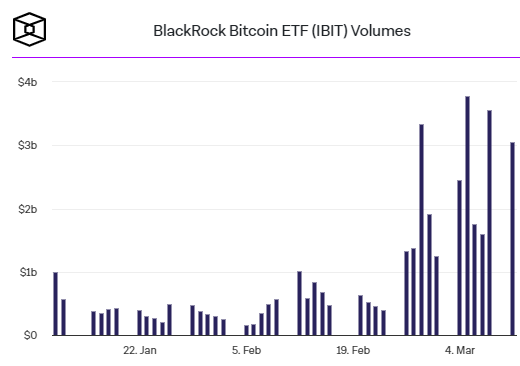

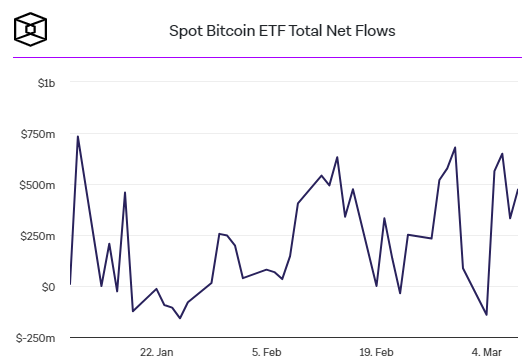

Yesterday, the cryptocurrency world witnessed significant developments. The United States recently approved Bitcoin exchange-traded funds (ETFs) which saw record inflows, turning the spotlight back on this investment vehicle. According to data provided by BitMEX Research, net bitcoin ETF entries surpassed $1 billion on March 12th. Additionally, it was revealed that Blackrock’s IBIT product had exceeded 200,000 BTC earlier this week.

Current Status of Bitcoin ETFs

It was discovered that a record entry of $849 million was made at a price level of $72,841.18 for Bitcoins under management.

For Bitcoin, a record entry of 14,706 BTC was reported. The total net Bitcoin ETF inflow has been over $4.1 billion since January 11, 2024.

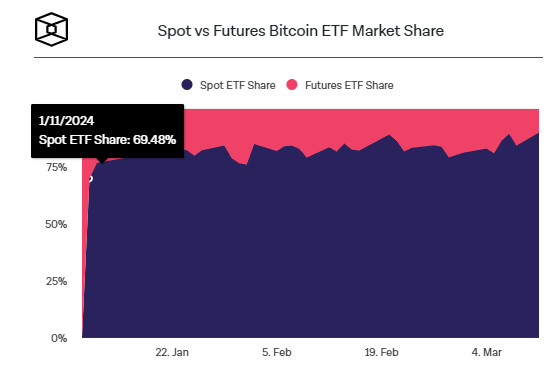

As of yesterday, spot bitcoin ETFs appeared to have captured more than 90% of the daily trading volume market share, indicating the highest level of all time. Bitcoin futures ETFs, on the other hand, only held about 10% of the market share at the time of writing.

The Block’s Vice President of Research George Calle commented on the matter:

Seeing over $1 billion in net inflows in just over a month since their inception is a new record, and nothing short of impressive for any ETF.

GSR Research Analyst Brian Rudick said in an interview with The Block yesterday:

US spot Bitcoin ETFs have achieved great success, surpassing even the most optimistic expectations. With over $10 billion in inflows in just two months, they are approaching what many thought they would do in the first year, and there are arguments for why inflows could increase from here, including more sales efforts by issuers, inclusion in asset manager product offerings, and normalization of GBTC outflows.

Latest Bitcoin Situation

Things seemed to be going well for Bitcoin. The price recently rose to $73,182, and at the time of writing, it refreshed its all-time high (ATH) once again at $73,311. The price increase in Bitcoin was also reflected in the market cap, which is approaching the $1.45 trillion level.

The rise in price and market cap was accompanied by an increase in the 24-hour trading volume. The 24-hour trading volume increased by 9.61% to $62.8 billion, but it still seemed far from the $100 billion level seen in recent days.

Türkçe

Türkçe Español

Español