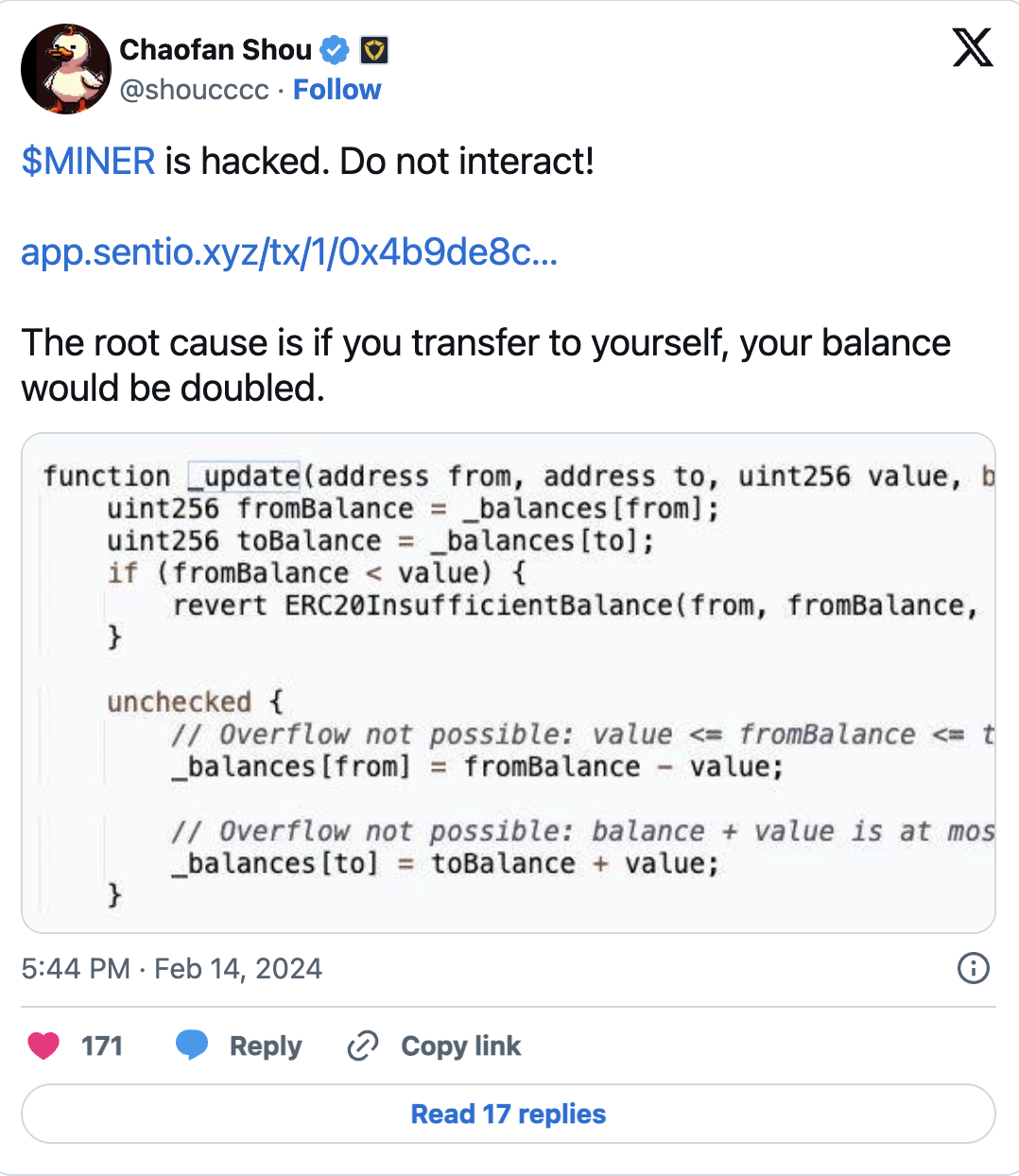

A new token called Miner, minted using the experimental ERC-X standard, has managed to capture the crypto community’s attention by plummeting over 99% in just a few hours before losses were stemmed. At the time of writing, each Miner token was trading at $11.41, down 87% within the day. As announced by the developers on February 14th, a glitch in the smart contract that allowed users to double their Miner holdings by transferring assets to themselves caused the $10 million sale.

What Happened with Miner?

The developers have announced that they will resolve this issue and ensure the contract is audited before being redeployed. The saved liquidity is worth 130 Ethereum and is currently equivalent to the liquidity provider ASTX LP, which will be used for redistribution for LP purposes. Yu Xian, the founding partner of Singaporean blockchain security firm SlowMist, commented on the double-spending glitch:

“It’s unfortunate that the contract has low-level gaps. You can double your balance by transferring money to yourself. There are too many standards applied without reference, the cost of innovation is a bit high, and the losses are not low.”

The ERC-X created by Miner developers is known as a new Ethereum token standard that combines features of ERC-20, ERC-721, and the newly invented ERC-404 token standards. In response to the issue, the Miner team asked the person who first discovered the smart contract fault to return 30% of the erroneous funds, amounting to $120,000.

ERC-404 and Potential Scenarios

Although many new Ethereum token standards have been implemented in recent years, experts have warned about their experimental nature and the lack of approval from the Ethereum Foundation. One such standard, ERC-404, was invented earlier this year and enables partial ownership of non-fungible assets.

The first token minted using ERC-404, Pandora, has since surpassed a market value of $200 million. With these developments, the real curiosity is what will happen in the ERC-404 space. It might be possible to see a different dimension of the developments happening in the Bitcoin Ordinals space in this area as well.

Türkçe

Türkçe Español

Español