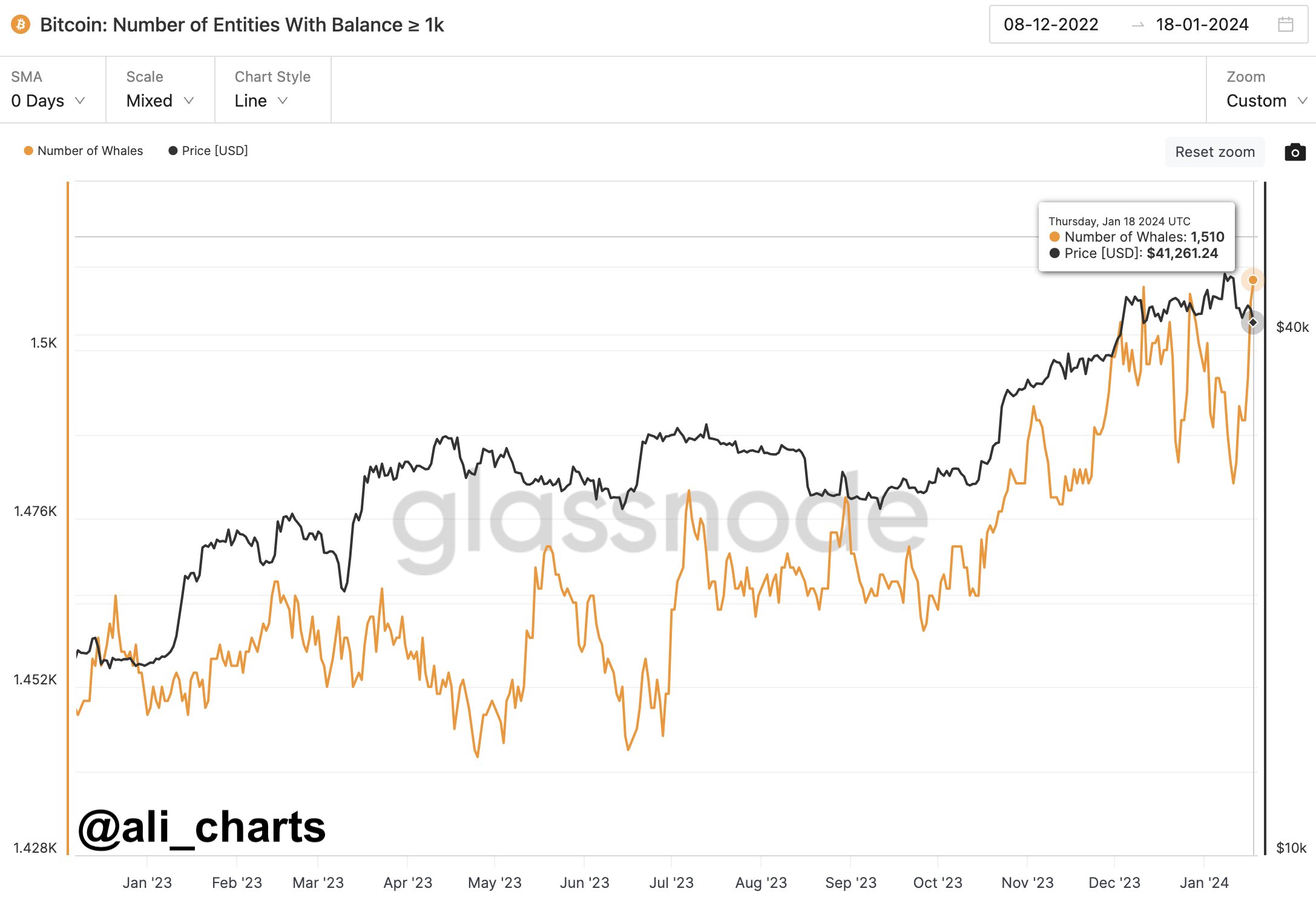

Analyst Ali Martinez, with a notable statement, draws attention to a significant increase in Bitcoin whales. As of today, the number of addresses holding more than 1,000 BTC has increased, reaching a total of 1,510 addresses, the highest point since August 2022. So what does this increase mean for Bitcoin? Let’s look into the details.

Increase in Bitcoin Whales: Fundamental Metrics Revealed

Analyst Ali Martinez’s observations highlight a notable increase in the presence of Bitcoin whales, those who hold significant amounts of cryptocurrency. The metric focusing on addresses with assets exceeding 1,000 BTC points to an increase towards levels not seen since August 2022.

The increase in the number of addresses holding significant amounts of Bitcoin raises intriguing questions about the underlying market dynamics. The notable rise in major BTC holders, now totaling 1,510, can be interpreted in various ways.

One possible interpretation is that this increase reflects a rising level of confidence among large Bitcoin investors. Increased whale activity often points to positive sentiments and belief in the long-term potential of cryptocurrency.

Alternatively, the increase in Bitcoin whales could be an indicator of strategic positioning in the market. Large portfolio owners may be strategically adjusting their portfolios in anticipation of future market movements. The actions of these significant players can serve as valuable indicators for other market participants.

Navigating Bitcoin Dynamics Amidst Whale Movements

For cryptocurrency enthusiasts and investors, closely monitoring whale activities can provide insights into potential market trends. Understanding the motivations behind the actions of large BTC holders can be effective in making informed decisions in the volatile crypto environment.

While the number of addresses holding over 1,000 BTC has reached its highest point since August 2022, market participants are encouraged to stay alert. Whether due to confidence or strategic maneuvers, the actions of Bitcoin whales have implications for the overall market.

In conclusion, analyst Ali Martinez’s observation of an increase in Bitcoin whales and the number of addresses exceeding 1,000 BTC reaching the highest level since August 2022 is stirring curiosity in the crypto community. Whether pointing to increased confidence or strategic positioning, the actions of these major holders contribute to the evolving narrative of the Bitcoin market.

Türkçe

Türkçe Español

Español