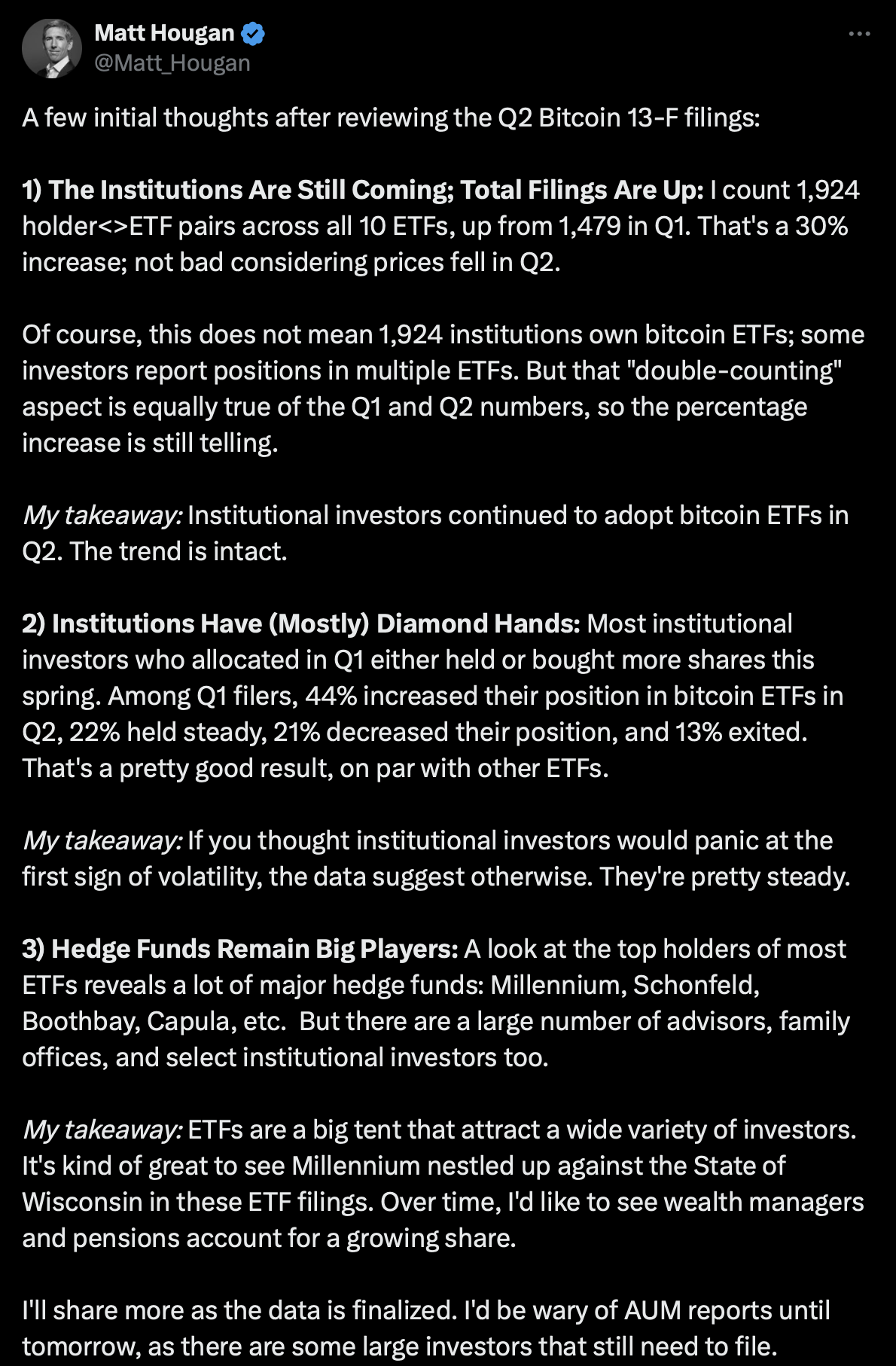

Bitwise’s Chief Investment Officer (CIO) Matt Hougan noted that institutional investors‘ interest in the Bitcoin (BTC) market is increasing. Hougan revealed that a total of 1,924 institutional investors hold funds in 10 spot Bitcoin ETFs traded on the exchange. This number indicates a 30% increase compared to the previous quarter.

Interest Remains High Despite Price Drops

Hougan emphasized that this increase continued despite the drop in cryptocurrency prices in the second quarter, stating, “This number does not mean that 1,924 institutional investors own spot Bitcoin ETFs. Some investors may have positions in multiple ETFs. However, since this double-counting situation is also valid for previous quarters, the percentage increase is still noteworthy.”

The CIO noted that institutional investors are generally “diamond hands,” meaning most investors avoid selling their spot Bitcoin ETFs. Accordingly, 44% of institutional investors who invested in the first quarter increased their positions in the second quarter, 22% remained steady, 21% decreased, and 13% exited.

Hougan added that these ratios are consistent with the activity in other ETFs and do not present any anomalies.

Highlighted the Significant Participation of Hedge Funds

Hougan stated that hedge funds continue to play a significant role in spot Bitcoin ETFs, highlighting that different types of investors also access the largest cryptocurrency through ETFs, saying, “Many advisors, family offices, and select institutional investors are also investing in Bitcoin through these ETFs.”

Hougan noted that spot ETFs attract a wide range of investors and expressed hope that asset managers and pension funds would hold a larger share over time.

According to current data, Bitcoin is trading at $58,742, down 2.15% in the last 24 hours.

Türkçe

Türkçe Español

Español