Millions of people around the world actively use PayPal for payments. There is no one who hasn’t heard of it. Before it was banned in Turkey (which the younger generation may not remember), it was widely used here as well. The new generation payment company recently launched its own altcoin. However, this stablecoin called PYUSD, which is pegged to the dollar similar to USDC, did not generate the expected excitement.

PayPal’s Altcoin

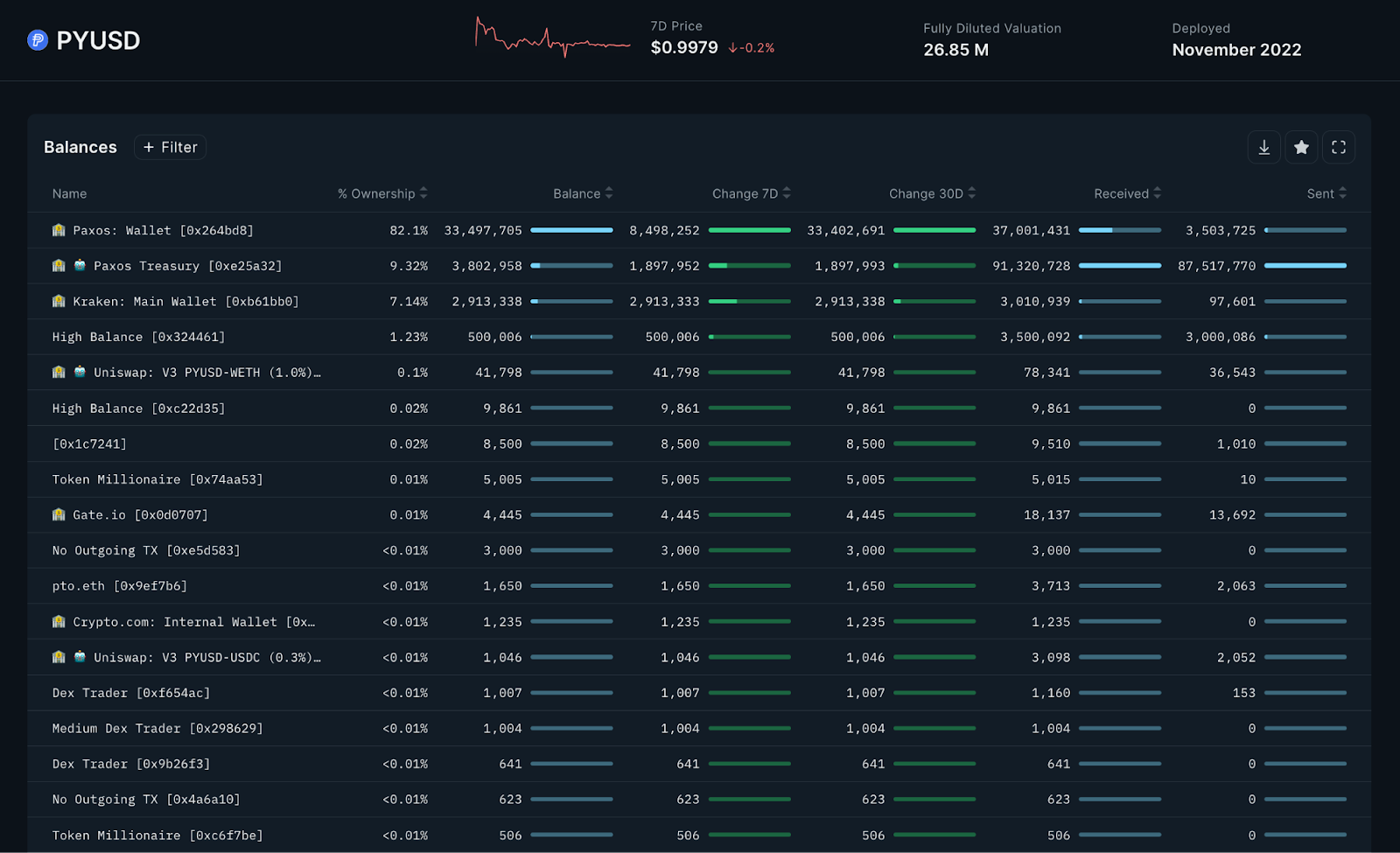

PayPal’s recently launched stablecoin, PayPal USD, is facing difficulties in attracting attention, according to on-chain data. Approximately 90% of PYUSD is currently held in the wallets of the stablecoin issuer, Paxos Trust, according to findings by blockchain analytics firm Nansen.

According to the latest Nansen report, Kraken, Gate, and Cryptocom, along with the balances in crypto exchange wallets, account for approximately 7% of the total supply. The buying activity among informed or professional investors, who are referred to as “smart money,” appears to be weak.

Current Status of PYUSD

PayPal’s launch of the stablecoin in early August raised high expectations in the crypto sector. It was believed that it would facilitate broader adoption of stablecoin and introduce cryptocurrencies to a wider audience for the first time. However, despite having more than 350 million users worldwide, the expected outcome did not materialize—at least not for now. Perhaps PayPal had the coming years in mind when taking this step?

The report stated:

“It appears that there is a lack of demand for PYUSD from crypto users when other alternatives are available (which may be due to PayPal targeting a different demographic).”

Pools on decentralized exchanges such as PYUSD/wETH and PYUSD/USDC represent less than 50,000 tokens. It is also not popular among individual investors. The largest individual wallet holds $10,000 worth of PYUSD stablecoin.

Furthermore, the data shows that fewer than 1,000 owners, excluding contracts or exchanges, have a balance exceeding $1,000. Despite modest purchases, PYUSD has been in circulation for less than three weeks.

The token, issued by Paxos Trust Co, was distributed on the Ethereum network and is fully backed by dollar deposits, short-term Treasury bonds, and similar cash equivalents.

Türkçe

Türkçe Español

Español