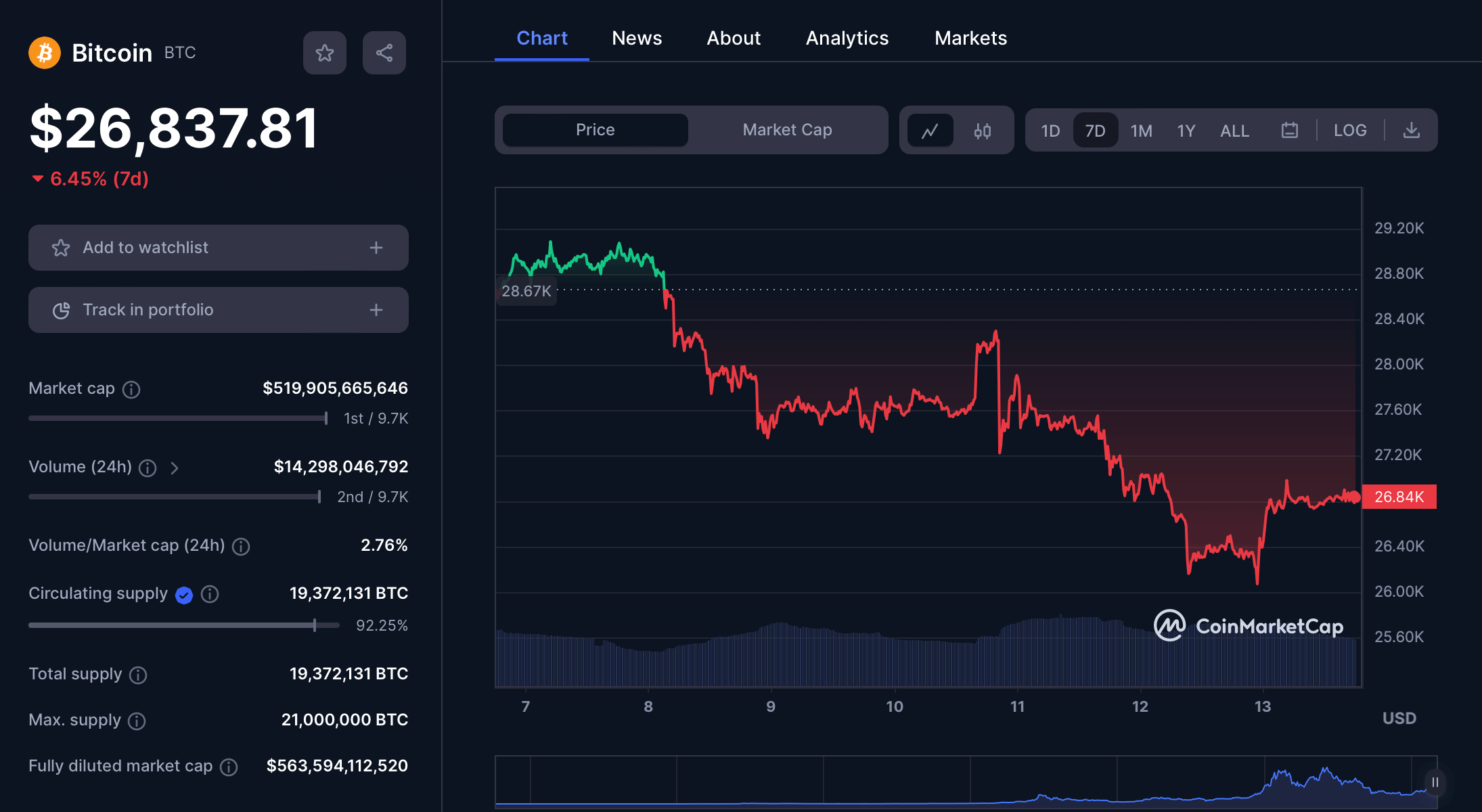

The cryptocurrency market had an active week due to the developments during the week. Bitcoin (BTC), the leading cryptocurrency, fell as low as $25,800 due to the negative news flows during the week. There was also a significant decline in the total market capitalization of the cryptocurrency ecosystem.

The Cryptocurrency Market is Having an Active Week

During the week, there were many developments that affected the course of the cryptocurrency market. From the release of US inflation data to Binance’s withdrawal from Canada and the restriction of CBDC use in Florida, many developments caused the cryptocurrency market to move.

Bitcoin (BTC), the leading cryptocurrency, fell as low as $25,800 during the week. The total market capitalization of the cryptocurrency ecosystem retreated to $1.2 trillion, according to CoinMarketCap (CMC) data. Volatility in the cryptocurrency market also increased significantly during the week.

