With the rise led by <a href="https://en.coin-turk.com/cryptocurrency-market-shows-strong-recovery-bitcoin-aiming-for-38k/”>Bitcoin in the cryptocurrency market, investments continue to flow into sectors related to crypto. Accordingly, the past month has seen a notable increase in volume in the NFT market, with a significant portion of the increased transaction volume occurring in Blur, the most popular NFT marketplace of recent times within the Ethereum ecosystem.

NFT Market’s Rise Attracts Attention

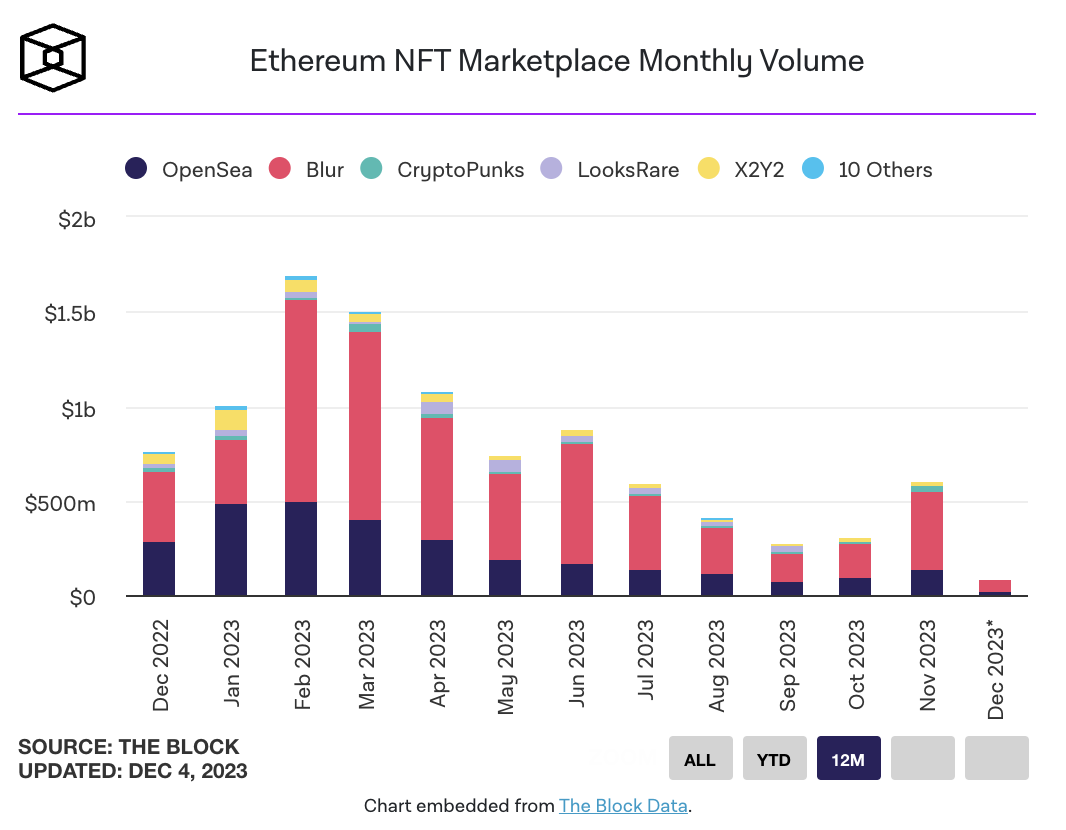

The upward momentum that started with Bitcoin has opened the way for an increase in the altcoin market, which has also led to a serious momentum in the NFT market. Accordingly, in November, the NFT transactions within the Ethereum ecosystem saw a volume worth $605 million. This figure represents an almost 100% increase compared to the $306 million monthly transaction volume experienced in October.

In just the first four days of December, the month’s NFT transaction volume has already reached nearly $90 million, with about $70 million of that occurring on the popular NFT marketplace Blur. Launched in October 2022, Blur is a zero-fee NFT marketplace designed to meet the needs of professional NFT traders.

