Shiba Inu (SHIB) experienced a dramatic increase in its token burn rate, rising by over 2,600% in just one day. This significant rise caught the attention of the cryptocurrency world and sparked discussions about the potential recovery of the popular memecoin. According to Shibburn, a total of 14.91 million SHIB were burned and removed from circulation in the last 24 hours, marking a 2,611% increase in Shiba Inu’s token burn rate.

Token Burns Continue to Draw Attention to Shiba Inu

As is well known, the Shiba Inu community has been actively burning tokens to reduce the total supply, which could potentially increase the value of the remaining tokens.

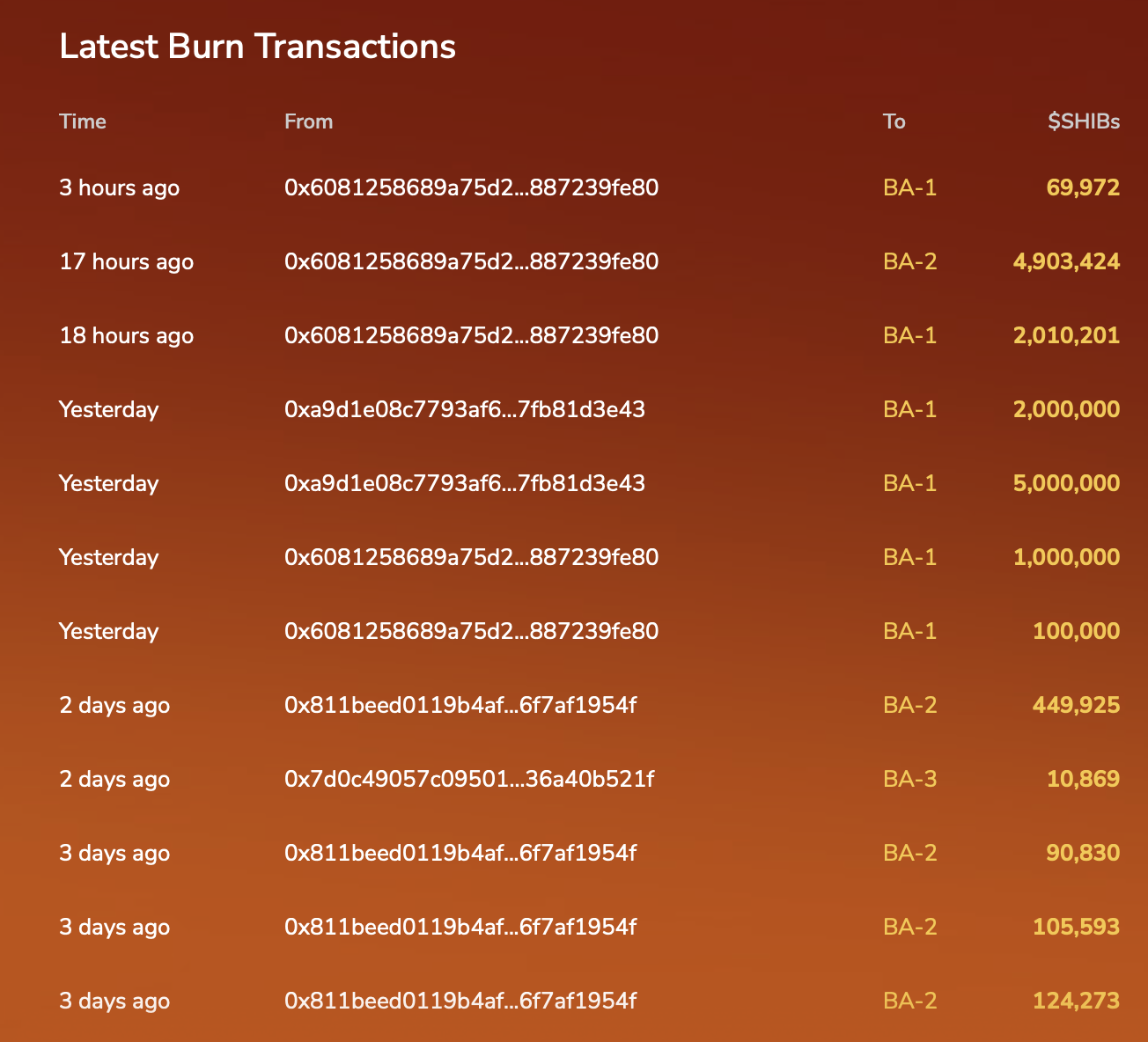

In this context, the two largest token burn transactions in the last 24 hours each burned approximately 5 million SHIB. This latest token burn activity demonstrates the community’s commitment to increasing SHIB’s value by reducing supply.

With the latest token burn transactions, the total number of SHIB removed from circulation has reached 410.72 trillion. This strategic token burn mechanism aims to limit the number of tokens in circulation. This can lead to increased demand and subsequently higher value. This approach has proven effective in increasing investor interest and fostering positive market sentiment for Shiba Inu.

Market Outlook for Shiba Inu

Despite recent fluctuations in the cryptocurrency market, some market experts remain optimistic about SHIB’s performance due to the high token burn rate. The technical outlook suggests that if the bullish momentum continues, SHIB could reach resistance levels of $0.000016, $0.000017, and potentially $0.000018 in the coming days. However, experts warn that if downward pressure increases, SHIB could fall below the support levels of $0.00001550 to $0.00001450.

At the time of writing, SHIB has fallen by over 3% in the last 24 hours, trading at $0.00001539. Despite this price drop, the altcoin’s trading volume increased by 16% to $238.79 million. Additionally, the Open Interest (OI) in Shiba Inu futures dropped by 13%, reflecting the prevailing bearish trend in the market.

Türkçe

Türkçe Español

Español