Bitcoin price today fell below $60,000 after a long period, with most altcoins experiencing rapid losses. However, some, like BTC, continue to perform well even as they search for new lows. Among all cryptocurrencies traded on the Binance exchange, the best performers at the time of writing are BOME, INJ, and SUI Coin. What are the reasons for their price increases? What are the current price predictions?

SUI Coin Commentary

The price of this altcoin rose today due to a partnership with a China-based technology company. The partnership with a subsidiary of ByteDance, the company behind TikTok, was big news. We will see what results this partnership with the social media giant brings in the future, but for now, it is enough to boost the price.

SUI Coin, which had dropped to $0.89, rebounded to $1.35 today. However, it has not yet reclaimed the $1.42 support level. If BTC allows, and with the support of the latest positive news, it could test the $2.11 resistance level anew.

INJ Coin Commentary

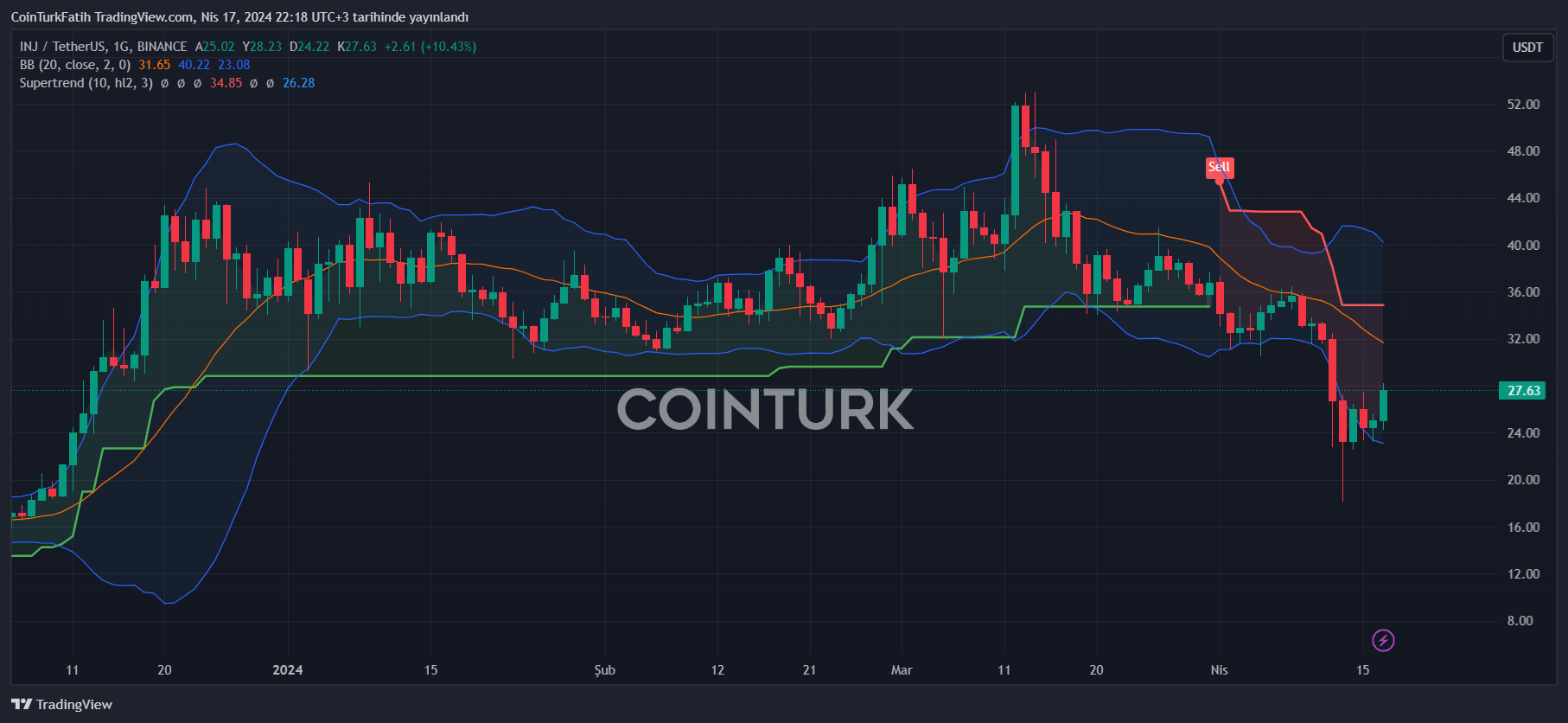

INJ Coin is also in the news this week. A significant 3.0 update affecting the token economy has been announced. The vote is expected to be completed by the end of the month. Annual inflation will significantly decrease with this update. A double-digit reduction in inflation is targeted every three quarters. Naturally, as token inflation decreases, an increase in INJ Coin’s price is expected.

If the voting and implementation are completed smoothly, this development could yield positive results for the price in the medium and long term. Despite a shakeup from BTC’s decline, the price has somewhat recovered following the latest news. If the $23.5 support level is maintained, a new attempt towards $32 could be seen. Reclaiming this region as support would lay a solid foundation for peaks above $50.

BOME Coin Commentary

BOME Coin was listed at a very opportune time but the events as of March 20 were a surprise. If BTC targets $67,000 again, the price, currently just below the $0.0098 support, could quickly return to $0.013. Current conditions are creating an unpleasant pressure on risk markets.

Predictions indicate that by Friday evening, after the stock markets close, the direction of the tension with Iran will be clearer. For now, two things can improve the negative sentiment in the markets. First, if April’s inflation turns out to be excitingly low (still weeks away from being announced), and second, if Israel makes a statement and announces they will not escalate the tension further.

Türkçe

Türkçe Español

Español