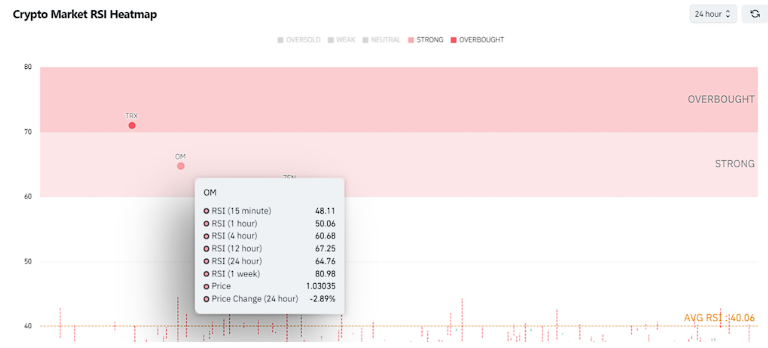

While the volatile price movements in cryptocurrencies continue, CoinGlass’s Relative Strength Index (RSI) heatmap on July 12 provided important information about some potential altcoins. The overall market RSI average remains at 40.046 today, staying below neutral. Despite this, some cryptocurrencies’ RSI values and technical outlooks may be giving buying signals.

MANTRA (OM) Comments

The first cryptocurrency thought to be giving a buying signal is MANTRA (OM). The RSI values for OM in various time frames reflected a strong outlook. The 15-minute RSI was calculated at 48.11, while the 1-hour RSI was 50.06, and the 4-hour RSI was 60.68, which could be interpreted as increasing buying pressure.

On the other hand, the 12-hour RSI value was 67.25, while the 24-hour value indicated 64.76. More importantly, the weekly RSI value was 80.98, which could be considered high even for overbought conditions. Despite a 2.62% drop in the last 24 hours, this strong RSI outlook might be seen as a buying opportunity among investors.

OM price continues to find buyers at the $1.07 level after the recent drop. The market cap is 888 million dollars, while the 24-hour trading volume dropped 51% to 81.6 million dollars.

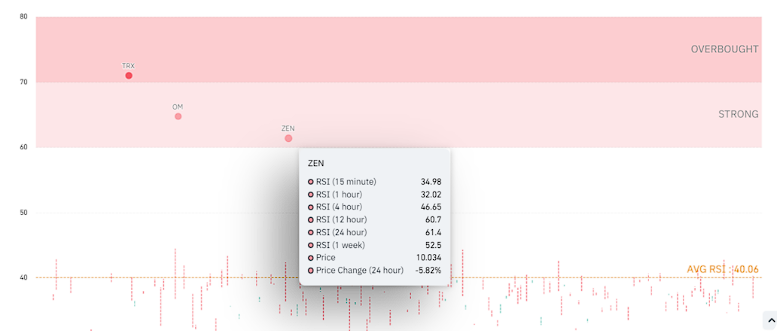

Horizen (ZEN) Price

The RSI value for Horizen (ZEN) reveals strong buying pressure in the market. The short-term RSI values for ZEN, starting with the 15-minute one, showed 34.98, while the 1-hour indicators were 32.02, indicating a sell zone. This suggests that ZEN might escape from overselling and potentially rise in the coming days.

The 4-hour RSI showed 46.65, while the 12-hour RSI value was approaching the overbought zone at 60.7. The 24-hour RSI value for ZEN was 61.4, and the 7-day value was 52.5, staying above neutral. Despite a 12% drop in the last 24 hours, the RSI values continue to suggest a potential recovery.

After the price drop, ZEN fell below $10 and found buyers at the $9.52 level. The market cap for ZEN also dropped similarly to 143 million dollars. The trading volume remained relatively stable, with only a 3% decrease to 23 million dollars.

Türkçe

Türkçe Español

Español