The popular altcoin Solana  $162 faced a significant setback as its community rejected a crucial proposal, SIMD-0228, aimed at altering the inflation model of its native currency, SOL. The voting process concluded with 43.6% in favor, 27.4% against, and 3.3% abstaining, failing to achieve the necessary majority for acceptance. Despite a participation rate of 74%, the proposal did not garner sufficient support.

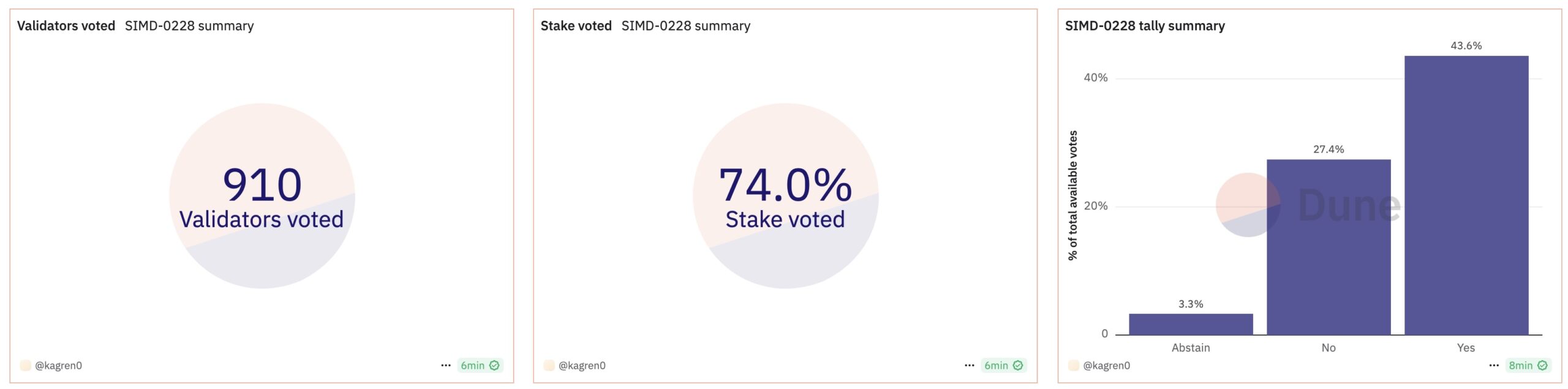

$162 faced a significant setback as its community rejected a crucial proposal, SIMD-0228, aimed at altering the inflation model of its native currency, SOL. The voting process concluded with 43.6% in favor, 27.4% against, and 3.3% abstaining, failing to achieve the necessary majority for acceptance. Despite a participation rate of 74%, the proposal did not garner sufficient support.

Key Changes Proposed for SOL Inflation Model

SIMD-0228 proposed shifting from a fixed-rate inflation system to a variable model based on SOL’s staking ratio. This new approach aimed to dynamically adjust the inflation rate according to the amount of SOL staked on the Solana network. The intention was to enable the network to respond more swiftly and effectively to market changes.

Proponents argued that this change would make Solana’s current economic policy more flexible and sustainable. They also suggested that the dynamic inflation rates would encourage more SOL holders to stake their coins. The main objective of the proposal was to create a stronger and more effective economic model to support the growth of the Solana ecosystem.

Insufficient Community Support

The primary reason for the failure of the proposal was the lack of adequate support from the community. Although a total of 910 validators participated, their votes were not enough to pass the proposal. Furthermore, the high percentage of negative votes at 27.4% highlighted clear divisions in opinions regarding the proposal.

The rejection of SIMD-0228 indicates that the existing fixed-rate inflation system will continue. This outcome was met with disapproval by some SOL coin holders who believed that a variable inflation model could have driven prices up by encouraging staking. It remains uncertain whether the Solana community will revisit similar proposals in the future, but discussions on economic policies for the altcoin are expected to persist.

Türkçe

Türkçe Español

Español