The CEO of the largest stablecoin, Tether, Paolo Ardoino, believes that global geopolitical tensions and macroeconomic trends will increase the importance of scarce assets like Bitcoin (BTC) and gold. In an interview with investor and venture capitalist Preston Pysh, Ardoino highlighted rising geopolitical issues worldwide and expressed his belief that the world is not entering a better period.

Expecting Increased Demand for Bitcoin and Gold

Ardoino stated that the high tensions starting in Europe and continuing in the US and other regions are causing global unrest. He emphasized that this situation would increase the demand for scarce assets like Bitcoin and gold, and he believes that investors turning to these assets is the most logical move.

The Tether CEO mentioned that China and other countries are buying “tremendous amounts” of gold out of fear, and individual investors should similarly diversify their portfolios by purchasing gold or Bitcoin. Ardoino argues that such investments will provide protection against potential adverse events in the future.

Ardoino said, “Everyone is afraid that something will happen. Buying Bitcoin and gold is the smartest thing you can do with your profits. You should invest a portion of your profits in something that can withstand God’s wrath, and maybe I’m wrong, but we will experience this situation in the future.”

Bitcoin and Gold Could Be the Safest “Safe Haven”

Ardoino’s statements serve as an important warning for investors to turn to assets like Bitcoin and gold, especially in light of current global uncertainties. These types of investments are considered the safest “safe haven” for investors against potential future risks.

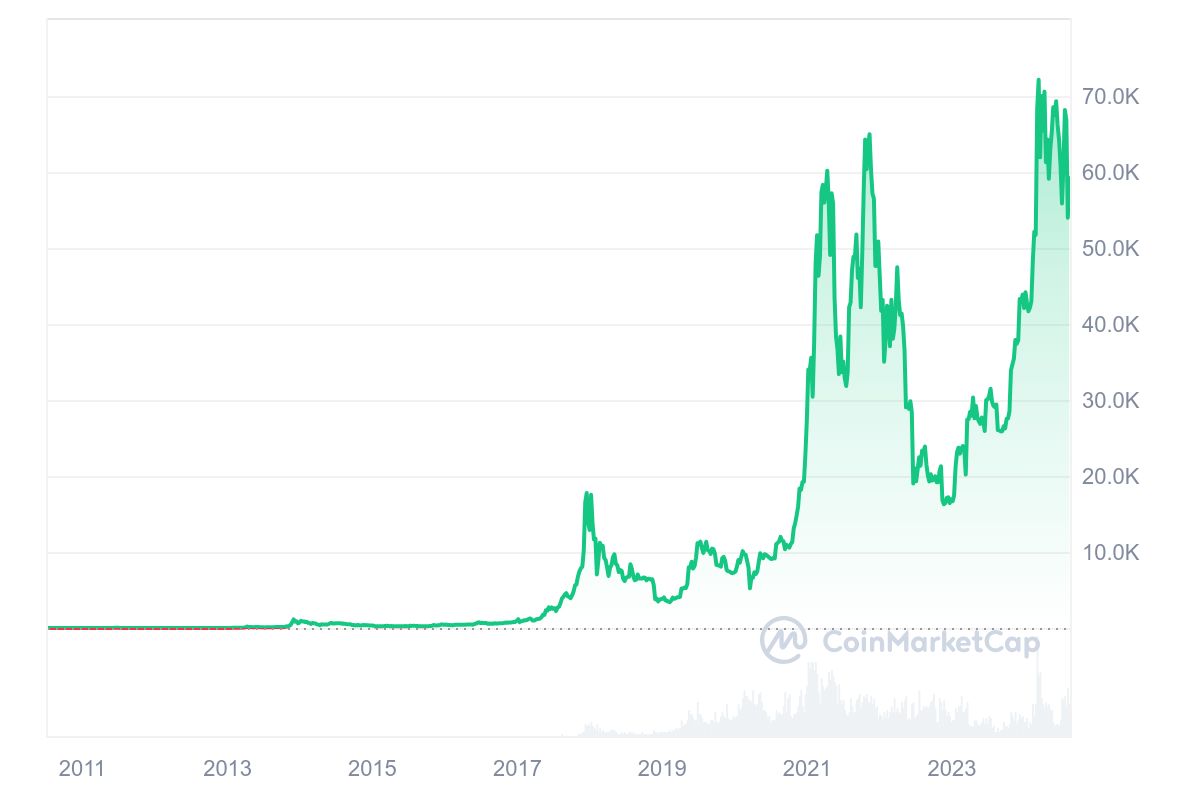

According to current data, BTC has risen by 0.16% in the last 24 hours, trading just above the 59,000-dollar threshold at 59,176 dollars. The ounce of gold has increased by 0.03% in the last 24 hours, trading at 2,472 dollars.

Türkçe

Türkçe Español

Español