Strategy, the world’s largest Bitcoin reserve company, faced a challenging December but began to recover early in January. This recovery was significantly influenced by the latest MSCI decision. As the company regained stability, it accelerated its Bitcoin accumulation and is now in a better position to make additional purchases.

Strategy’s Recent Bitcoin Purchase

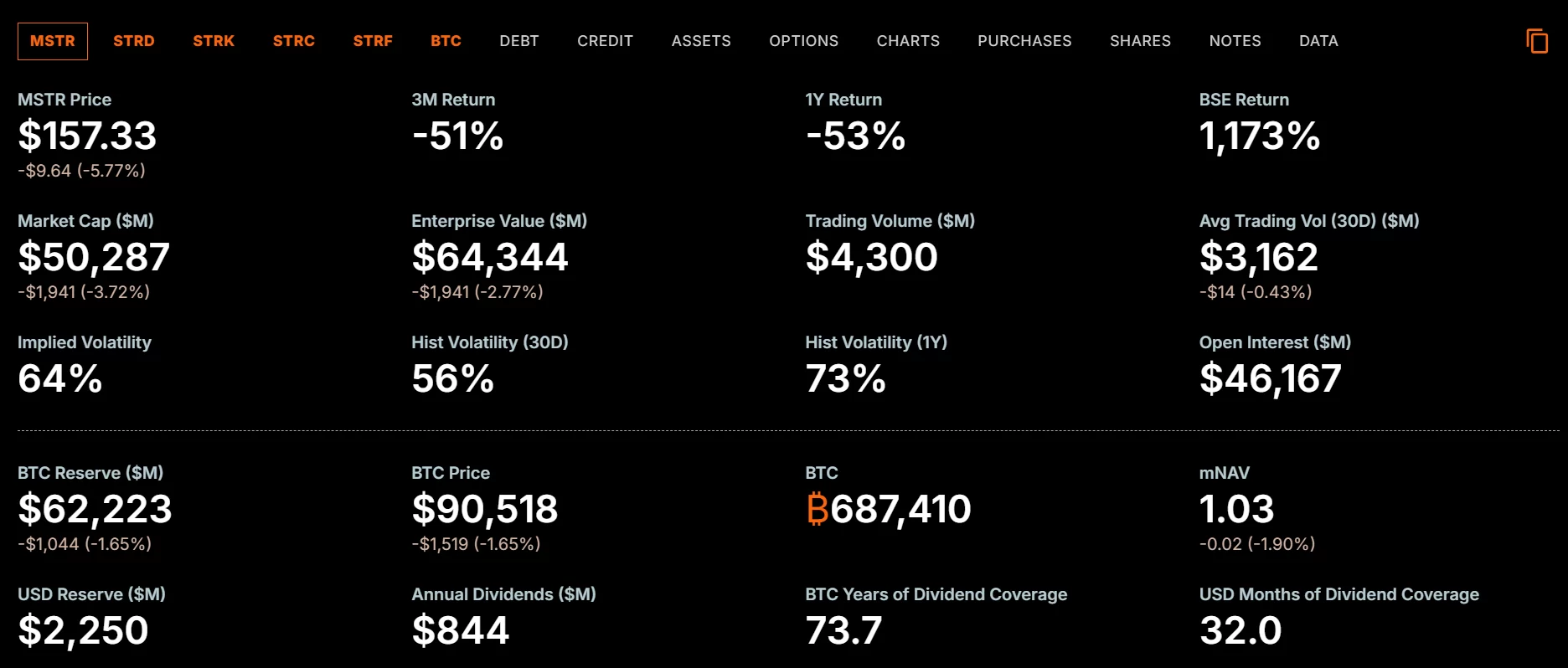

Last week, Strategy acquired 13,627 BTC. This purchase, worth approximately $1.25 billion, was made at an average cost of around $91,519 per Bitcoin. Currently, the company’s total Bitcoin reserves have risen to 687,410 BTC, with a total expenditure of $51.8 billion. The average cost for the entire BTC accumulation stands at $75,353.

Impact of MSCI’s Decision

The company experienced recovery after its MNAV dropped below 1, following MSCI’s decision to postpone a planned delisting. Although the 1.1 level has not yet been breached, maintaining a level above 1 is a positive development.

However, it’s important to note that MSCI’s announcement is a postponement rather than a reversal of the delisting decision. The organization still considers removing cryptocurrency reserve companies from global indices because they resemble funds rather than stocks in their behavior. This suggests that fears and uncertainties could resurface in the future.

Despite these concerns, the immediate outcome of last week’s decision was favorable. Strategy’s renewed capacity to enhance its Bitcoin holdings reflects its resilience and strategic adaptations to external market factors.

The ongoing developments in the cryptocurrency market continue to influence both established and emerging players, as seen through the lens of Strategy’s recent activities. Continuous monitoring of MSCI’s decisions remains crucial for understanding future market dynamics and strategic positioning.