In a recent market development, a wallet address known to be associated with Bitcoin investment company Amber Group made a significant move by depositing a total of 10.89 million LDO worth $32.81 million into Coinbase. This strategic maneuver, which occurred about 2 hours ago, necessitates a closer look at the whale’s actions and potential outcomes.

Analysis of Historical Withdrawal and Deposit Transactions: From Binance to Coinbase

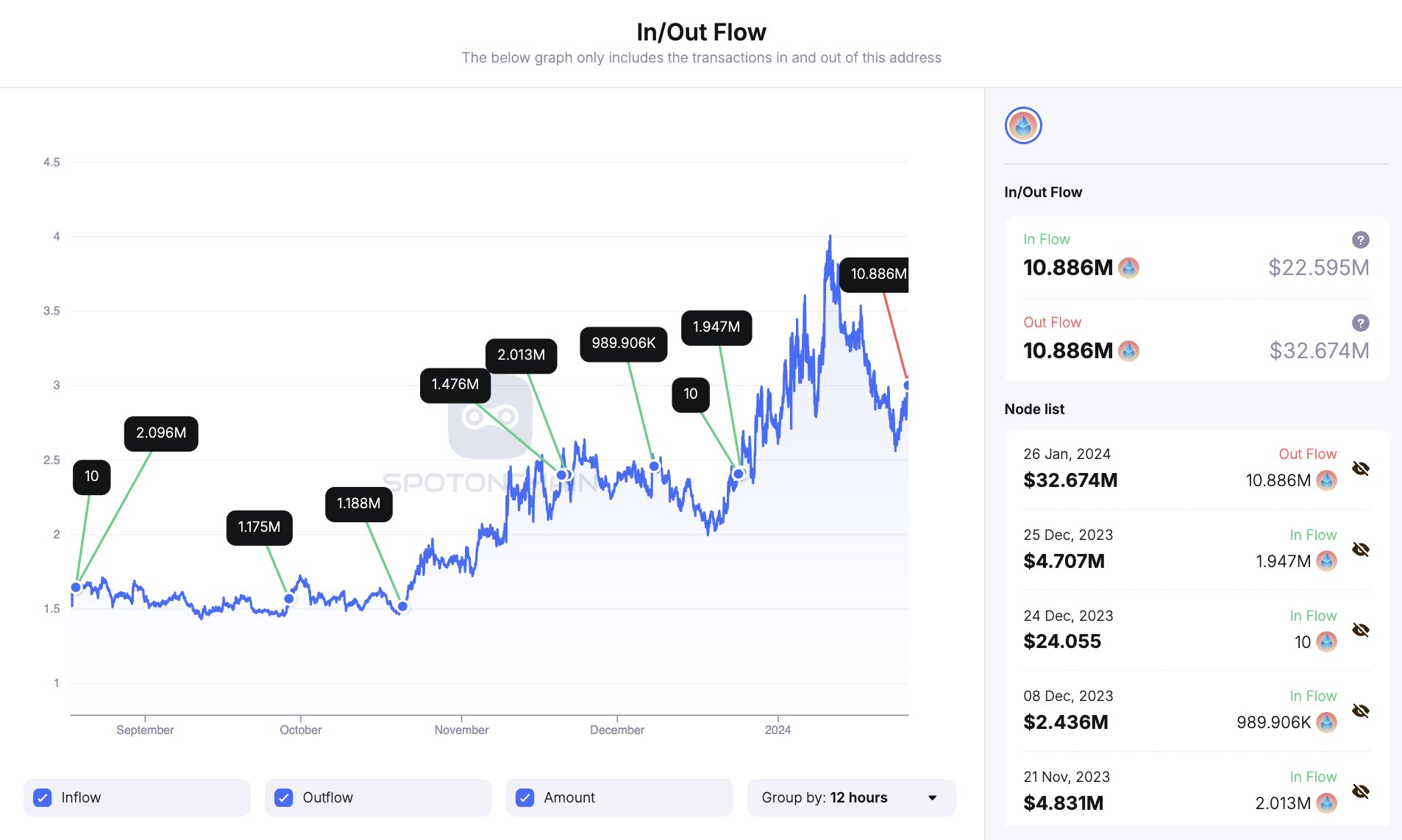

When examining the transaction history, it is seen that Amber Group carried out a series of withdrawal transactions from Binance during the period of August-December 2023. During this time frame, the average purchase price of the altcoin LDO was $2,076. However, with a notable change in strategy, Amber Group chose to deposit all of its LDO assets into Coinbase at a higher value of $3,014.

The strategic shift from withdrawing altcoin LDO at an average of $2,076 on Binance to depositing at $3,014 on Coinbase has raised intriguing questions about Amber Group’s objectives. Selling the deposited tokens at their current market value could yield a significant increase of 45.1%, amounting to an estimated profit of approximately $10.21 million.

Key Takeaways and Considerations

Timing and Market Dynamics: The timing of the deposit into Coinbase is a step in harmony with broader market dynamics. It could also mean a strategic response to evolving conditions. Understanding the context surrounding this move is very important for interpreting Amber Group’s intentions.

Profitability Calculation: The estimated profit of $10.21 million based on current market value highlights the potential gains that can be achieved with strategic moves in the cryptocurrency market. This figure serves as an important metric for assessing the success of Amber Group’s decision.

Whale Watching Strategy: The actions of leading whales, especially those associated with influential organizations like Amber Group, often serve as indicators for other market participants. The decision to deposit tokens into Coinbase could affect market sentiment and trigger other reactions.

Navigating the Crypto Landscape: Implications for Investors

Crypto investors and enthusiasts need to understand and interpret whale movements to make informed decisions. The strategic shift observed in this case underscores the dynamic nature of the crypto environment, where large transactions can significantly influence market trends.

In conclusion, the recent deposit of 10.89 million LDO into Coinbase by a wallet address associated with Amber Group has added a new element to the crypto narrative. The strategy’s shift from Binance withdrawal transactions to Coinbase deposit transactions indicates a calculated approach potentially influenced by market conditions.

Türkçe

Türkçe Español

Español