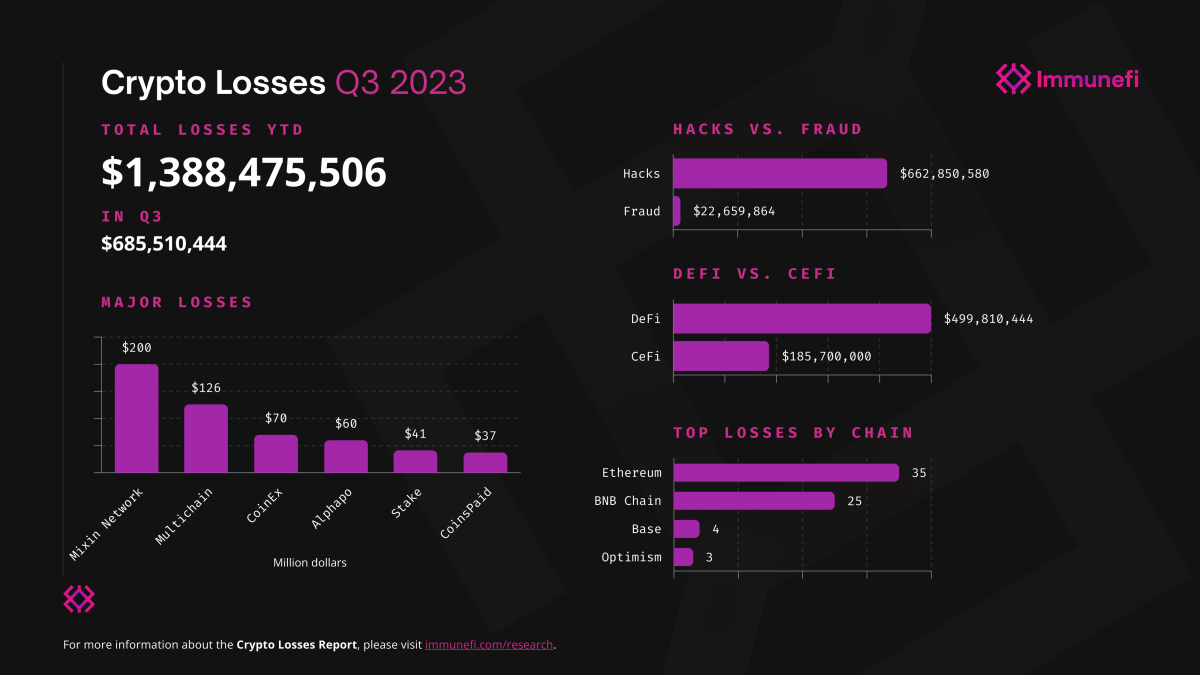

The cryptocurrency market has left behind a quarter in which $685.5 million worth of funds were stolen. Due to hacks and scams, fund losses that have shaken the market have reached $1.4 billion from the first day of the year until today. Almost half of this recorded fund loss was given in hack attacks targeting interchain protocols Mixin Network and Multichain.

The 3rd Quarter Became the Worst Quarter of the Year

In the 3rd quarter of 2023, $685.5 million worth of funds were stolen from projects in the cryptocurrency market. Almost half of this recorded fund loss was given in hack attacks targeting interchain protocols Mixin Network and Multichain. According to the latest report prepared by web3 bug bounty platform Immunefi, fund losses in the 3rd quarter increased by 59.9% compared to the $428.7 million lost in the 2nd quarter. There was a 153% increase in the year-on-year period.

The fund losses in the quarter reached $1.4 billion in 2023 due to hacks and scams, marking the worst quarter of the year. Mitchell Amador, CEO of Immunefi, said in the report, “The 3rd quarter was a quarter where the highest fund loss of the year occurred due to large-scale hack attacks targeting protocols such as Mixin Network and Multichain. State-sponsored hackers played a major role as they were claimed to be behind many attacks in this quarter. Their focus on CeFi particularly led to a sharp increase in losses in this sector.”

A total of $326 million was stolen in the hack attack targeting Mixin Network in September and the hack attack targeting Multichain in July. This figure corresponds to 47.5% of the total fund loss in the 3rd quarter. The Lazarus Group, a North Korean-backed hacking group allegedly responsible for high-profile hack attacks on platforms such as CoinEx ($70 million), Alphapo ($60 million), Stake ($41.3 million), and CoinsPaid ($37.3 million), is held responsible for $208.6 million, which is equivalent to 30% of the stolen funds in the quarter.

Ethereum (ETH) became the most targeted network in 35 out of 76 incidents (42.7% of fund losses), while BNB Chain accounted for 30.5% of fund losses in 25 incidents. Since the launch of Coinbase’s Layer 2 network Base on August 9, four projects, namely LeetSwap, SwirlLend, Magnate Finance, and RocketSwap, have been targeted by hack attacks.

Hackers Continue to Target DeFi Especially

Approximately $662.9 million worth of funds were stolen in DeFi due to 49 protocol vulnerabilities, which accounted for 96.7% of the recorded fund losses and saw a 66.1% increase compared to the previous year. A total of $22.6 million was lost due to 27 fraud and scam incidents, accounting for 3.3% of the total fund losses, which decreased by 23.9% compared to the previous year.

The data shows that DeFi continues to be the most attractive target for hackers, and hack attacks targeting this area accounted for $499.8 million (72.9%) of the fund losses in the 3rd quarter. Furthermore, this figure indicates an 18.5% increase compared to the previous year.

Türkçe

Türkçe Español

Español