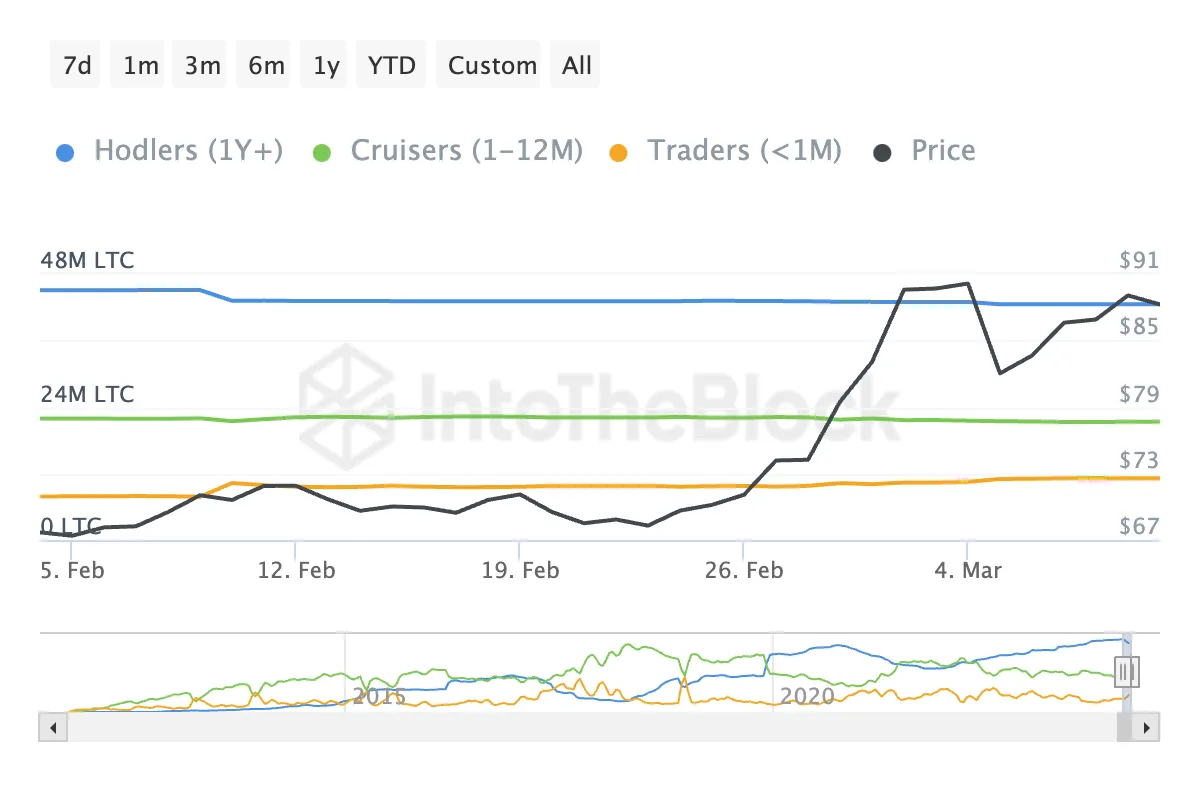

Litecoin, has seen a significant transformation since the beginning of February, with investors holding LTC for less than a month increasing their assets from 7.84 million LTC to 11.13 million LTC. However, the long-term LTC holding period has decreased during this time. The LTC price recently surged by 40% in a single day. Analyzing the data is crucial to understanding whether this upward trend will continue.

Notable Data in LTC Holdings

When examining how long investors hold onto their LTC, there is an increase in short-term investors. These are investors who have held LTC for less than a month. The number of tokens they hold has risen from 7.84 million LTC to 11.13 million LTC. This represents a significant increase of 41.96% in just one month. However, there is a downside to this increase in short-term holders. The number of long-term holders, also known as Hodlers, has decreased during this period. Hodlers’ LTC assets have dropped from 45 million to 42.5 million.

This trend of more short-term investors and fewer long-term holders could have two consequences for LTC’s price. First, it could lead to increased volatility. Short-term investors tend to buy and sell more frequently, which can cause price volatility. Secondly, the decline in Hodlers could be a sign that long-term users are losing confidence in LTC, which could create downward pressure on the price.

RSI Level and LTC

For LTC, a notable move in the RSI from 48 to 71 over a 7-day period reveals much about market dynamics and potential future price movements. The Relative Strength Index (RSI) measures whether an asset is overbought or oversold. Generally, an RSI above 70 indicates an overbought condition, suggesting the price may fall. Conversely, an RSI below 30 suggests an oversold condition, indicating readiness for a potential rise.

Such a change in RSI points to a strong increase in buying pressure for Litecoin, highlighting a significant rise in investor interest and market activity. This ascent past the overbought threshold of 70 has critical implications for LTC’s short-term price trajectory.

The asset may be entering an overvalued phase, which could signal an impending price correction. This scenario often emerges as investors begin to take profits, which could lead to a sell-off that might temper the LTC price increase.

Türkçe

Türkçe Español

Español