Despite the common belief that high demand when a cryptocurrency is held in low amounts on cryptocurrency exchanges leads to price increases, cryptocurrency expert Willy Woo broke the mold by stating that buying large amounts of Bitcoin (BTC) during periods of low supply in exchanges will not necessarily trigger a significant price increase.

The Barrier to Supply Shock: Futures Market

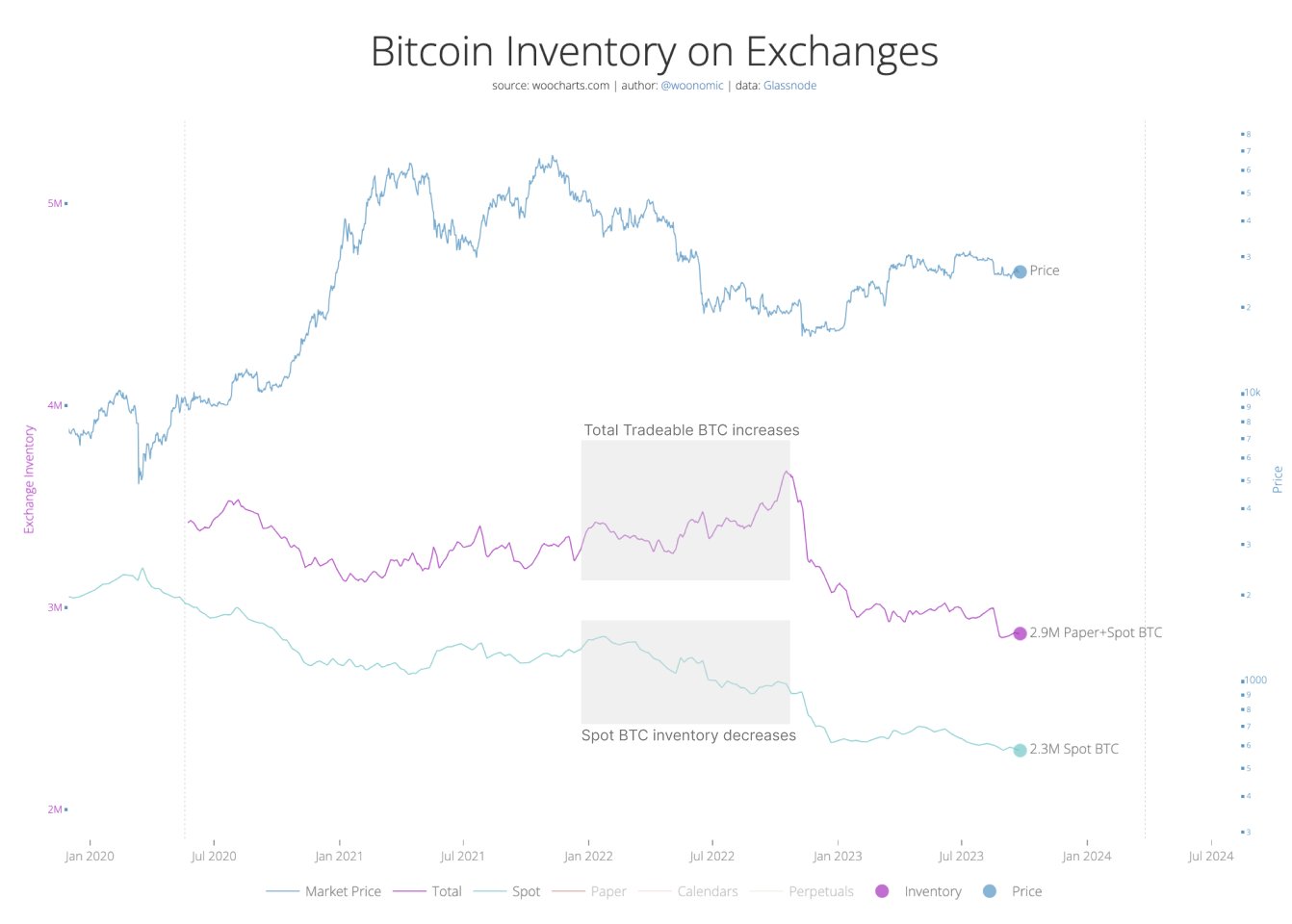

On September 24, Woo emphasized in a post on his personal account that investors buy small amounts of BTC on cryptocurrency exchanges during the bear market in 2022. The cryptocurrency expert noted that the belief that low Bitcoin reserves on cryptocurrency exchanges combined with high demand would increase the price does not reflect reality and is merely a misconception.

The cryptocurrency expert also marked his opinion on a chart showing Bitcoin reserves on cryptocurrency exchanges, stating, “There was no supply shock because synthetic BTC is now being minted through futures markets. The market bottomed when futures markets were relieved.”

As the expert mentioned, an investor who wants to invest in Bitcoin can now buy a futures-based ETF instead of buying Bitcoin from the spot market. However, this cannot be a trigger for an absolute supply shock because these are merely paper bets on the price increase, and a hedge fund can facilitate the creation of new synthetic BTC by taking the opposite side of the bet.

“The Problem Can Only Be Solved with a Spot Bitcoin ETF”

Woo believes that the occurrence of a supply shock depends on the launch of a spot Bitcoin ETF. The cryptocurrency expert emphasized that this problem can only be solved with the introduction of a spot Bitcoin ETF and added the following:

A spot Bitcoin ETF will help address this issue. Applications for a spot Bitcoin ETF have been rejected for a full 7 years while futures markets have developed. In fact, the U.S. Securities and Exchange Commission’s (SEC) view on a spot Bitcoin ETF is quite clear.