It was not a great day for cryptocurrencies, but a new era for the markets began last week with the approval of an ETF. The current downturn or weakness, however, could discourage those who were mistaken today about the end of the slump when BTC was below $20,000 from their hopes for 2024. Investors who trade with excessive emotion are highly affected by positive/negative developments.

Dogecoin (DOGE)

The king of meme coins is still the largest by market value, but it has not been delivering for a long time. It’s been about 2 years since we heard that the developers were working on their own smart contract solution. The Dogecoin Foundation did not create the expected impact during this period, and its reactivation did not yield much beyond a few headlines on the first day. Elon Musk does not care about it or the rest of the crypto as much as before, and the outlook for DOGE is not better than the market overall.

The problem is that DOGE is a speculative asset. It does not produce any benefit, and for its story to continue, it needs the involvement of influencers who can direct large crowds. If this does not happen, the social dominance, interest, and headlines of 2021 may not be repeated. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

From this perspective, if we are not going to see a new 2021, DOGE will not have a daily volume of 40 billion dollars and will have to aim for 0.3 dollars instead of 1 dollar.

Dogecoin Analysis

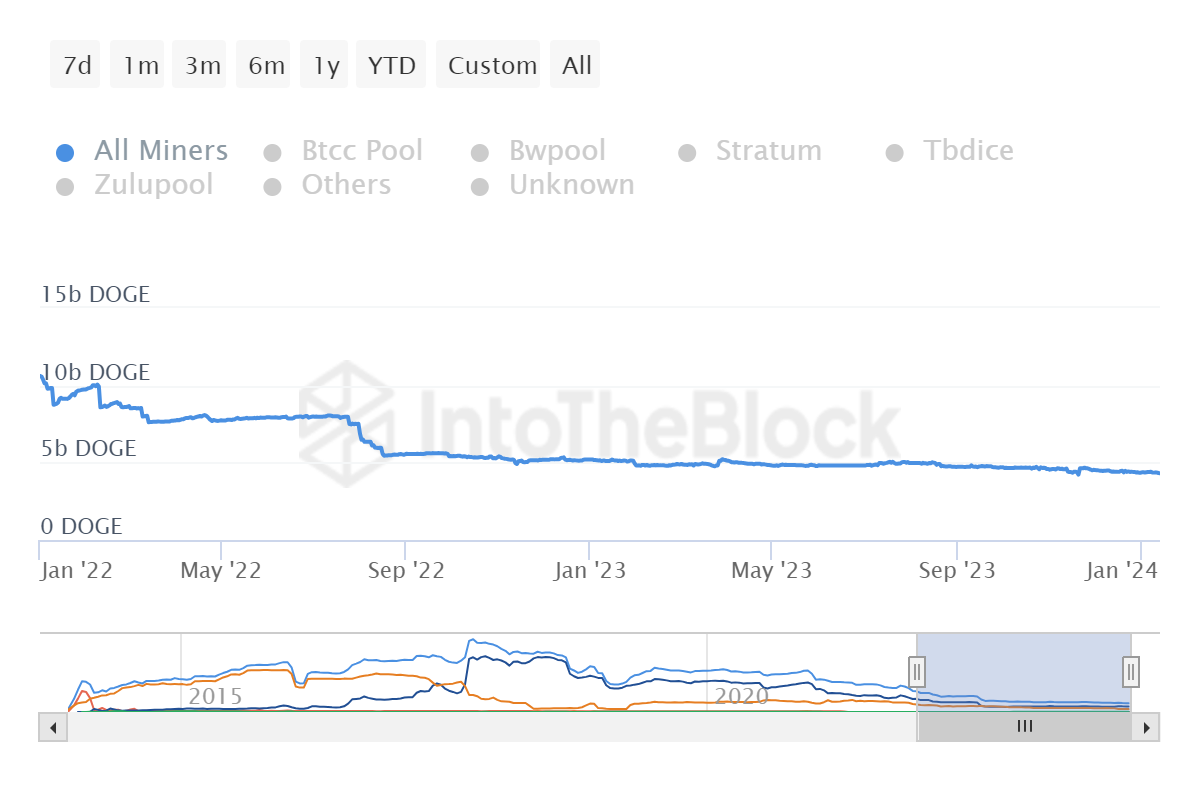

Long-term views are the result of comprehensive observations. The aforementioned issue bluntly confronts the investor with the reality that Dogecoin is moving away from its glorious days. Take a good look below, why is this chart showing miner reserves constantly depleting? Despite the general market rise, why are miners constantly busy with sales?

DOGE reserves, which were at 10.05 billion at the beginning of 2022, have declined to 4.32 billion in about 2 years. It is a fact that the change in sentiment and events that stifle potential have affected the biggest DOGE holders. They have reduced their reserves by nearly 8% in just 90 days and continue to do so at every opportunity.

Important indicators such as social volume and search volume also show that interest in DOGE is waning. Moreover, the growing interest in newer meme coins like PEPE and BONK has weakened Dogecoin. Investors aware of the long-term risks may have to wait for the days when Dogecoin will shine again. During periods of prolonged rise, liquidity will eventually visit assets like Shib and Doge for rapid ascents, but this does not seem to be happening in the short term.

Türkçe

Türkçe Español

Español