Solana (SOL), gained a significant number of users, experiencing an optimistic month in terms of network activity. However, the same cannot be said for the token’s price movement, which remained under the influence of bears during this period.

Solana’s Analytical Reports

Artemis shared a tweet last month highlighting the blockchains with the highest daily active users. Solana could not make it into the top three dominated by Fantom (FTM), Optimism (OP), and Base, but it was content with a promising 21% monthly increase. Experts took a closer look at Artemis’s data to see how other relevant metrics performed last month. Additionally, Solana’s Daily Active Addresses have shown an increase over the past 30 days.

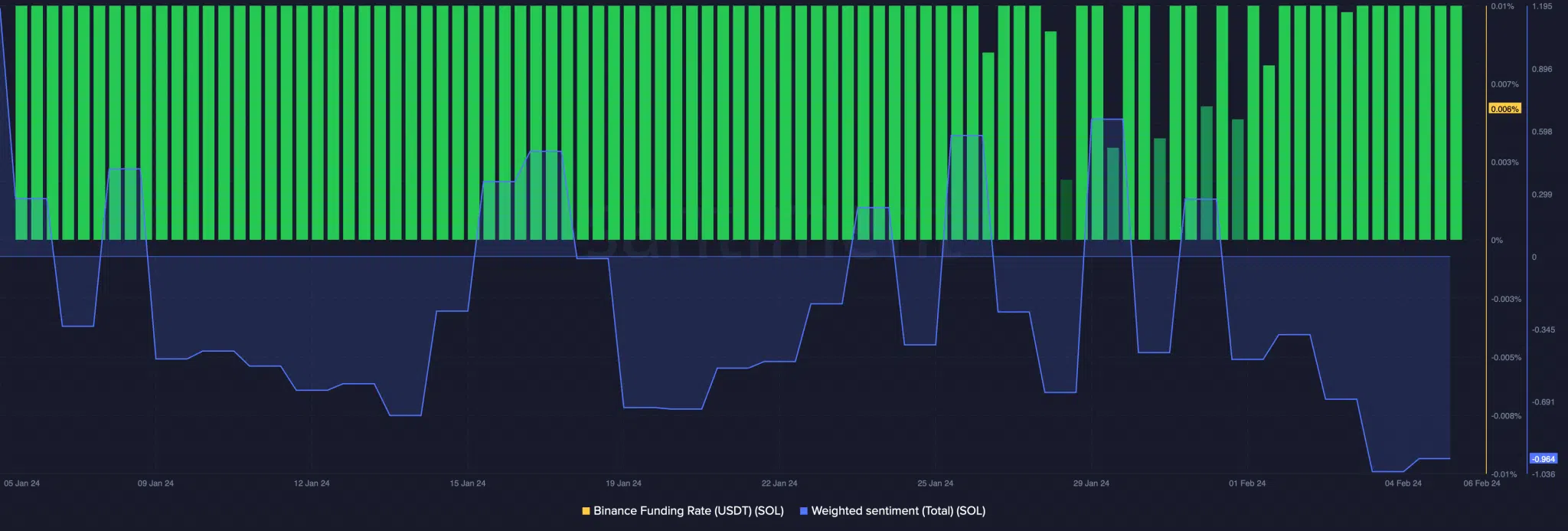

As a result, the blockchain’s daily transactions remained high during the same period. Even though the blockchain’s network activity is rapidly increasing, the token’s price movement is not quite in sync. According to CoinMarketCap, SOL’s price saw a slight increase of just over 1% last month, moving sideways. At the time of writing, SOL is trading at $96.06 with a market value of over $41.9 billion. Furthermore, SOL’s weighted sentiment remained on the negative side for most of the past month.

Current Data on SOL

Moreover, the Binance funding rate also remained on the rise. This could mean that derivative investors are actively purchasing SOL due to low price volatility. Looking at Solana’s daily chart, it seems likely that a few more slow-moving days could be experienced.

The Bollinger Bands indicated that the SOL price is in a less volatile region. The MACD also showed the possibility of a downward trend. However, SOL’s Money Flow Index (MFI) recorded a sharp rise, indicating an uptrend. In conclusion, while Solana experienced an increase in its user base and a positive period of network activity, it did not rise to the top of the best blockchains according to Artemis data, and its price movement remained under the influence of bears. Increases in other metrics indicate rising network activity, but SOL’s price has not progressed steadily.

Türkçe

Türkçe Español

Español