Tether, the world’s largest stablecoin, has managed to remain resilient despite years of various controversies. Recent panic among investors due to the EU ban has not deterred Tether’s stability. Those who succumbed to fear became victims of short-term debates.

Tether’s Impressive 2024 Report

The company announced the completion of a reserve audit by the globally renowned auditing firm BDO. This report is now accessible on their official website. The year 2024 witnessed extraordinary performance, with the last quarter surpassing annual net profits of $13 billion, marking it as the largest earnings period ever.

Tether’s equity has exceeded $20 billion, with increasing investments in emerging sectors such as renewable energy, Bitcoin  $91,967 mining, artificial intelligence, telecommunications, and education. A notable highlight from the last quarter of 2024 is the company achieving a record $113 billion in U.S. Treasury bond assets.

$91,967 mining, artificial intelligence, telecommunications, and education. A notable highlight from the last quarter of 2024 is the company achieving a record $113 billion in U.S. Treasury bond assets.

USDT Sees Significant Growth

In the last quarter, the circulating supply of USDT increased by $23 billion, indicating more liquidity entering the markets. While we haven’t observed a significant rise in altcoin prices, the demand for USDT is noteworthy. Throughout 2024, the total issuance of USDT rose by $45 billion, nearly equating to the total value of the second-largest stablecoin.

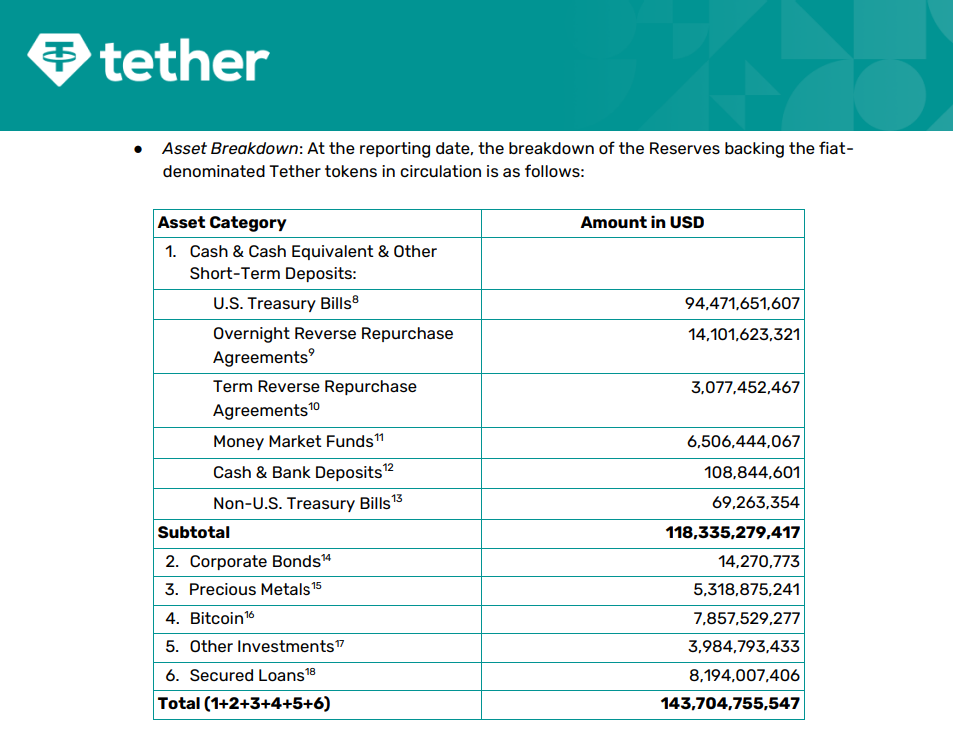

Tether’s total assets amount to $157.6 billion, with a total reserve obligation for circulating USDT tokens at $137.6 billion. The total reserve held for circulating USDT is $143.7 billion.

CEO Paolo Ardoino stated that Tether’s confirmation for the last quarter of 2024 strengthens its position as a global leader in financial transparency, liquidity, and innovation. With U.S. Treasury assets surpassing $113 billion, a reserve surplus exceeding $7 billion, and $45 billion in new token issuance throughout the year, Tether continues to set the gold standard for stability and trust in digital assets.