Ripple‘s (XRP) price closed below a critical horizontal range, fueling fears of a downward trend. Unless the price recovers this range and initiates a significant upward movement, the downward trend is expected to continue.

Ripple (XRP) Price Analysis!

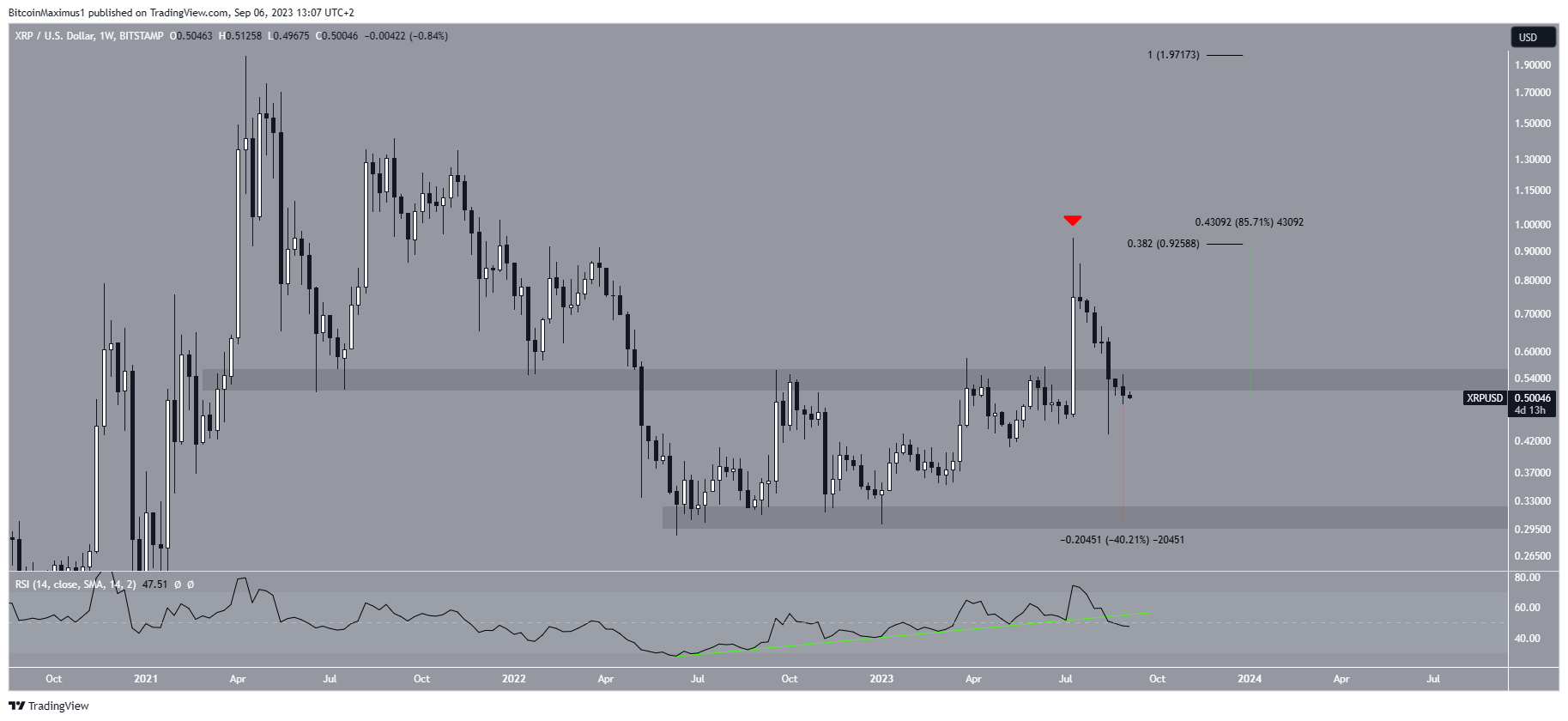

The weekly timeframe technical analysis for XRP shows a bearish trend. This is indicated by both the price movement and RSI readings. Firstly, the XRP price has been declining since reaching its yearly high of $0.93 in July. It was rejected by the 0.382 Fib retracement resistance level, indicating that sellers took control and a long upper wick was formed, confirming the downward trend.

Shortly after, the price dropped below the long-term horizontal range of $0.55. It was expected that this region would provide support after XRP’s initial breakout. However, since the price fell and closed below this level last week, the situation did not unfold as expected. If the downward movement continues, the nearest support at $0.30 will be 40% below the current price. On the other hand, reclaiming the $0.55 range could lead to an 85% increase in price, reaching the yearly high of $0.93.

Expectations for the Future of Ripple

Additionally, the weekly RSI for the token entered a bearish trend. When evaluating market conditions, analysts use RSI as a momentum indicator to determine whether the market is overbought or oversold and whether to accumulate or sell an asset. If the RSI value is above 50 and the trend is upwards, bulls still have the advantage, but if the reading is below 50, the opposite is true.

The indicator has dropped below 50 and broken the rising support line. Both of these are signs of a bearish trend in the cryptocurrency and could support further downward movement. If the price continues to drop, the nearest support will be $0.40, which is 22% below the current price. The support is formed by an ascending support line that has been in place since June 2022. Since this line has been present for such a long time, a bounce can be expected when the price reaches it.

Türkçe

Türkçe Español

Español