Bitcoin price is bouncing back and forth in the support-resistance zone between $28,000 and $27,200 like a ping pong ball. This movement is not very exciting, and we have been seeing a price that has been trapped in a narrow range for weeks. With low volumes, high inflation, and rising oil prices, there are many events that feed the pessimism of cryptocurrency investors. So is there any hope?

The Future of Cryptocurrencies

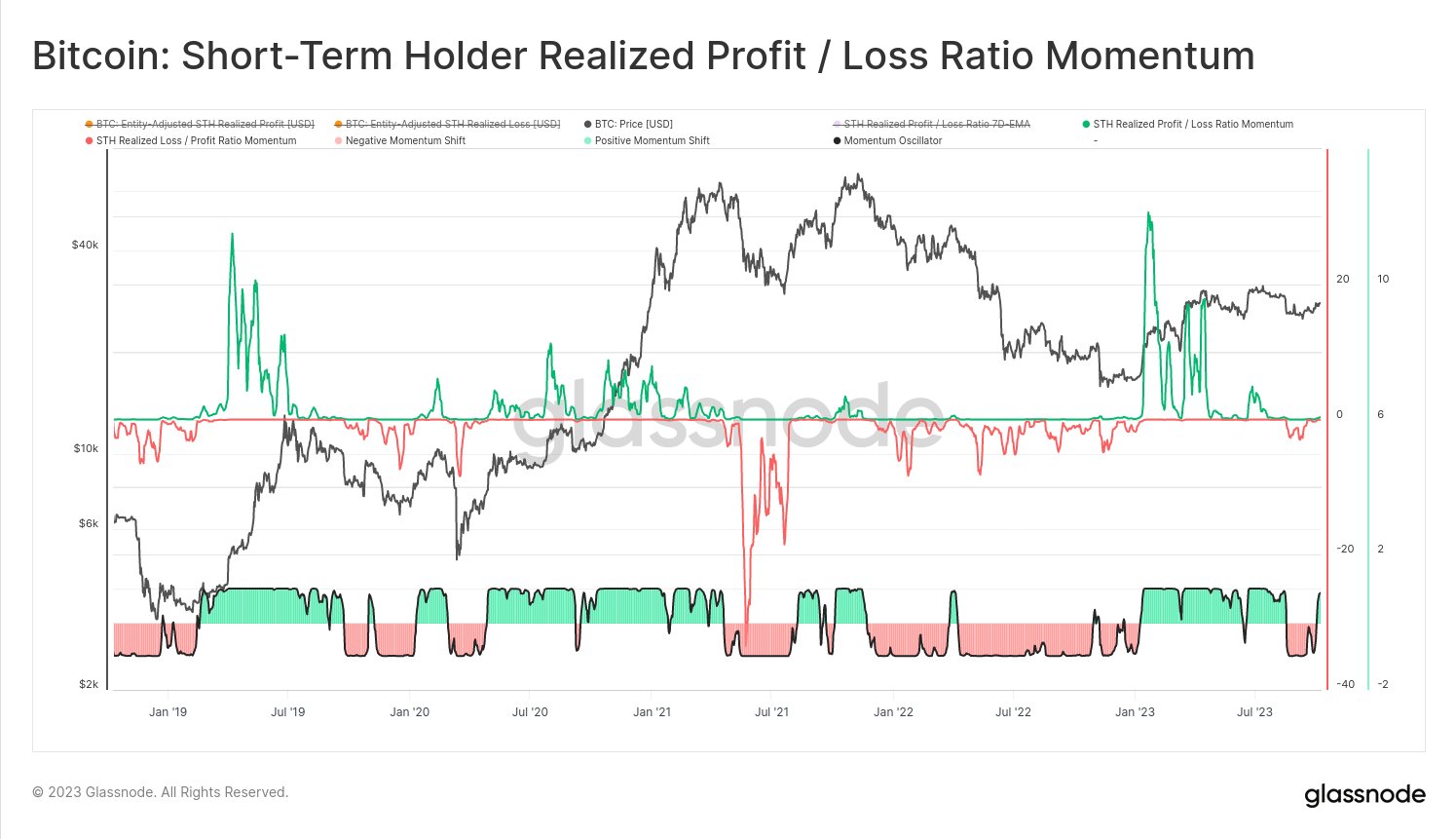

Glassnode, a crypto analytics firm, shared its latest predictions about the market amidst all this pessimism in the macro landscape. Unlike anonymous analysts, Glassnode experts share their comments based on data rather than speculation. Therefore, their latest market analysis could be interesting.

Checkmate, an on-chain expert and the lead analyst at Glassnode, says that the profit/loss momentum metric for short-term Bitcoin investors has recently recovered and turned green again. According to Glassnode, the profit/loss momentum indicator focuses on determining the current trend of the relevant asset. Short-term investors represent the group that added BTC to their wallets less than 155 days ago.

Indicator of Rising in Crypto

We have realized that this indicator is useful in predicting the future of the market. So what does this indicator point to? Checkmate says that this metric is the “most sensitive on-chain trend indicator” developed by Glassnode so far. We may now be entering a period of growth.

“Bears negatively affected the market with sales from $29,000 to $26,000. However, despite the significant losses in the market (the most bearish period since FTX), they could not deepen the decline.

There are two interpretations for the green turnaround:

– The last buy before doomsday.

– The return of power.”

Checkmate, the analyst king, says that the strong position of the cryptocurrency despite such a turbulent environment indicates a rise. Checkmate also believes that Bitcoin is still in a “value zone.”

BTC is trading below the real market average price of $29,700. According to Glassnode, the realized average market price is a model that represents the cost basis for all coins acquired in the secondary markets.

According to Checkmate, the Bitcoin price will rise again, and the bears are mistaken about further losses. BTC is currently finding buyers at $27,413.