The International Payments Bank (BIS) continues to take different steps in the blockchain sector. The bank has developed a concept proof platform (PoC) that allows tracking of on-chain data analytics from cryptocurrency exchanges, including Bitcoin, and public blockchain ecosystems. The team is working to continue the development of the project and add more data sources to the platform, with a focus on the Ethereum ecosystem after the tests on the Bitcoin network.

BIS Aims to Create a Secure Environment

In this work, BIS collaborates with Deutsche Bundesbank, De Nederlandsche Bank, the European Central Bank, and the Bank of France. The bank announced a successful PoC called Project Atlas to measure the macroeconomic suitability of cryptocurrency exchanges and DeFi protocols.

In its statement, the BIS Innovation Center highlighted the high-profile risks in the crypto industry, citing the Terra crash in 2022 that deeply affected many cryptocurrency investors. Referring to financial stability and the lack of potential risk associated with such protocols, the team published the details of the protocol that aims to provide accurate and transparent analysis, information, and economic insights about the sector.

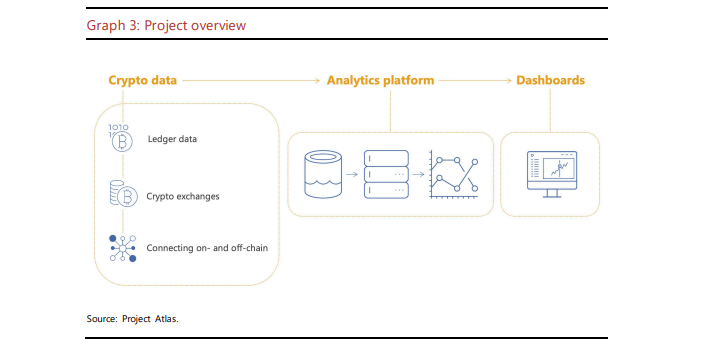

Project Atlas makes a breakthrough by combining on-chain data from cryptocurrency exchanges with data from public blockchain ecosystems, allowing the tracking of cryptocurrency flows between geographic locations. In the initial phase, transactions transferred to centralized exchanges on the Bitcoin network for cross-border flows and the locations of the exchanges will be monitored.

The Team Announced the Roadmap

Project Atlas will serve as a platform that visualizes data collection and analysis results, including on-chain transfers and global movements of funds. The PoC will provide an overview of cross-border fund flows and a data flow for central banks to assess their relative economic importance in different jurisdictions within the crypto ecosystem. The team summarizes this situation as follows:

“The data will allow for the structural analysis of flows and the investigation of the impact of price shocks, financial market developments, and country characteristics on crypto flows.”

The team also announced that they will add more data sources to the platform to move to the next development stage. With a specific focus on the Ethereum ecosystem, the team will also add data from DeFi protocols to the platform.

Türkçe

Türkçe Español

Español