Ripple (XRP) bulls sprang into action on March 11. The cryptocurrency’s trading activity pushed prices up from the day’s opening at $0.608 to $0.744, a 22.37% increase, before prices fell back below $0.7.

The Struggle of XRP Bulls

A recent report exceeded expectations that predicted a move towards $0.7, leading to increased earnings for the altcoin, but also raised questions about the sustainability of demand. On March 11, the highest levels of the $0.7 range were surpassed, yet bulls could not defend this level as support.

The situation resembled a rapid rise towards the $0.7 resistance at the beginning of November, which was quickly rejected. The On-Balance Volume (OBV) indicator’s rise above July’s highest levels and its ability to stay there is noteworthy. The continuous increase in buying volume could keep bears at bay, but it is uncertain whether this optimistic outlook will persist.

Liquidity in Ripple

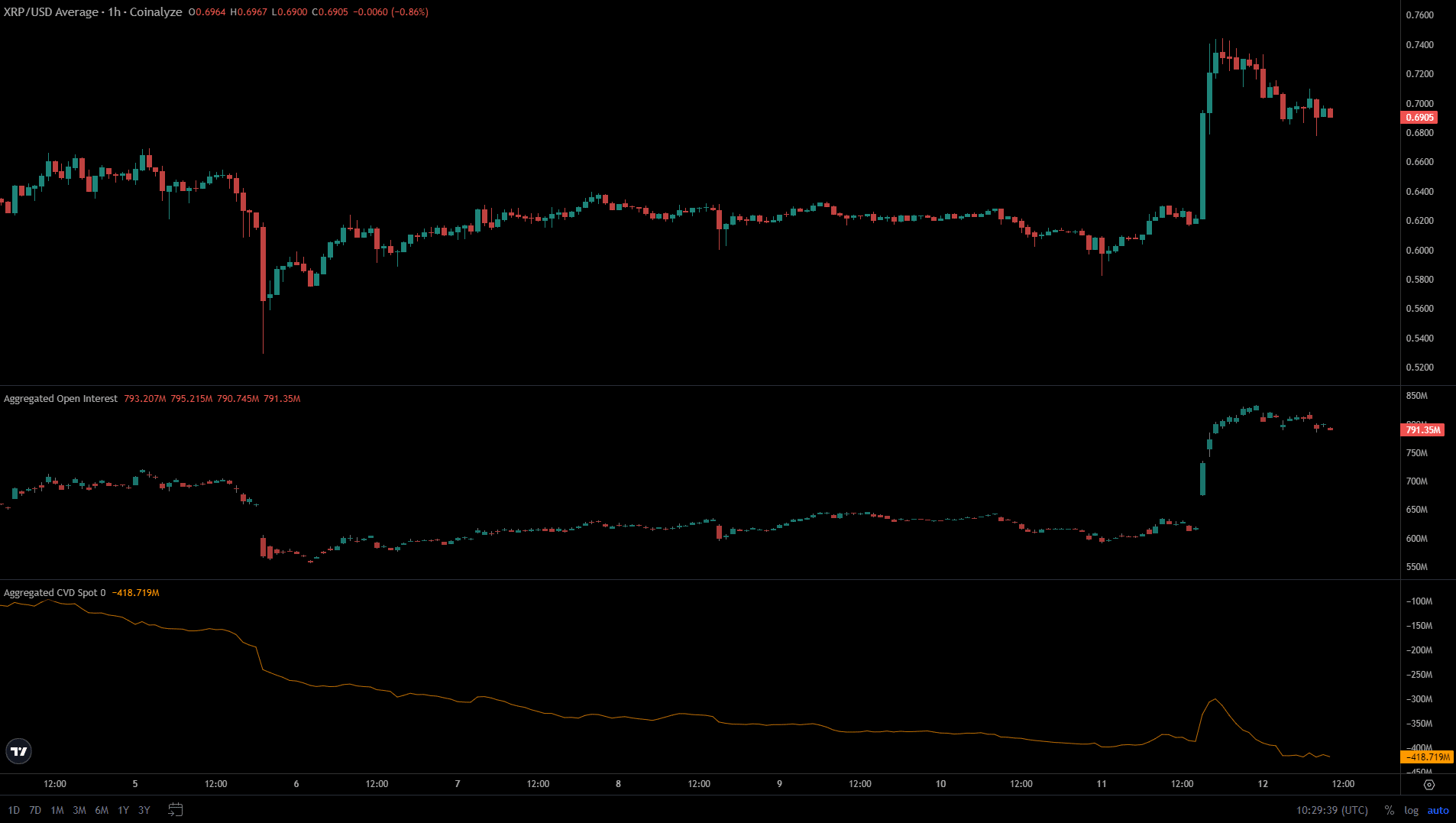

Furthermore, experts now indicate that a downward move towards $0.64 or $0.52-$0.54 could start, given the reduced liquidity just above $0.7. The price of the cryptocurrency is swayed by liquidity, and despite the strength of the altcoin market, XRP lags behind. As XRP prices rose, open interest followed, increasing from $600 million to $830 million, with spot Cumulative Volume Delta (CVD) also rising.

However, the second indicator continued its previous downward trend, which is bad news for bulls. According to experts, the rise could be driven by the futures market, not by real demand, suggesting it could be a liquidity trap. Therefore, a pullback towards the support levels of $0.64 and $0.54 could follow. Consequently, Ripple surged 22.37% to $0.744 on March 11 but failed to break the $0.7 resistance, entering a downtrend. Experts point out that this could be related to futures rather than actual demand.

Türkçe

Türkçe Español

Español