Today, the cryptocurrency market has been at the center of attention in recent times. Geopolitical instability and high inflation figures in the US are causing uncertainty in many areas. Following all these developments, the decline in the cryptocurrency market continues to deepen. The increase in volatility in the markets has led to an increase in liquidations in the futures market, and the total locked value (TVL) in the sector has fallen to its lowest levels since February 2021.

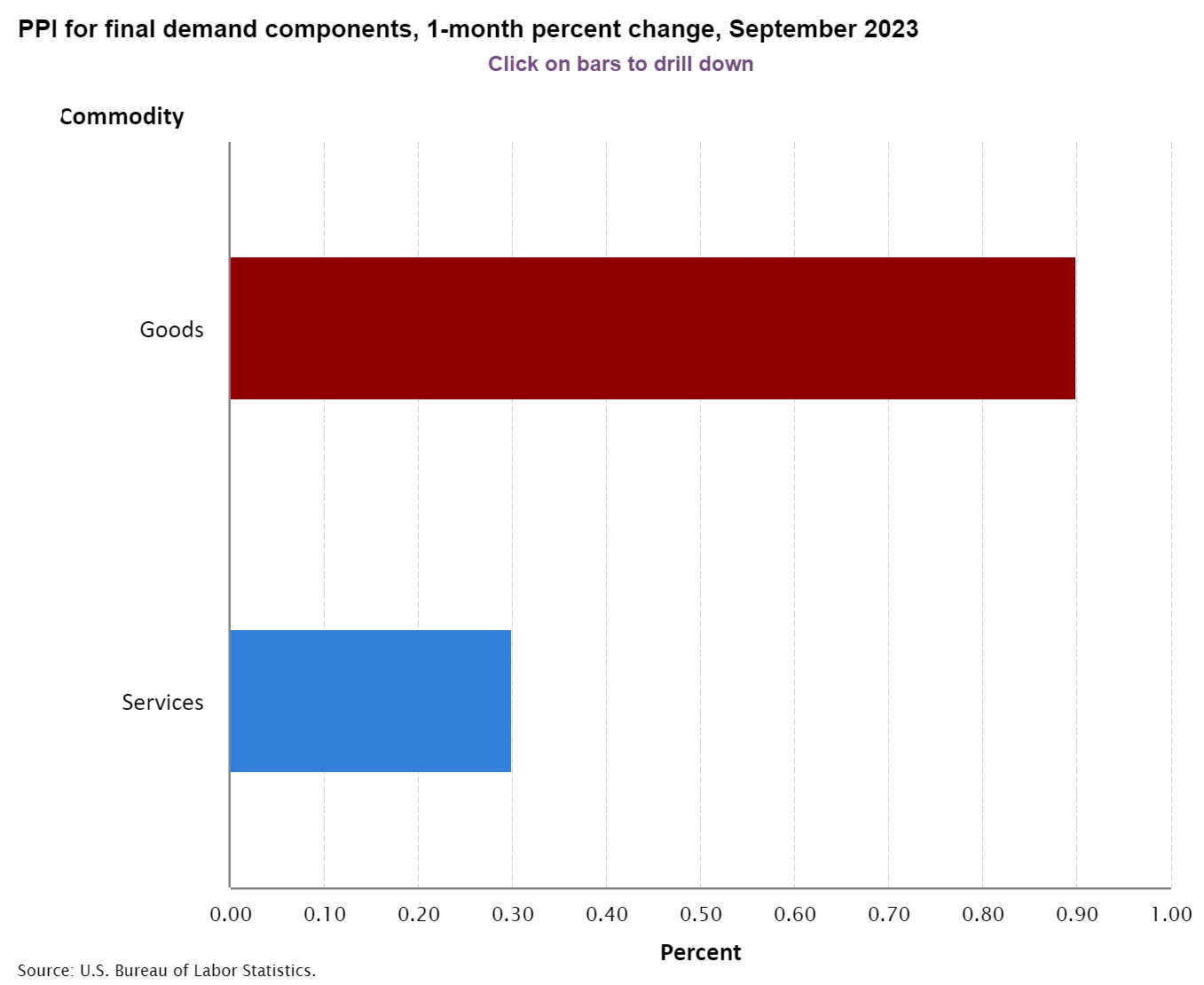

PPI Data Deeply Impacted All Markets

The Producer Price Index (PPI) data announced today caused concern with a 0.5% increase. Following the higher-than-expected PPI data, the price of Bitcoin dropped to its lowest level in the last two weeks, causing October gains to evaporate.

