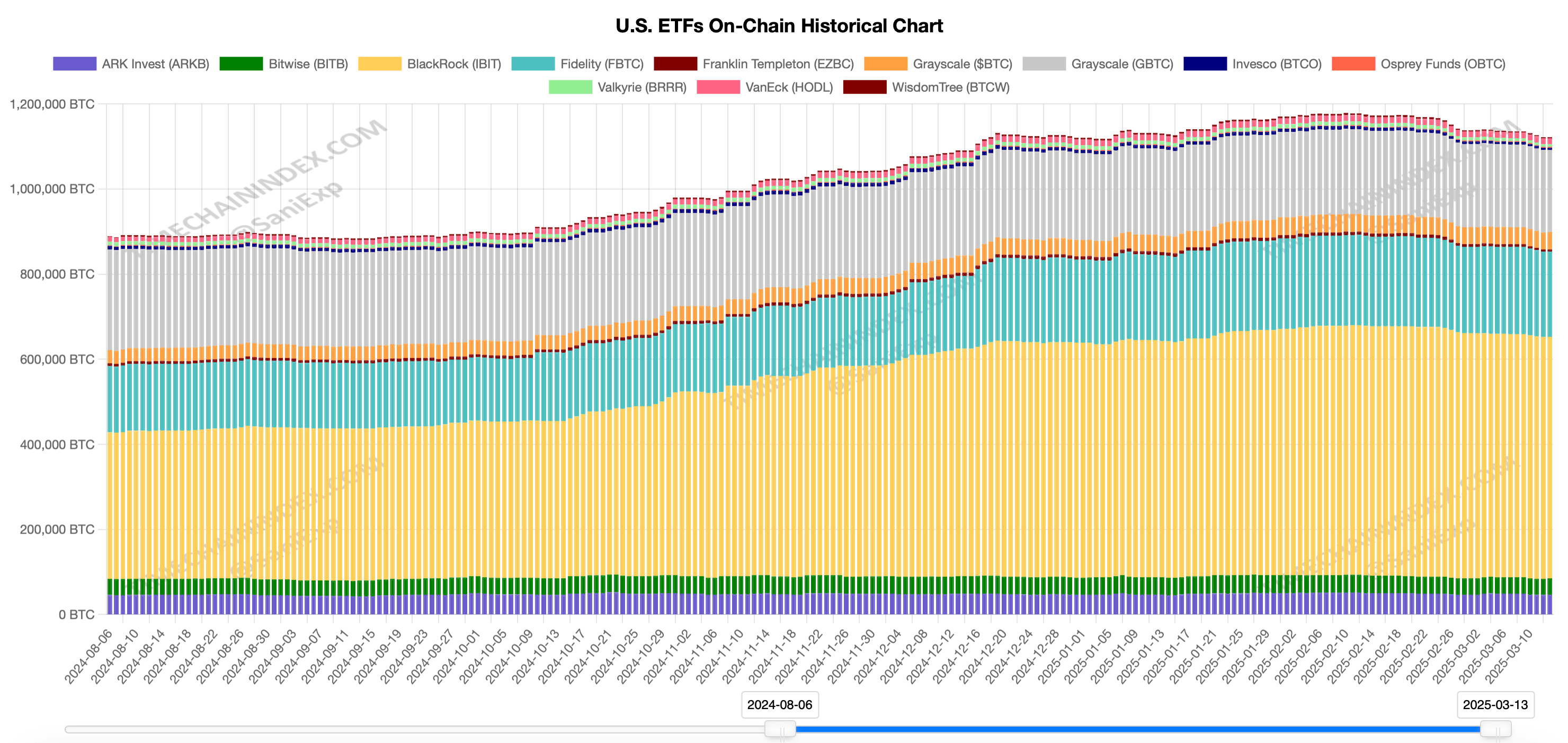

Since February 6, 2025, spot Bitcoin  $103,756 exchange-traded funds (ETFs) in the United States have lost 4.76% of their total assets. Between early January and February 6, these funds added 56,802 BTC but saw nearly the same amount (55,348 BTC) withdrawn over the following 35 days. This drop has been valued at approximately $4.58 billion.

$103,756 exchange-traded funds (ETFs) in the United States have lost 4.76% of their total assets. Between early January and February 6, these funds added 56,802 BTC but saw nearly the same amount (55,348 BTC) withdrawn over the following 35 days. This drop has been valued at approximately $4.58 billion.

Sudden Withdrawal in US Spot Bitcoin ETFs

Spot Bitcoin ETFs experienced rapid growth since the beginning of the year. On January 1, 2025, these funds held a total of 1.12 million BTC, which increased to 1.177 million BTC by February 6. However, after reaching this peak, there was a sharp decline, leading to an outflow of 55,348 BTC within 35 days.

Despite this decrease, US spot Bitcoin ETFs currently hold 1.121 million BTC, representing 5.6% of Bitcoin’s total market value. The total assets of these funds are approximately $93.25 billion.

Are New Spot Bitcoin ETFs on the Horizon?

Currently, there are 12 spot Bitcoin ETFs trading in the US. However, a new one may soon enter the market. Osprey Funds filed an application for the Osprey Bitcoin Trust (OBTC) with the SEC on February 14, 2025. Although not yet approved, it is reported that as of March 16, 2025, OBTC holds approximately 1,934 BTC, valued at around $160 million.

This new application indicates that investor interest in spot Bitcoin ETFs remains strong. However, the recent significant outflows from these funds suggest that the market could be volatile.

Türkçe

Türkçe Español

Español