Blockchain company Ripple has decided to make a move indicating its entry into the $150 billion stablecoin market by announcing the launch of a dollar-backed stablecoin. This move will bring Ripple face to face with stablecoin giants Tether, the issuer behind the largest stablecoin UDST, and Circle, which issues USDC. Let’s look at the details of this development.

Ripple Launches Dollar-Backed Stablecoin

Ripple is initially launching its stablecoin in the US but is also considering offering additional regional stablecoins in markets outside the US, such as Europe and Asia. According to Ripple, the stablecoin will always be supported on a 1-to-1 basis by an equivalent total asset reserve (US dollar deposits, US government bonds, and cash equivalents) held by the company.

The crypto company stated that its reserves would be accounted for in public monthly attestation reports, but did not disclose which firm would conduct the audits.

Ripple CEO Brad Garlinghouse made a statement on the matter, saying that competition in the stablecoin space does not deter them. Garlinghouse mentioned that the company decided to offer a stablecoin to the market in response to last year’s “depegging” incidents of rival companies Tether’s USDT token and Circle’s USDC, which temporarily lost their dollar peg.

Concerns About Stablecoins

USDT temporarily lost its $1 peg in 2022 due to market instability stemming from the collapse of popular “algorithmic” stablecoin terraUSD. USDC also briefly fell below $1 in 2023 following the revelation of its relationship with the bankrupt tech-focused lending institution Silicon Valley Bank.

Some critics question the source of Tether‘s reserves. There are also doubts about whether the company is sufficiently capitalized to survive a “bank run.” Tether claims its token is fully backed by quality reserves and that it has always been able to meet redemption requests, even in times of distress.

Garlinghouse, without naming names, mentioned that there are “some uncertainties” among US regulators about the current market leader. He defended Ripple as a regulated institution with licenses in various countries, including New York, Ireland, and Singapore. Garlinghouse also stated that Ripple has not abandoned XRP as a payment token, expressing his belief that stablecoins will serve as a complementary product to the XRP ecosystem.

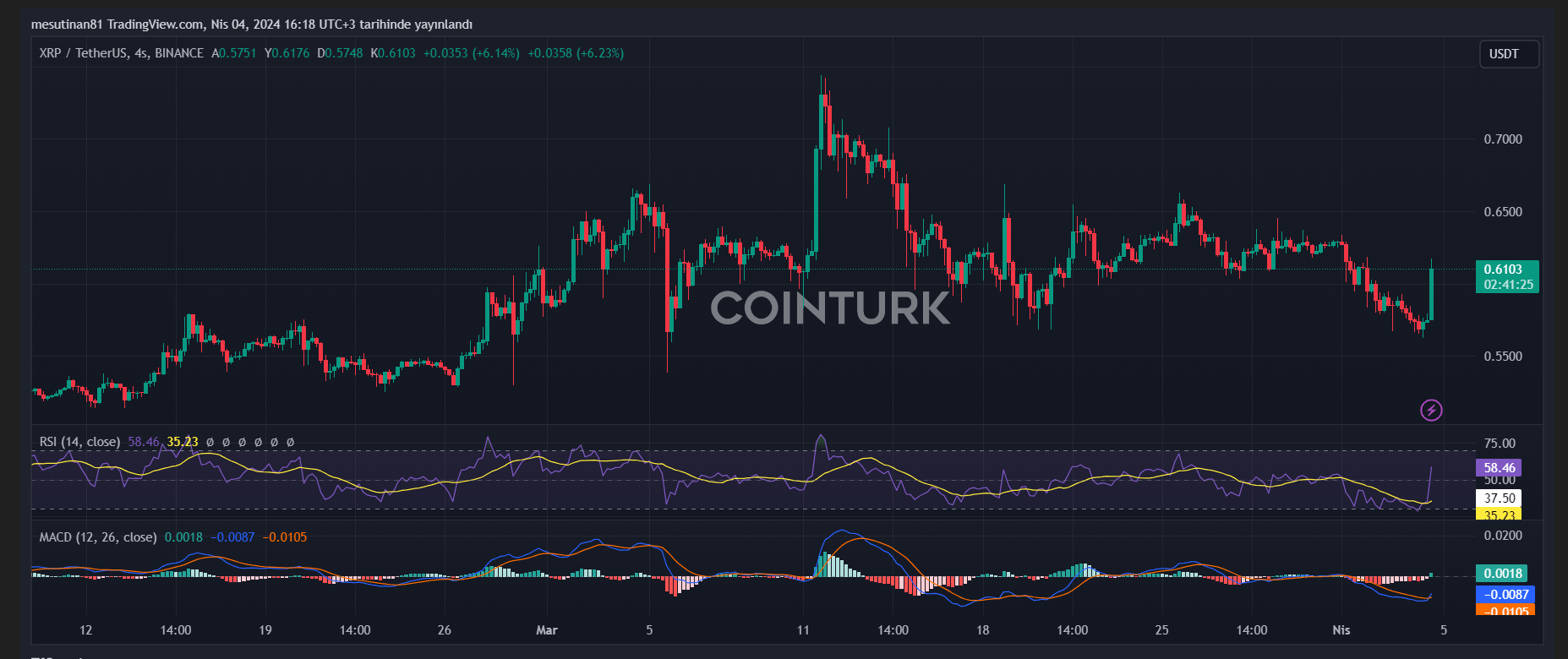

The XRP price responded immediately to this development. The cryptocurrency’s price rose from $0.56 to $0.61.