Japan-based investment company Metaplanet has raised a total of 9.5 billion Japanese yen (60.6 million dollars) this week by issuing two bonds. The company announced that these funds will be used to expedite purchases of Bitcoin (BTC)  $107,227.

$107,227.

Plans for 2025 Accelerated to This Year

Metaplanet, listed on the Tokyo Stock Exchange, stated today that it issued a fifth bond worth 5 billion Japanese yen (31.9 million dollars). This follows the announcement made on Tuesday about a bond issuance of 4.5 billion Japanese yen (28.7 million dollars). Both bond issuances bear no interest and will mature on June 16, 2025.

CEO Simon Gerovich mentioned, “These funds will allow us to pull forward our planned Bitcoin purchases for 2025 to this year.” This move comes after the company’s decision in May to adopt Bitcoin as a strategic reserve asset.

Stock Activity Continues for the Company

Meanwhile, Metaplanet shares closed at 3,610 Japanese yen, down 4.24% on the Tokyo Stock Exchange on Friday. However, the company’s share value has increased by 2,023% since the beginning of the year. In contrast, the Nikkei 225 index, where the company is listed, fell by 0.2% on the same day. Additionally, the company’s shares began trading on the OTCQX market in the U.S. on Thursday, closing the first trading day down 9.96%.

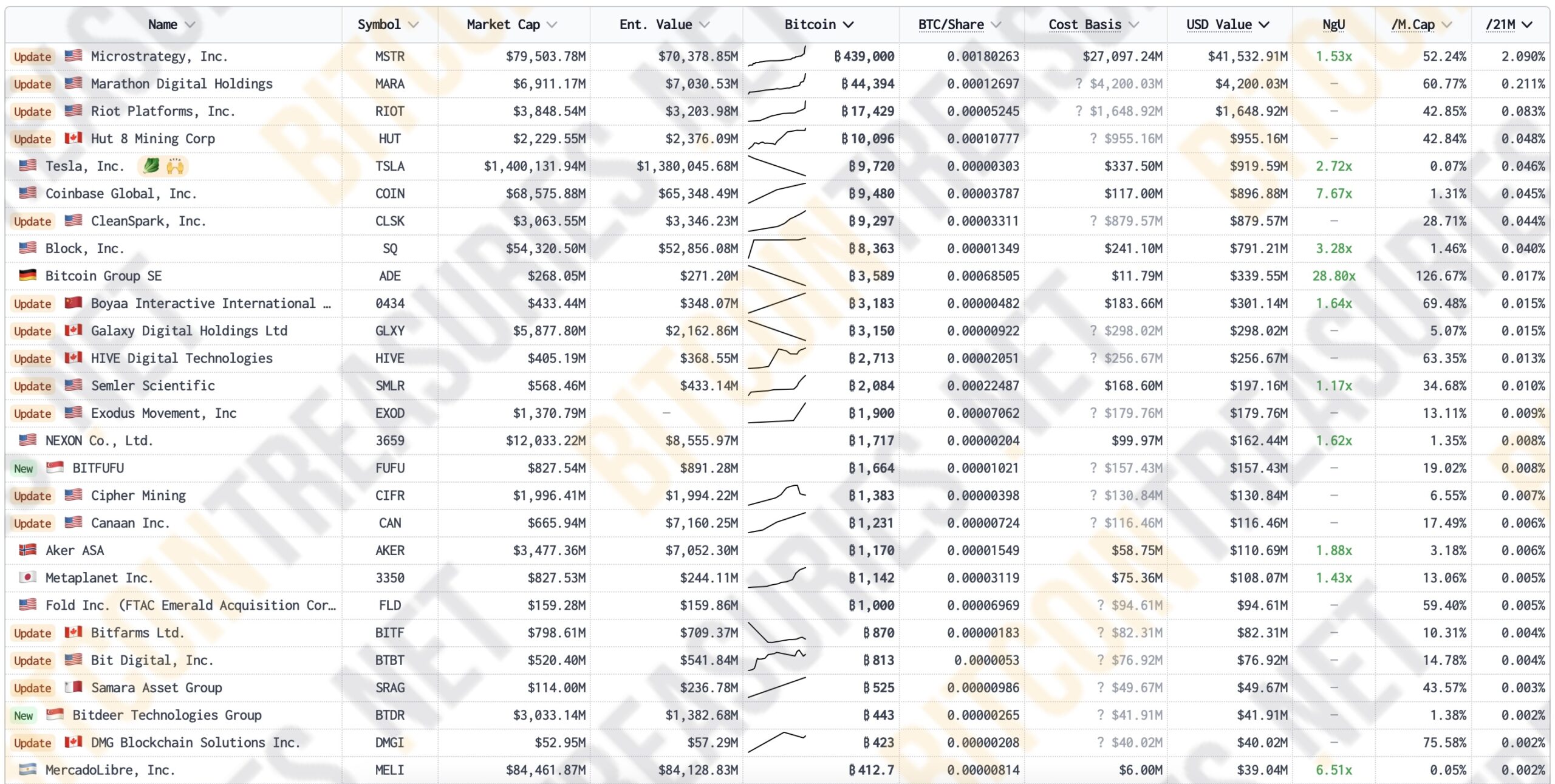

Recently, Metaplanet has gained attention due to its Bitcoin purchases, but the company still lags behind major Bitcoin investors like MicroStrategy. According to BitcoinTreasuries data, MicroStrategy continues to hold the largest corporate Bitcoin reserve with 439,000 BTC.

Türkçe

Türkçe Español

Español