The cryptocurrency market has recently experienced a significant shift in sentiment and has now entered a new phase characterized by bullish speculation. This change in sentiment is evidenced by Bitcoin’s (BTC) Fear and Greed Index, which has risen to 65% today. This level indicates a significant increase in crowd greed and a growing fear of missing out (FOMO) among investors.

Increased Buying Pressure in the Cryptocurrency Market

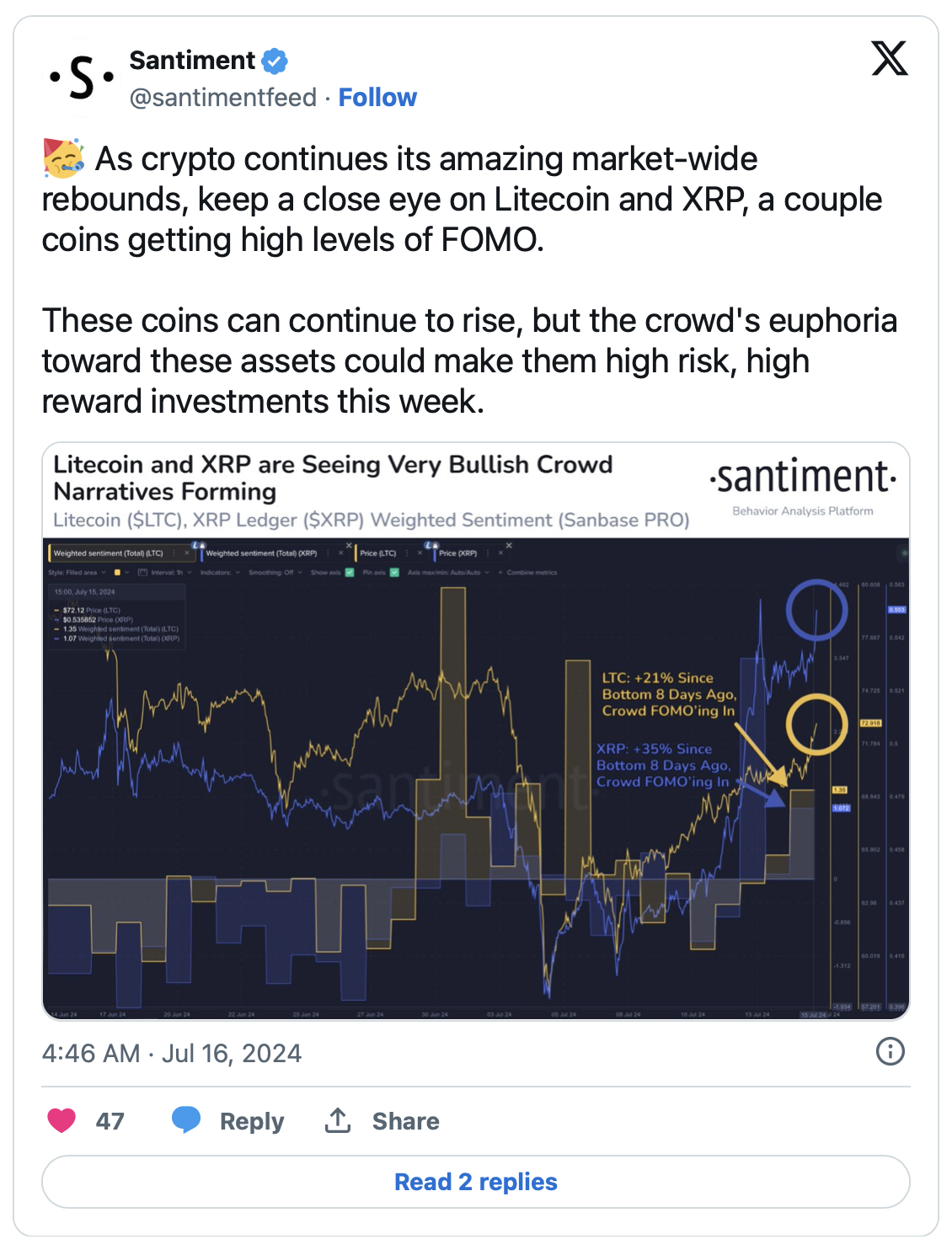

Leading stablecoin issuer Tether recently contributed to the overall buying pressure in the market by minting $1 billion USDT on the Tron network. On-chain data shows that long-term cryptocurrency investors have recently increased their accumulation rates. For example, spot Bitcoin ETFs in the US have seen over $1.5 billion in cash inflows in just the past two weeks. Additionally, on-chain activities in the altcoin sector have significantly increased due to news flows about the potential listing and trading of spot Ethereum ETFs in the US next week. This has led to close monitoring of altcoins ahead of the spot Ethereum ETF approval. Cryptocurrency analysis firm Santiment reported that two altcoins are currently standing out: Ripple’s XRP and Litecoin (LTC).

Speculations around XRP have intensified due to the expectation of a possible settlement in the ongoing lawsuit between the US Securities and Exchange Commission (SEC) and Ripple Labs. According to on-chain data analysis by Santiment, XRP has seen a notable increase in FOMO, with its value rising over 20% in the past five days.

Currently, XRP is trading above the $0.50 threshold and holds approximately 1.33% market dominance. From a technical perspective, XRP needs to reclaim the 50 and 200 Moving Averages (MAs) on the weekly chart as a support level to secure a rise towards the next target range of $0.58 to $0.60.

Litecoin’s LTC has also shown impressive performance, standing out among altcoins with its price rising over 20% in the past two weeks, surpassing the $70 threshold. This price increase is attributed to increased whale activity on-chain and growing FOMO among investors. Similar to XRP, LTC’s price needs to close above the weekly 50 and 200 MAs to invalidate the prevailing downtrend of the past four months.

What’s Next?

The recent activity in both XRP and LTC reflects a general trend of renewed investor confidence and increased buying pressure in the cryptocurrency market. The minting of $1 billion USDT by Tether and significant cash inflows into spot Bitcoin ETFs in the US indicate growing interest and investment in cryptocurrencies. As the market awaits the listing of spot Ethereum ETFs, further increases in on-chain activities and price movements are expected.

Türkçe

Türkçe Español

Español