Analyst Michaël van de Poppe, who evaluated this latest decline in the cryptocurrency market during the week, evaluated critical price levels in a series of posts on his Twitter account. The analyst suggested that if Bitcoin cannot exceed the $26,500 to $26,800 band in the near term, depreciation could accelerate and BTC could retreat to $25,000 levels.

Uncertainty of Direction in the Market Continues

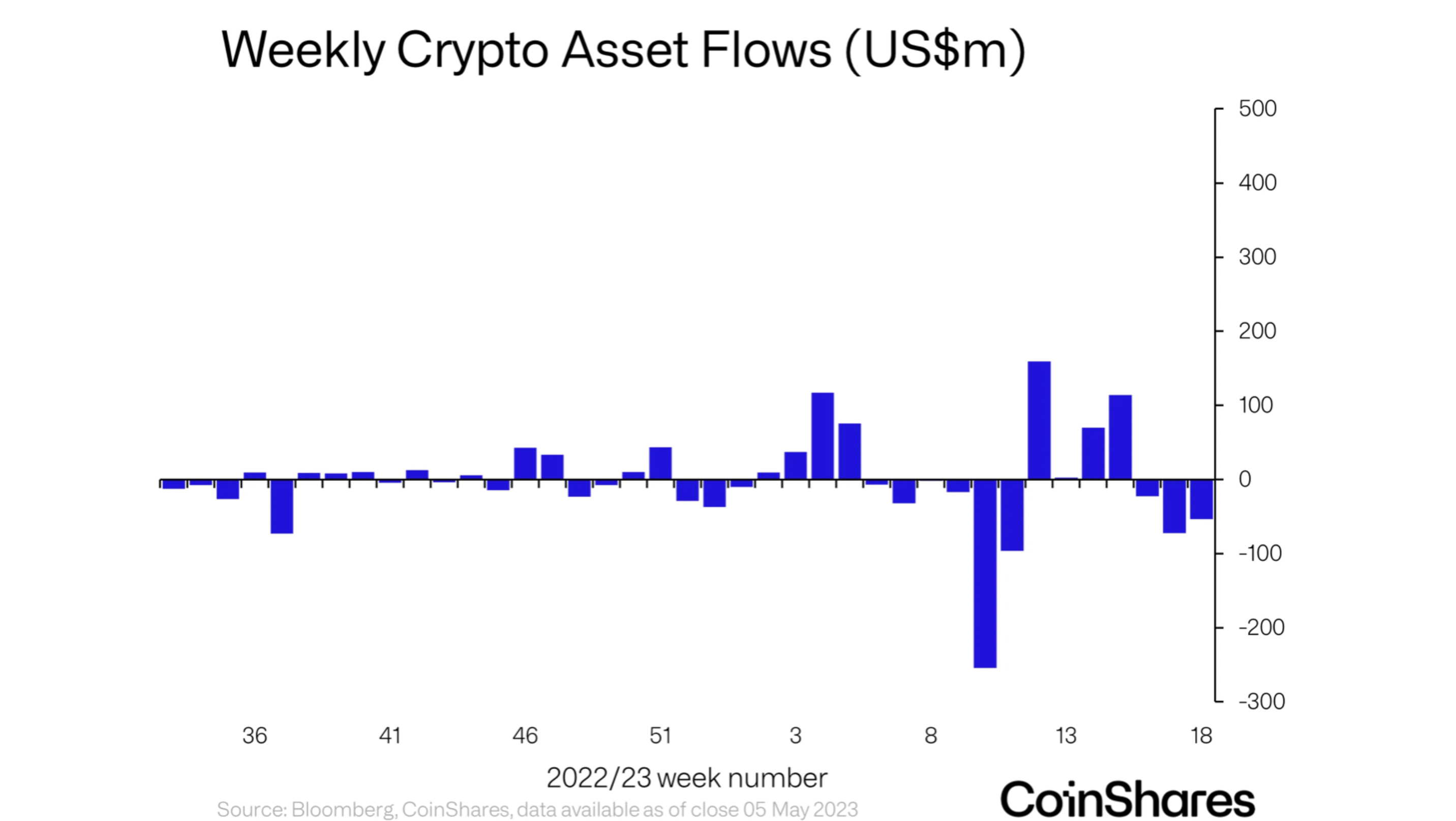

Earlier this week, digital asset manager CoinShares also published a report sharing data on weekly fund flows in digital asset investment products. According to the CoinShares report, there was a total outflow of nearly $32 million in Bitcoin-focused investment products last week, while digital asset investment products saw a total outflow of nearly $54 million.

On the other hand, Binance temporarily stopped BTC withdrawals twice due to network congestion, causing concern among investors. This problem at Binance caused high amounts of BTC outflows on cryptocurrency exchanges.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry risks due to their high volatility and should conduct their own research.

Türkçe

Türkçe Español

Español