It seems that bulls and bears are fiercely competing in the cryptocurrency sector, especially regarding Bitcoin (BTC). While this struggle is ongoing in the market, analysts continue to share their bullish outlooks. In this context, a prominent market figure, PlanB, has presented a significant future BTC outlook.

Bitcoin Price Prediction

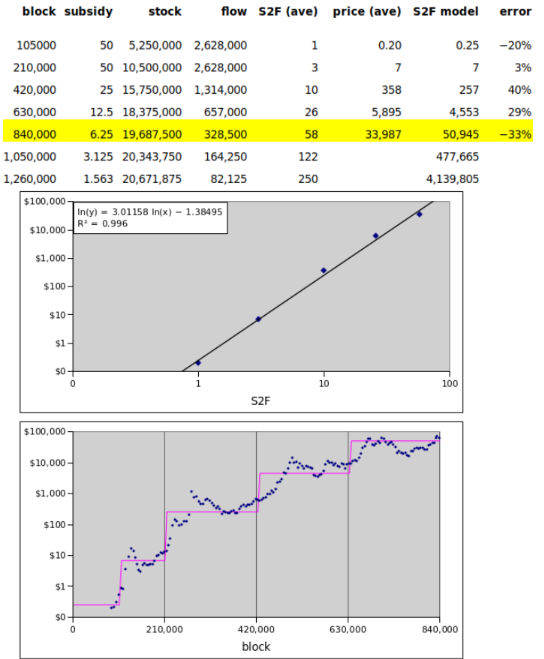

Cryptocurrency analyst and creator of the stock-to-flow (S2F) model, PlanB, shared a post on May 7 predicting the average Bitcoin price for the 2020-2024 halving period at $34,000.

This prediction was slightly below his previous 2019 forecast of $55,000.

Following this, PlanB updated the S2F model with new data pointing to similar parameters and results, setting the average Bitcoin price for the 2024-2028 halving at $500,000.

For the next halving period, 2028-2032, he calculated the Bitcoin price at $4 million.

Reviewing past statements, PlanB recently predicted that Bitcoin would surpass $100,000 in the second half of 2024.

The price closure in April was slightly above $60,000, representing a 36% increase since the beginning of the year (YTD).

Additionally, professional cryptocurrency investors and analysts suggest that a market peak might occur in 2025, potentially reaching a Bitcoin price level of $200,000.

BTC Price Analysis

As of writing, the current BTC price is at $62,471, which represents a 1.19% decrease over the last 24 hours.

Over the previous seven days, there has been a 7.42% progression, and recent data from May 8 shows a 13.90% decrease in the monthly chart analysis.

Bitcoin’s market cap has fallen to $1.23 billion, a 2% decrease. Bitcoin’s 24-hour trading volume is at $25 billion, with only a 0.1% decrease.

This 24-hour volume reflects the market’s uncertainty, with sellers hesitant to sell and buyers cautious about purchasing.

On the other hand, the reluctance of sellers to short-sell under uncertain market conditions could also reflect an expectation of a market rise among the same group.

Türkçe

Türkçe Español

Español