Warren Buffett, the world-renowned investor, has been attracting the attention of many investors with his stance on the cryptocurrency market, sparking debates within communities. However, Buffett’s position in the crypto-friendly bank he acquired in 2023 continues to make him happy. According to this, Nubank shares are experiencing one of the best rises in recent times.

Warren Buffett’s Notable Investment

Known as the Oracle of Omaha, Warren Buffett purchased 107 million shares of Nu Holdings, the owner of a Brazil-based fintech company and crypto-friendly Nubank, in two separate rounds through Berkshire Hathaway in 2021.

In June 2021, Berkshire made a $500 million investment in Nu Holdings, and in December 2021, it added $250 million worth of shares to its account. According to the second quarter earnings report of 2023, the company has not sold a single share since then.

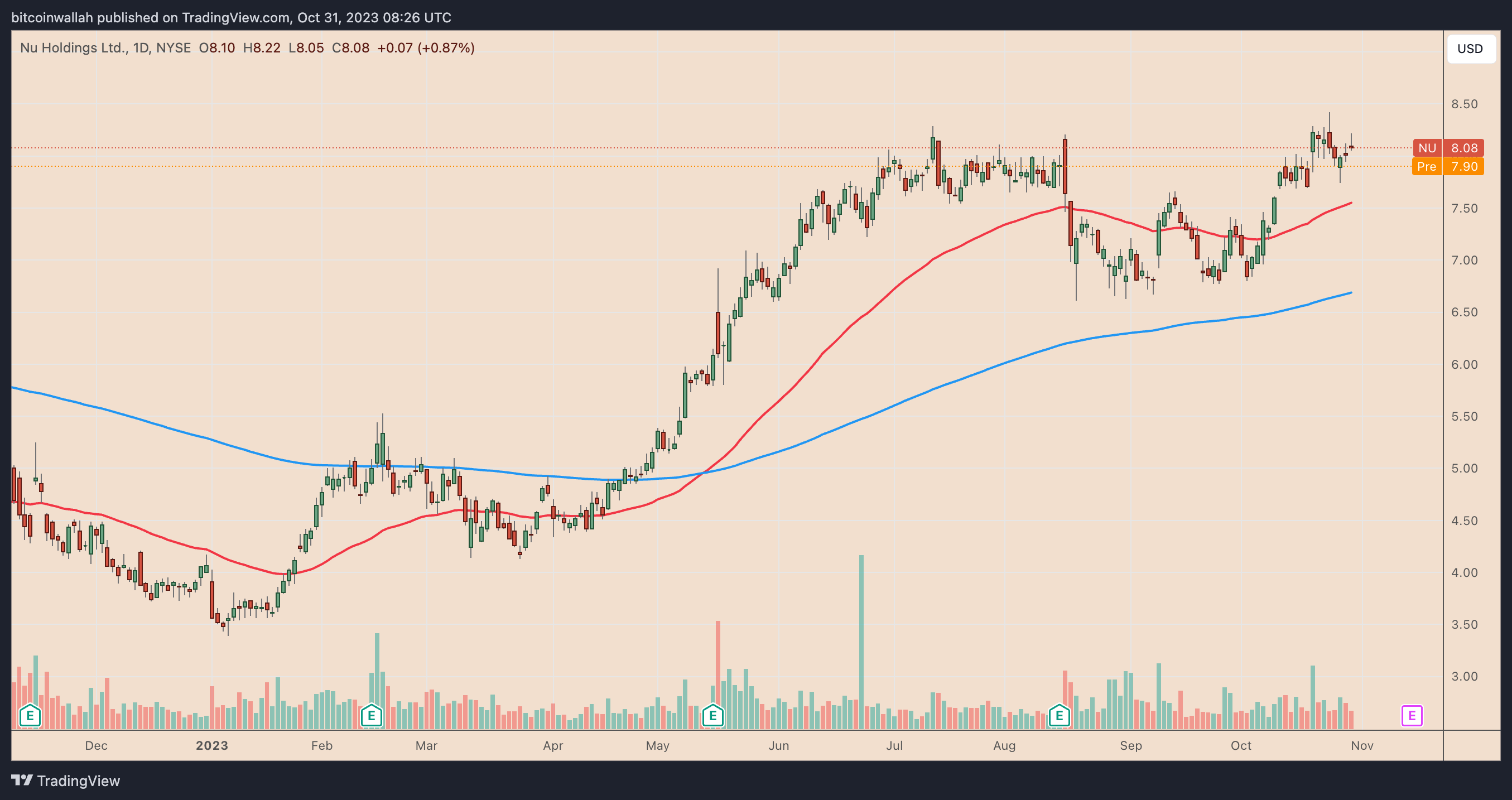

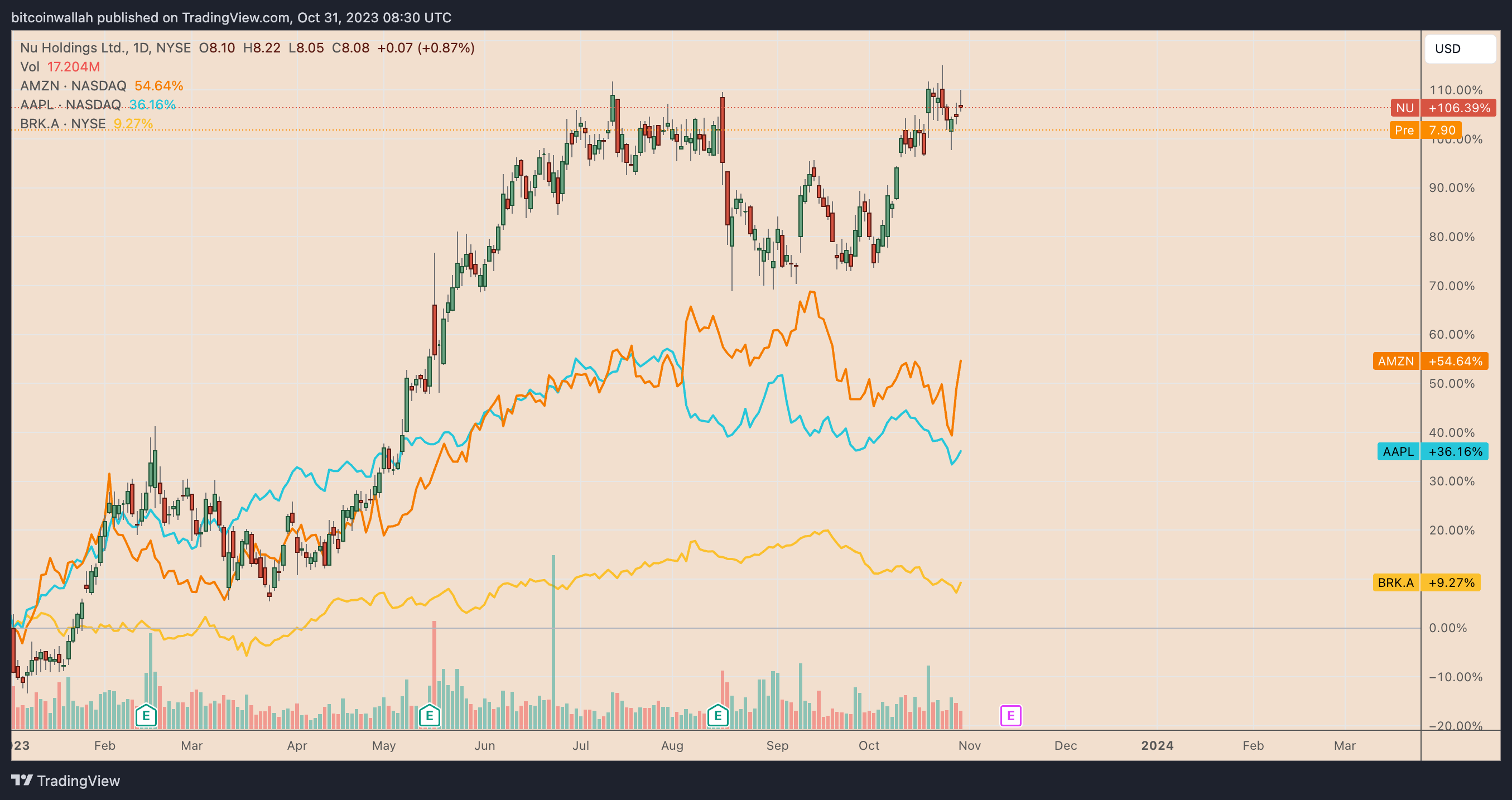

The share price of Nu Holdings has currently increased by approximately 106% since the beginning of the year, and assuming Buffett has not sold any of his Nu shares, his $750 million position is now worth approximately $879.5 million. However, during the rise in February 2022, the value of the position reached over $1 billion.

Berkshire Hathaway’s Nubank Wave

Nubank is known as a crypto-friendly bank as it offers crypto-related services to more than 1.35 million users in some departments. Therefore, investing in the bank can be seen as indirectly engaging with the crypto industry.

This includes Easy Invest, a trading platform that offers a Bitcoin exchange-traded fund (ETF) product, and Nubank, a crypto financial services platform that offers BTC and Ethereum trading services. Nubank also launched a loyalty token on the Polygon blockchain network. In addition, in May 2022, Nu Holdings invested 1% of its cash assets in Bitcoin, and company officials made the following statement:

“This move reinforces the company’s belief in Bitcoin’s current and future potential to disrupt financial services in the region.”

Nubank, with over 80 million customers in Brazil, stands out as the largest fintech bank in Latin America. Another interesting fact is that while Buffett’s other major holdings, Amazon, gained 54.65% in value, and Apple gained 36% in value, Nu shares outperformed these companies.

As of September 2023, Apple is Berkshire Hathaway’s largest investment, accounting for approximately 45% of its $354 billion investment portfolio. Nu also outperformed Berkshire Hathaway’s stocks, rising by 9.25% annually.

Türkçe

Türkçe Español

Español