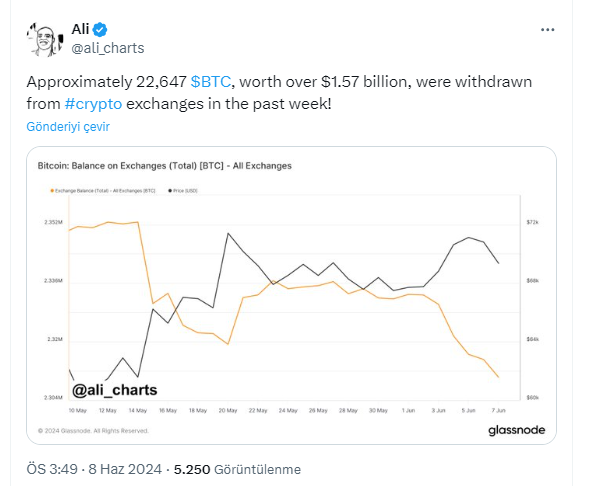

Cryptocurrency market experienced a drop yesterday, disappointing many investors, but Bitcoin withdrawals from exchanges increased. Last week, approximately 22,647 Bitcoin (BTC) worth over $1.57 billion were withdrawn from various cryptocurrency exchanges. Ali Martinez highlighted this issue. What could this increase mean?

Significance of Bitcoin Withdrawals from Exchanges

Firstly, such a large amount of Bitcoin being withdrawn from exchanges usually indicates a change in investor behavior. Withdrawing Bitcoin from exchanges typically shows that owners prefer to hold it long-term rather than preparing to sell.

This trend might indicate a bullish sentiment as investors seem confident in Bitcoin’s future value and prefer to store their assets in private wallets rather than leaving them on exchanges where they are more accessible for trading.

Current Supply on Exchanges Decreases

Secondly, this movement can also affect Bitcoin’s liquidity on exchanges. With a significant amount of BTC being withdrawn, the current supply on exchanges decreases. Lower liquidity can lead to higher volatility as large buy or sell orders can have a more pronounced effect on the market price. Investors often closely monitor these metrics as changes in exchange reserves can provide insights into potential price movements.

Additionally, the current trend can be influenced by external factors such as regulatory developments, macroeconomic conditions, or advancements in the cryptocurrency ecosystem. For instance, increased regulatory scrutiny or changes in legislation might prompt investors to secure their assets in private wallets. Similarly, macroeconomic factors like inflation or economic instability might drive investors to hold onto Bitcoin as a hedge against traditional financial uncertainties.

Active Role of Institutional Investors

Another consideration is the role of institutional investors in these movements. This week, we also saw this through inflows into Bitcoin ETFs. Institutional participation in the cryptocurrency market has significantly increased over the past few years. Large withdrawals might indicate that institutional players are increasing their holdings, further validating Bitcoin as a legitimate asset class. Institutional investors’ participation can also contribute to the perception of Bitcoin as a long-term investment rather than a speculative asset.

Moreover, advancements in crypto infrastructure, such as the development of decentralized finance (DeFi) platforms and improved security measures, can encourage investors to move their assets off exchanges. The possibility of earning yields through DeFi protocols and enhanced security can make holding Bitcoin in private wallets more attractive.

Türkçe

Türkçe Español

Español