Blur Takes the Lead in the NFT Marketplace

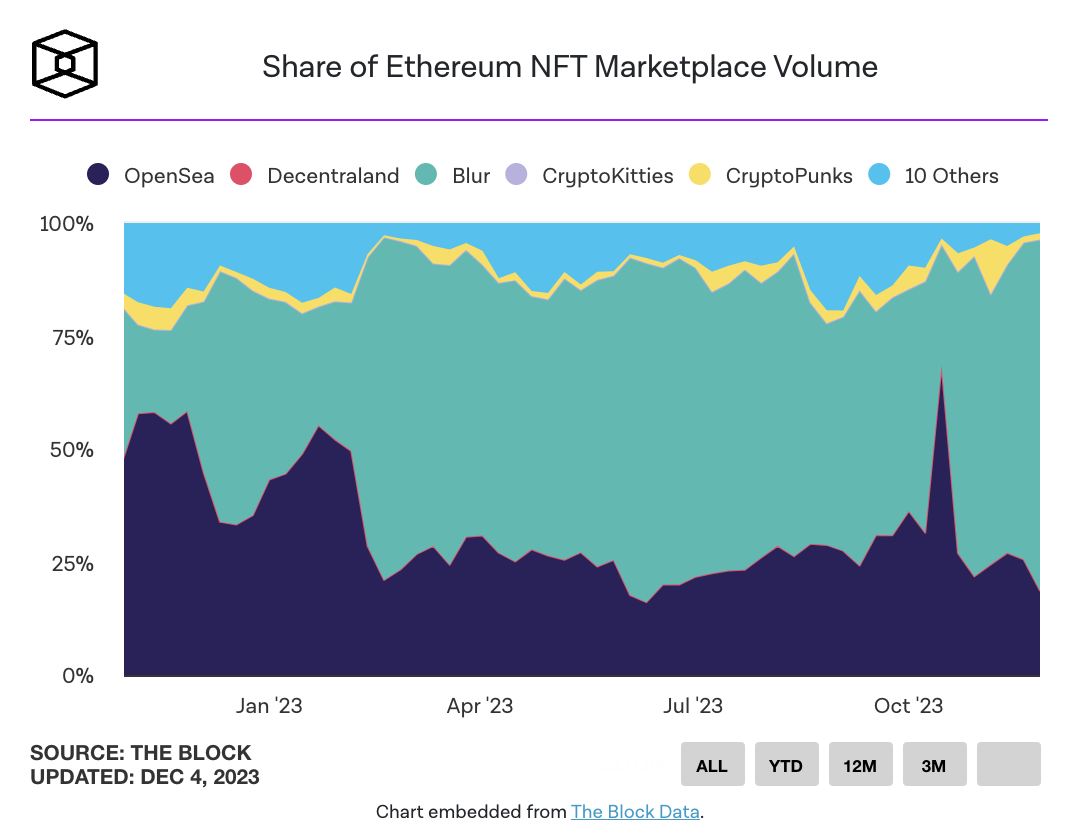

Since February, the NFT market has witnessed a significant market share shift from OpenSea to Blur, and subsequently, the Blur marketplace has now come to dominate almost 80% of the total transaction volume in the NFT market within the Ethereum ecosystem.

Up until last year, OpenSea, which was the largest NFT marketplace in the sector, has experienced a serious loss of users and currently holds about 17% of the NFT transaction volume in the Ethereum ecosystem. One of the biggest reasons for this situation is the ongoing airdrop event carried out by Blur.

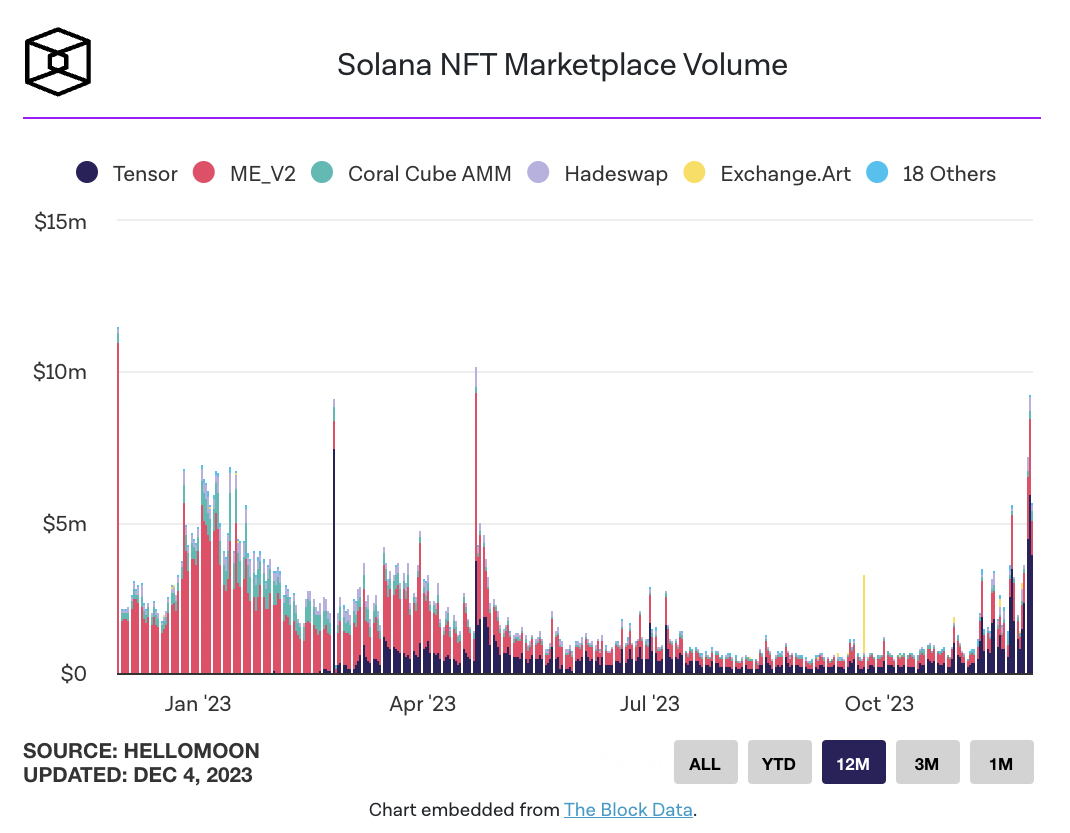

In addition, Solana-based NFT marketplaces are also experiencing a significant increase in trading transactions, with daily volumes rising throughout November. On November 30th, the total transaction volume in Solana-based NFT marketplaces reached $9.3 million, the highest level since April, with a large portion of this volume occurring on Tensor, with daily transaction volumes exceeding $5 million.

Türkçe

Türkçe Español

Español