Along with the inflation data, many major banks have renewed their predictions that the US will enter a recession this year. According to the analysis by U.S. Bank, there are larger interest rate hikes on the horizon in the US, and therefore investor sensitivity will continue to remain low in the current economy:

“US stock performance is showing a mixed trend in the early days of October due to inflation and increasing interest rates, as well as the announcement of third-quarter corporate earnings.”

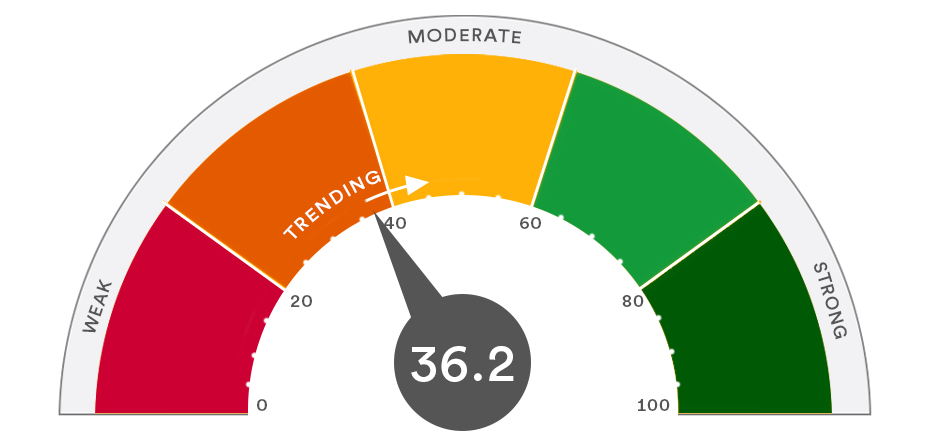

TVL Reaches Its Lowest Level in Years

TVL data is a way to examine the sensitivity of investors in the blockchain ecosystem, such as proof-of-stake (PoS), and to verify the healthy functioning of the ecosystem. At the same time, developments across decentralized applications (DApps) can also be tracked with this metric.

According to the data obtained on October 11, the TVL value in the crypto market is currently $36.8 billion. This level was last seen on February 7, 2021. The protocol with the highest TVL value is dominated by Lido, which has a 38% market dominance. A 15% decrease in transaction volumes was added to the decrease in TVL.

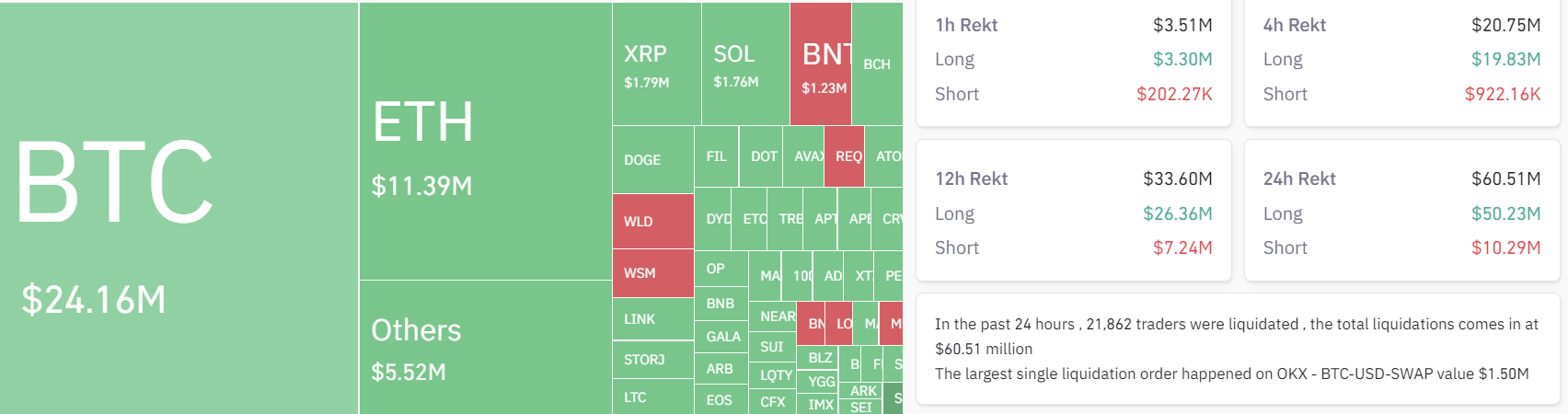

Record Losses in the Futures Market

Liquidation of long positions in the futures market without buying pressure from transaction volume or large amounts of TVL has always had a negative impact on the cryptocurrency market.

Within just 24 hours, approximately $50.3 million worth of long positions were liquidated in the cryptocurrency market. The largest liquidation occurred on the OKX exchange. As a result of a single transaction, an investor experienced a loss of $1.5 million due to the liquidation of their Bitcoin long position.