The DeFi market, which plunged following the downturn on August 2nd in the cryptocurrency market, has regained its momentum and experienced a remarkable revival. According to the latest data, the DeFi market has witnessed a significant increase, reaching a total value of $45 billion and bringing vitality to the sector with the total value of locked tokens.

LINK, INJ, and SNX on the Rise

As of August 13th, the total locked value in the DeFi market has exceeded $45 billion, with a trading volume of $1.8 billion in the last 24 hours. This indicates a 6% increase in total value and a 6.39% increase in trading volume. Chainlink (LINK) has been the shining star among DeFi-focused cryptocurrency projects this week, achieving a 5% increase in value. In addition to LINK, some DeFi-focused tokens such as Synthetix (SNX) and Injective Protocol (INJ) have also experienced significant growth, moving against the sideways trend of the market.

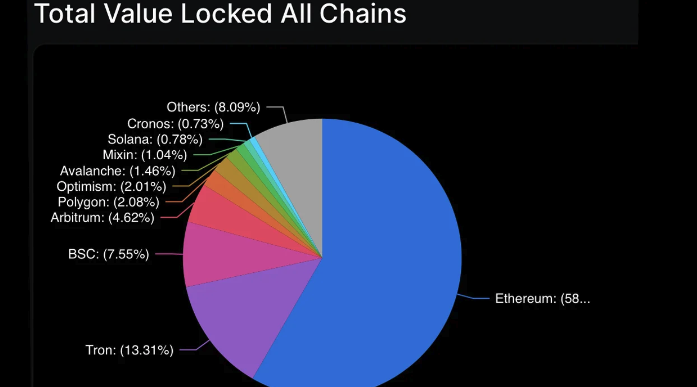

When we look at the valuation of these locked tokens, it is evident that Ethereum remains the dominant network, as expected. However, Ethereum’s share, which is over 58%, has been gradually decreasing over the years. It is quite surprising to see Tron in second place. The main reason for this is the presence of USDT and other stablecoins on the Tron network. Binance Chain ranks third, followed by Arbitrum, Polygon, and Optimism.

The Top 3 Winners of the DeFi Battle

Although Arbitrum, Polygon, and Optimism entered the market much later compared to Avalanche, they have a much larger share in the DeFi market, which is quite surprising. The overall growth of the DeFi market is driven particularly by Polygon, Arbitrum, and Optimism. Knowing that there are 202 blockchain platforms demonstrates the importance of even a 2% share.

While ETH seems to remain the leader for a long time, it could suffer significant losses against layer 2 networks. However, many of these layer 2 networks are ETH-compatible, indicating that the dominance of the Ethereum network will likely continue.