Tron (TRX) has seen its total locked value (TVL) rise to $7 billion, indicating a strong network. With the cryptocurrency showing an upward trend in the second half of October, investor confidence was also increasing.

TRX Price Prediction

A previous price analysis highlighted a downward trend and suggested a possible pullback towards $0.0869. Although there was a slight decrease, it was not as deep as expected. This reflected the strong bullish trend in the market.

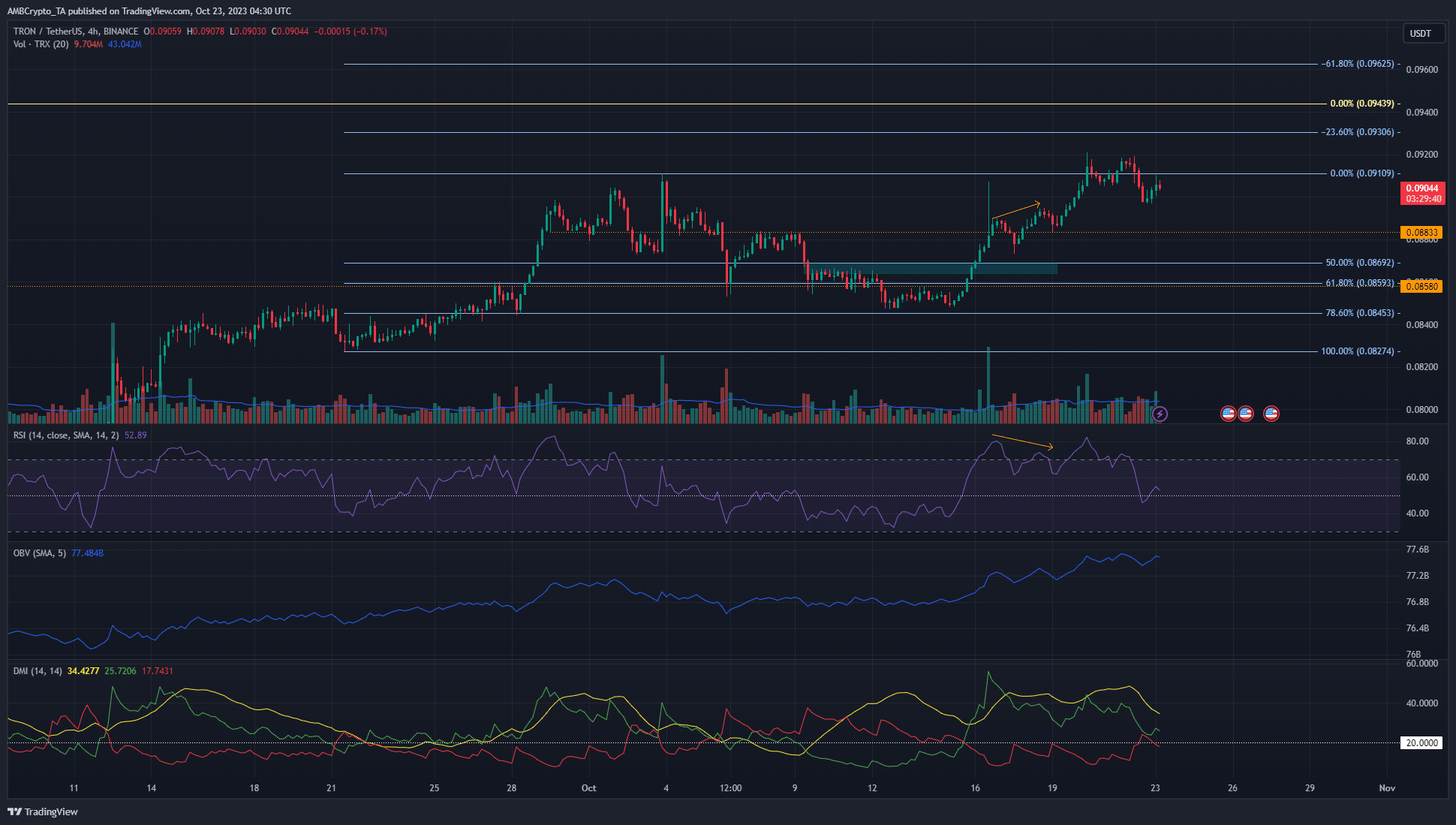

In mid-October, the cryptocurrency retraced its September rally and tested the 78.6% Fibonacci retracement level at $0.0845. Since then, bulls have managed to sustain a strong uptrend and broke the local resistance at $0.0883. At the time of writing, TRX was trading at $0.0911. The Fib extension levels indicated potential profit-taking levels for bulls at 23.6% and 61.8% extension levels, which were $0.093 and $0.0962, respectively.

Additionally, the $0.0944 level marked the highest point during TRX’s rise from $0.0645 in June and July. The RSI on the H4 chart was neutral, close to 50. The market structure favored the bulls, but breaking the recent low of $0.0905 could indicate a change in structure.

Current Data for TRX

However, the DMI, ADX, and +DI signaled the continuation of a strong uptrend with their values above 20. The cumulative delta levels reached $15.89 million. There were nearly $1 million short liquidations at the $0.089 level, and more at $0.0088. Long position liquidations were not significant.

Therefore, it is possible for TRX to experience a short-term pullback to capture these liquidation levels. Investors may expect a decline and change in the lower time frame market structure before entering long positions.

Türkçe

Türkçe Español

Español