The US inflation data exceeding expectations continues to cause declines in the cryptocurrency market. After the October 12 Wall Street opening and the US September Inflation Data, Bitcoin was trading at $26,720 at the time of writing. So, what are the possible scenarios for Bitcoin and how do analysts interpret this situation? Let’s examine together.

US Data Keeps the Market Under Pressure

Data from TradingView shows that Bitcoin volatility has been relatively calm compared to the early days of October. The most important factor behind this situation is undoubtedly the uncertainty in US macroeconomic data.

The Consumer Price Index (CPI) pressure in September reached 3.7% compared to the expected 3.6%. When food and energy sectors are excluded from the index, the CPI figure appears as 4.1%. An official statement on this matter came from the US Bureau of Labor Statistics:

“The all items index increased 3.7 percent for the 12 months ending September, the same increase as for the 12 months ending August. The index for all items less food and energy increased 4.1 percent over the past year. The energy index declined 0.5 percent over the 12 months ending September, while the food index increased 3.7 percent.”

The financial commentary source The Kobeissi Letter criticized the US macroeconomic data. In a post made on X, analysts drew attention to both monetary policy and the difficult position of the Federal Reserve:

“PCE and PPI inflation are rising while CPI inflation is above expectations.”

What Do Analysts Think about Interest Rate Hikes?

The pressure of interest rates in the US continues to receive serious attention worldwide. Especially in traditional markets, this pressure leads to significant losses in the cryptocurrency markets. Additionally, the concept of “higher for longer” about interest rates has come to the fore again among experts, causing concerns among many investors.

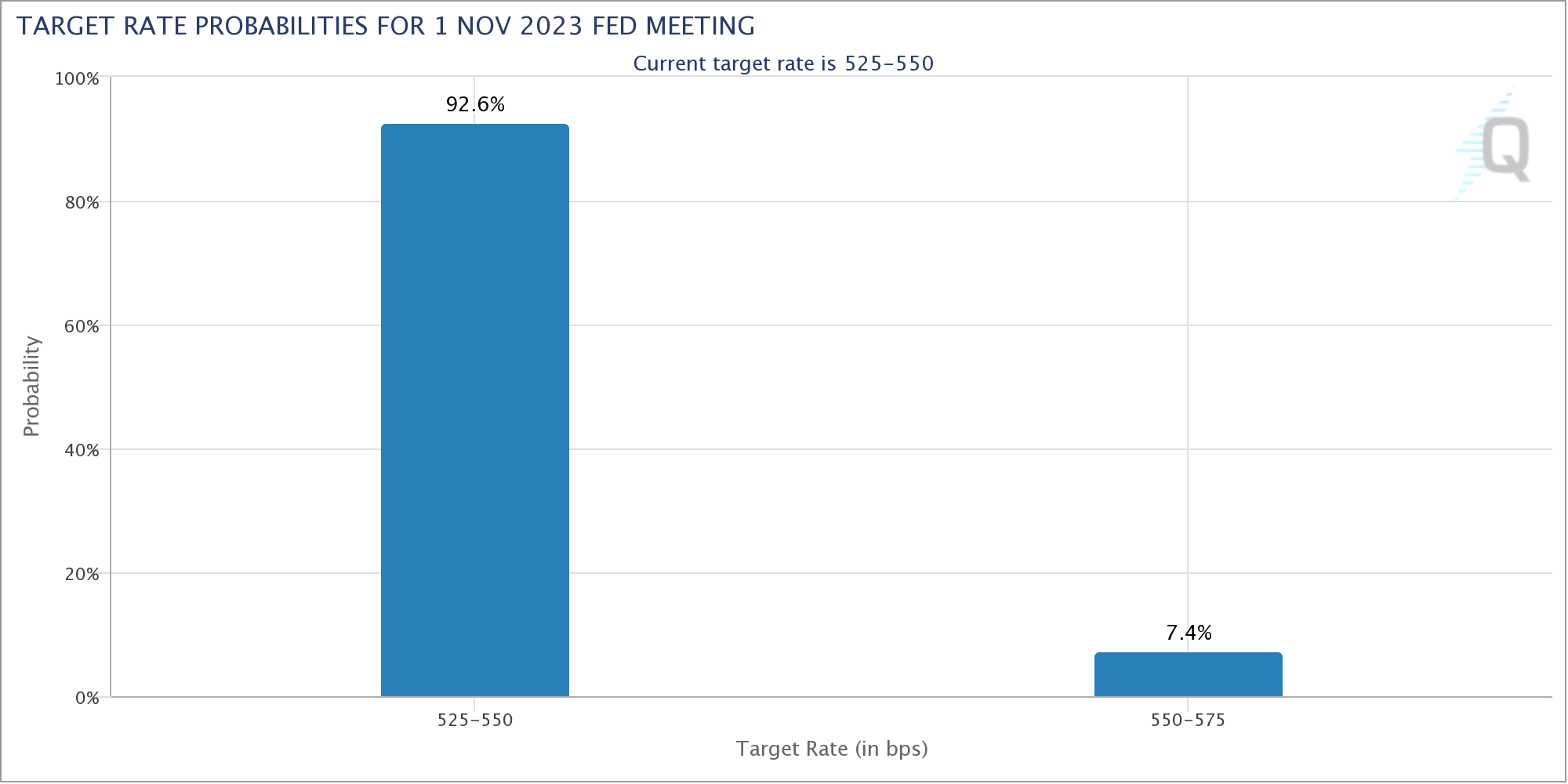

Following the CPI data, the possibility of raising interest rates in the Federal Open Market Committee (FOMC) meeting on November 1 started to be discussed. However, according to the data obtained from CME Group’s FedWatch data analysis platform, the decisions made by analysts kept this rate at a minimum level of only 7.4%.