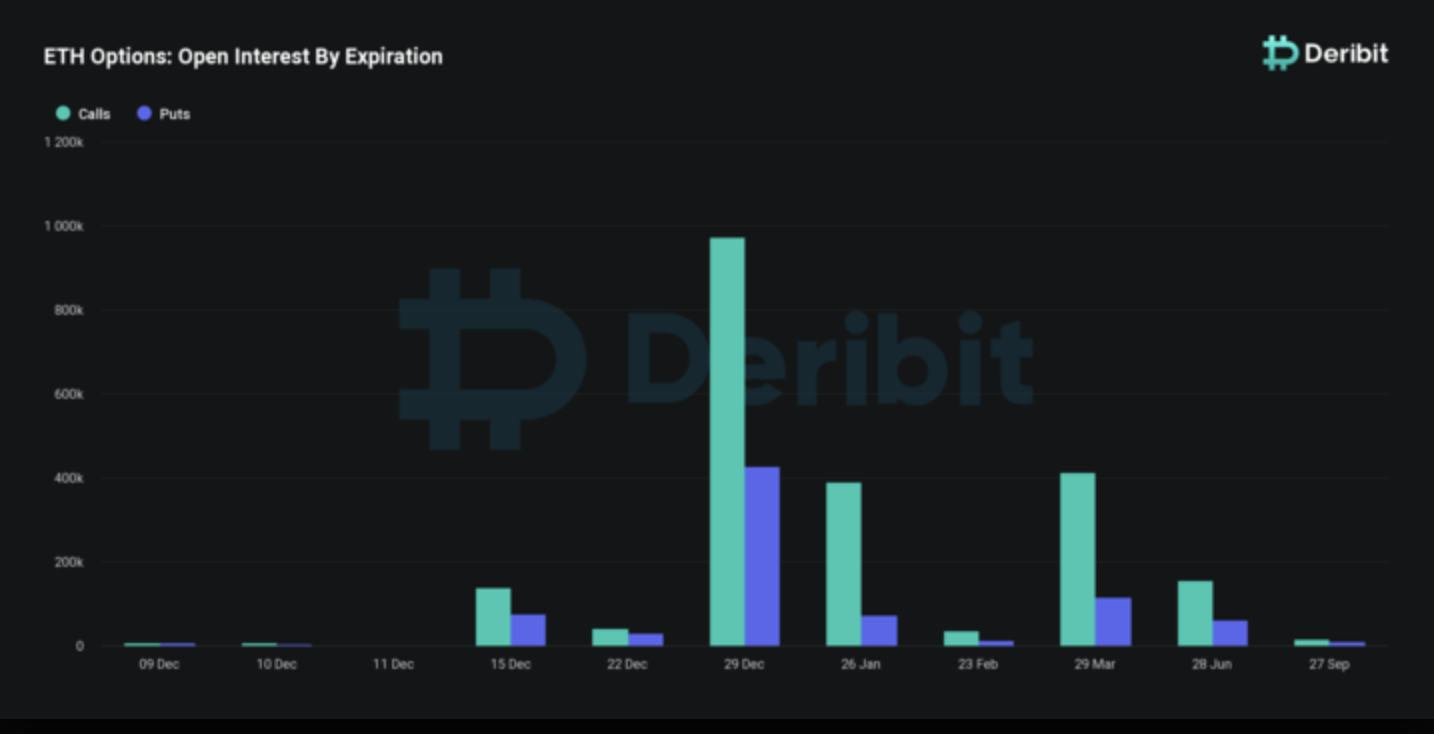

According to data from the futures exchange Deribit, there are more pending calls in Ethereum option contracts than long positions before the end of January. These calls are happening towards investors who prefer to short. Accordingly, investors have two options; they should either add more assets to their contracts or bear the loss.

Famous Name Draws Attention with Ethereum Prediction

Deribit’s Commercial Director Luuk Strijer announced that this situation indicates many investors predict Ethereum’s price will gain value by early 2024. Strijer made the following statement on the subject:

“If you look at the end of the year Ethereum maturity, the put-call ratio is 0.44, which means a ratio of 10 calls against 4.4 puts. In January 2024, this ratio is 0.19. This means 2 puts against every 10 calls and shows a much more bullish distribution.”

The ratio of call options being below one indicates that the purchase volume exceeds the sales volume and there is a bullish trend in the market. A buyer of a call option indirectly shows a bullish trend in the market, while a buyer of a put option shows a bearish trend. Deribit data also shows that there were more than twice as many sales calls as sales transactions before the maturity that took place on December 29th.

Investors Predict Ethereum Price Will Increase

Among the approximately 974,000 call options pending for the end of the month maturity, the largest group is the call options at the $2,500 exercise price. This indicates that many futures investors predict that the ETH price will rise above this level by the end of December. There was a significant increase in the open interest in Ethereum options towards December 29th, the upcoming end of the month, quarter, and year end date. Strijers made the following statement on the subject:

“The December expiration is the largest expiration Deribit currently owns. Currently, there are nearly 50% of the total $7 billion nominal open interest in Ethereum options that will expire on December 29th, which is $3.3 billion.”

The increase in open interest indicates new money entering the market, increased participation, and potential liquidity. It also signals that new investors are showing interest in the cryptocurrency market and promises better price discovery.

Türkçe

Türkçe Español

Español