positive on an annual basis for the first time:

“All I can say is, ‘buckle up’ and hold on tighter. Any downturns are buyable. See these as gifts and ignore the doomsayers. We are not at the end of the Bitcoin bull run.”

Crypto analysis account InvestAnswers told its 204,700 followers on May 3 that “M2 money supply developments are accelerating rapidly! Get ready for the Bitcoin journey… Here the journey begins.” Raoul Pal had also indicated in October 2023 that looking at global M2, Bitcoin prices were set to rise.

Türkçe

Türkçe Español

Español