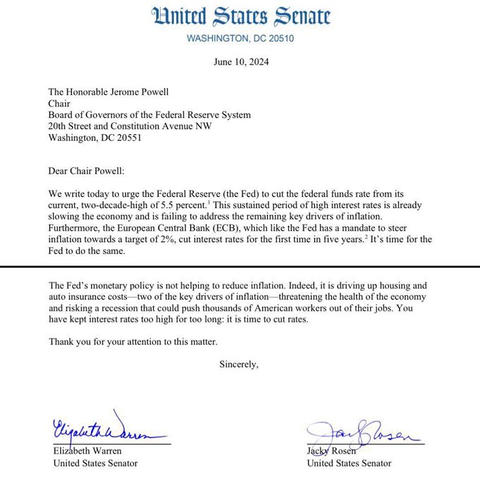

United States Senators Elizabeth Warren and Jacky Rosen addressed Federal Reserve Chairman Jerome Powell in a letter dated June 10, 2024, calling for a reduction in the federal funds rate. The letter highlights concerns about the current rate of 5.5%, the highest in the last twenty years. The senators argue that these high interest rates are already negatively impacting the economy by slowing growth and not effectively addressing the underlying causes of inflation.

Senators Call for Interest Rate Reduction

The senators emphasize that prolonged high interest rates not only strain the economy but also neglect the fundamental causes of inflation. They cite the European Central Bank (ECB) as an example, noting that the ECB has managed to steer inflation towards the 2% target while maintaining the lowest interest rates in the last five years. This comparison supports the argument that it is possible to manage inflation effectively without maintaining such high interest rates.

The letter also underscores the broader impacts of the Federal Reserve’s current monetary policy on ordinary Americans. The senators express concern about the rising costs of housing and auto insurance, which significantly contribute to inflation. They argue that high interest rates further increase these costs, thereby threatening the overall health of the economy. The letter warns that these economic conditions could lead to job losses affecting thousands of American workers.

Current Monetary Policy Causes Harm

The senators argued that the current monetary policy does not serve the purpose of reducing inflation. They stated that high interest rates add economic pressure, particularly on the housing and insurance sectors. According to the senators, this situation creates a ripple effect on the economy, increasing financial pressure on American families.

The letter calls for a reassessment of the Federal Reserve’s approach, advocating for lower interest rates to promote economic stability and growth. Senators Warren and Rosen emphasized the need for a policy change to reduce the risk of a potential recession.

Urgent Action Call is Positive for Bitcoin Investors

The senators also highlighted that the Fed’s actions have a direct impact on the livelihoods of American workers and that maintaining high interest rates could jeopardize economic recovery. The letter suggested that lower interest rates would be more effective in addressing the fundamental causes of inflation and promoting a healthier economic environment.

In the conclusion of the letter, there is an urgent call for action. The senators emphasize the urgency of reassessing the Fed’s strategy.

Türkçe

Türkçe Español

Español