Contrary to the rises seen in many altcoins, Polygon (MATIC), which has been in the top 20 for a long time, has not kept up with the upward momentum of the last 7 days. MATIC tested the $0.55 level on July 16 but failed to surpass it. After this, the price pulled back to $0.52, then recovered to $0.5451.

Investors in Polygon Face Losses

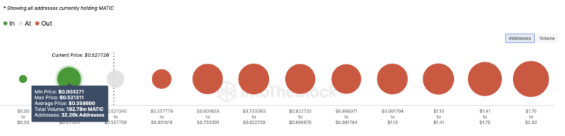

After the peak performance seen in March, the MATIC price fell to $0.48 last week. Following the price drop, the Global In/Out of the Money (GIOM) indicator provided important data. Briefly, GIOM shows groups of investors who are currently profitable, waiting in loss, or at the breakeven point.

Regarding the Polygon network, interestingly, there were no investors in profit until July 9. Although the price has recovered somewhat, only those who bought tokens between $0.0032 and $0.52, representing 5% of the total investor ratio, are currently profitable at the current MATIC price levels.

Will MATIC Price Drop?

Daily price reviews show that MATIC tested the historical support level of $0.47 on July 5. Only seven days later, the price jumped to the $0.54 region. On the other hand, due to the lack of MATIC-oriented liquidity in the market, as indicated by the Money Flow Index (MFI), it seems difficult for the price to reach $0.57.

Briefly, MFI is an indicator that reveals the inflows and outflows in a cryptocurrency.

If an increase in this indicator is reflected in the charts, it can be interpreted that there is capital to support the price rise. However, a decrease in MFI can be interpreted oppositely. Looking at the chart below, it is noticeable that the indicator could not pass the neutral line, and it can be interpreted that the bulls are losing their hopes for MATIC day by day.

If the market’s approach to MATIC continues like this, the price could fall below $0.50 and possibly visit $0.47. However, a close above the $0.53 level could invalidate bearish predictions and trigger a price movement to $0.64.

Türkçe

Türkçe Español

Español