A notable portion of altcoins achieved double-digit gains in the last 24 hours, with some aiming for their historical peaks. We recently touched on the details regarding BNB and SOL Coin. So, what is the current situation for XRP, LUNA, and FLOKI Coin?

XRP Coin Price Prediction

As this article is being prepared, Asian investors are starting their day with BTC dropping to $72,600. If this trend continues, the rise in altcoins could pause. Let’s first take a look at the latest situation on the XRP Coin front.

XRP Coin, which continues to linger at $0.68, could not maintain its $0.74 peak. Both the ongoing litigation and the rapidly increasing circulating supply are significantly undermining the appetite for risk for this popular altcoin. If we don’t start seeing positive news flow unexpectedly, the $0.93 barrier could remain in place for a long time.

The current support level for XRP Coin is at $0.58. For price volatility to increase, investors oscillating between the $0.74 resistance and support need to see the anticipated breakout.

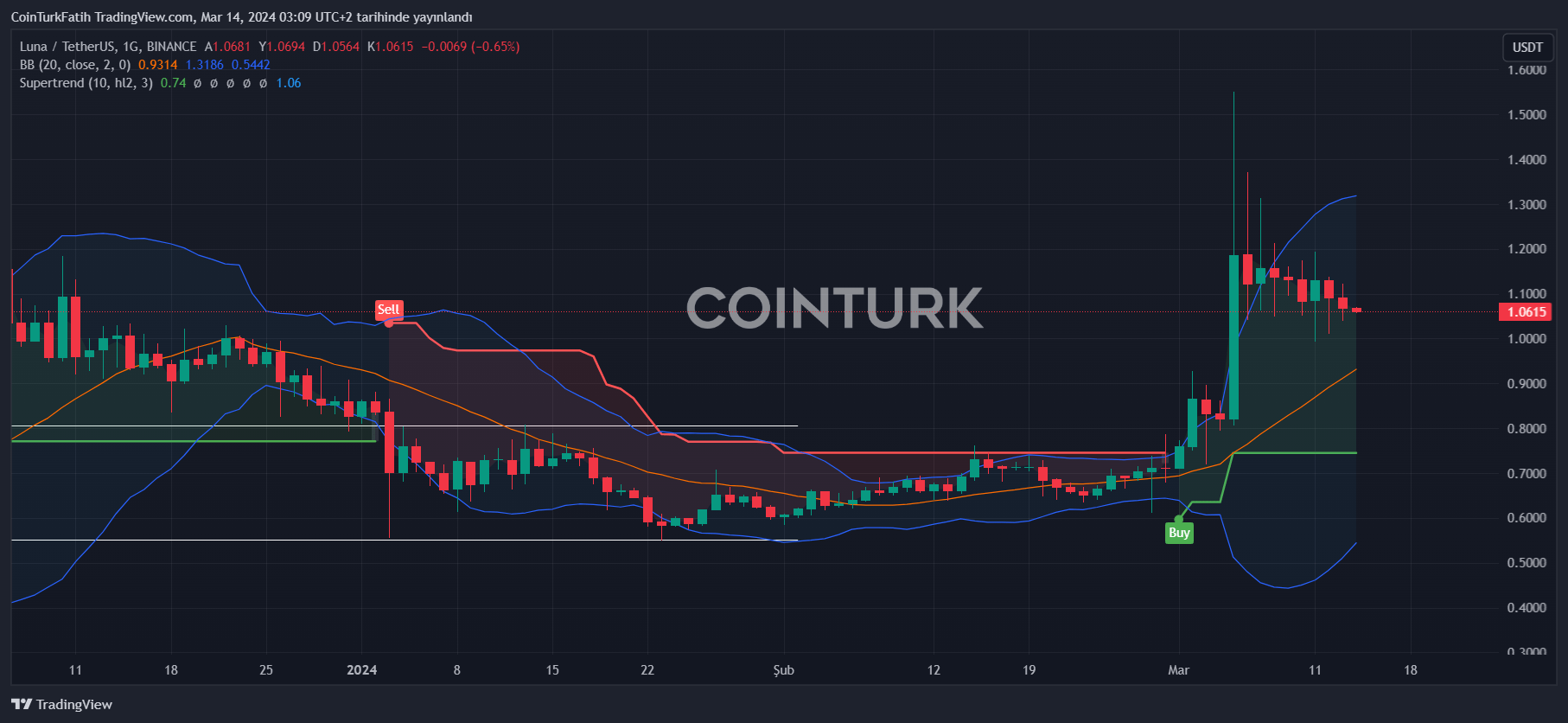

LUNA Coin Price Commentary

Known for its speculative price movements and narrowly escaping collapse in 2022, LUNA Coin continues its gradual decline. The price is now at $1.06, and as mentioned hours ago, if this last support area is lost, we could see a rapid fall to $0.8. The $1 region’s resilience is finding support from BTC optimism.

The short wicks indicate that short-term traders are buying the dips. There’s no easy profit in futures trading, and such movements are normal. However, potential BTC overselling could make LUNA Coin’s decline frustrating.

FLOKI Coin Commentary

Until its March 12 peak, FLOKI Coin’s price saw an increase of nearly 800%. After setting a new all-time high, the popular meme coin is struggling to maintain $0.0002625 as support. It has been successful in the short term.

If we’re to see a rapid decline (possible BTC drop?), tests at $0.000220 and $0.000177 could come next. Closures below these levels have the potential to trigger fast sales with the exit of investors who are up about 94% in profits. The proportion of short-term investors is also high, and all this could lead to dips below $0.000120.

Türkçe

Türkçe Español

Español