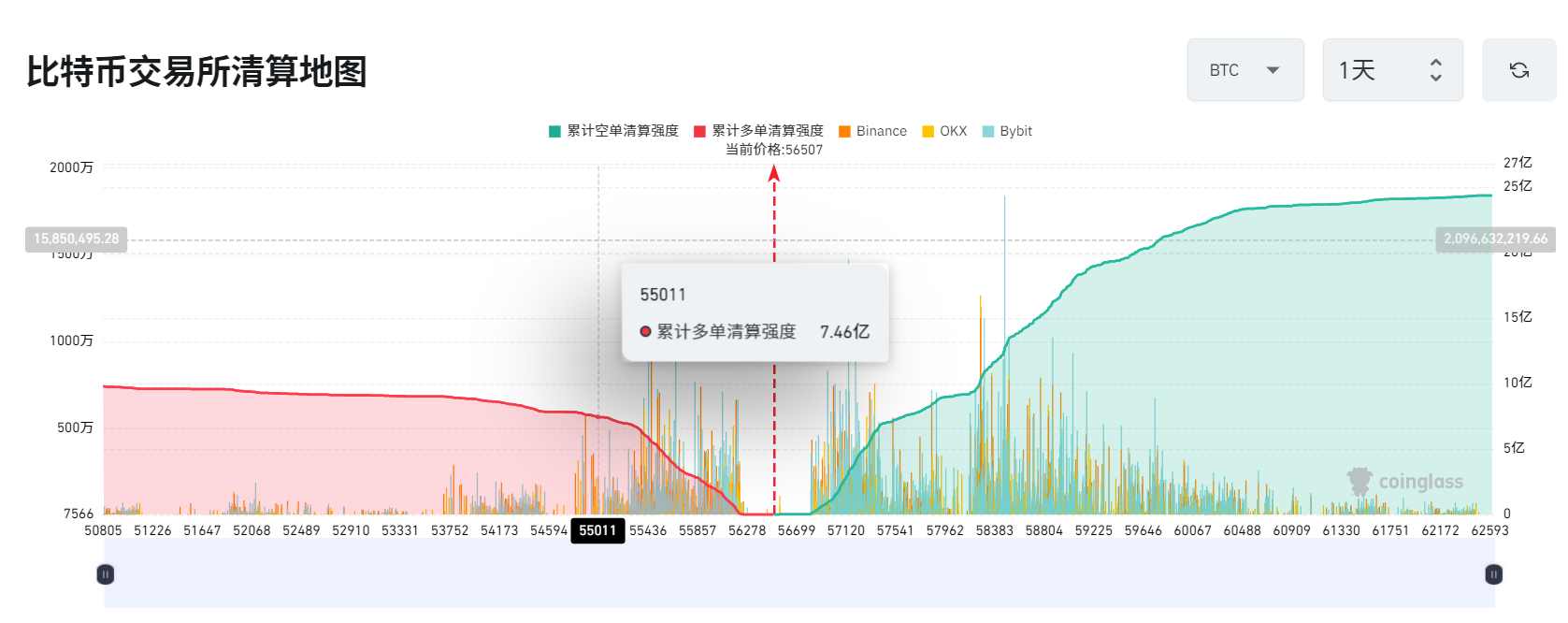

According to Coinglass data, Bitcoin‘s price movements around key thresholds could trigger significant liquidations on major centralized exchanges. If Bitcoin’s price falls below $55,000, long positions on exchanges could face liquidations amounting to $746 million. Conversely, if it rises above $58,000, short positions could see liquidations totaling up to $900 million.

Market Makers Tend to Target Liquidation Clusters

These liquidation levels do not represent the exact number of contracts expected to be liquidated or their precise value. Instead, the data visualizes the “intensity” of liquidations by showing the relative importance of each liquidation cluster compared to neighboring clusters. This intensity explains how much the market could be affected if Bitcoin’s price reaches these critical levels.

Coinglass data provides a visual representation of how the market might react to price changes, with higher liquidation “bars” indicating stronger reactions due to waves of liquidations at certain price levels. For traders and investors, these liquidation levels serve as key indicators of potential market volatility and risk.

Understanding these dynamics is crucial for market participants to anticipate and manage the turbulence caused by liquidations when Bitcoin approaches these significant price levels. Market makers typically target these liquidation zones, rewarding or penalizing investors based on their preferences.

Bitcoin Continues to Face Selling Pressure

Currently, Bitcoin’s price remains under downward pressure, and market observers emphasize the need to closely monitor the lower liquidation cluster levels. As the largest cryptocurrency approaches these key price levels, the pressure on long and short positions could influence overall market sentiment, triggering further downward or upward movements.

At the time of writing, BTC is trading at $56,569 with a very limited increase of 0.16% in the last 24 hours.

Türkçe

Türkçe Español

Español