Bitcoin’s attempts to rise above $40,000 are being thwarted by recent developments. Several events have been exerting significant pressure on the cryptocurrency markets. The FUD surrounding Tether and Binance has largely subsided. However, the pressure from MTGOX and Silk Road continues.

US to Sell Bitcoin Seized from Silk Road

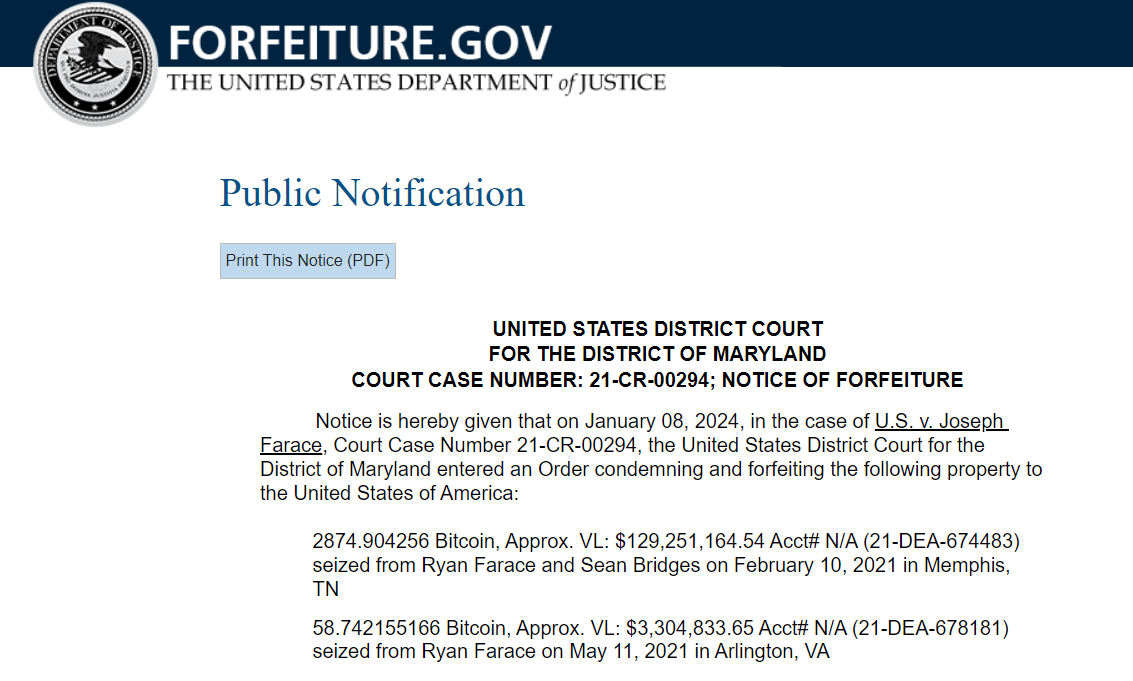

MTGOX has started sending notifications to creditors this week. The US has just announced that it will sell $130 million worth of BTC seized during the Silk Road operation. This notification is to allow individuals who may have a claim on the assets to come forward. If no claims are made, the sale is expected to occur within 2 months.

Since the Silk Road assets were seized during a Dark Web operation, no claims on the assets are expected. Therefore, it is likely that the US will officially conduct the sale before April. Although the figure might negatively impact the market in the short term, it is relatively small compared to the GBTC redemptions. Therefore, there is no need for investors to panic.

The real issue is whether the US will decide to sell other BTC assets (worth billions of dollars) it holds during this quarter. Additionally, the MTGOX distribution expected to be completed by the end of the year will also create a billion-dollar pressure on the market.

Türkçe

Türkçe Español

Español