New research indicates that whales have been purchasing Bitcoin, maintaining pressure above a critical resistance level until April 24. According to TradingView data, Bitcoin’s price movement saw a rise to $67,000 following the latest daily close. Bulls, still in a tight range, continued to move away from order book liquidity for the BTC/USD pair.

Investors Continue to Accumulate

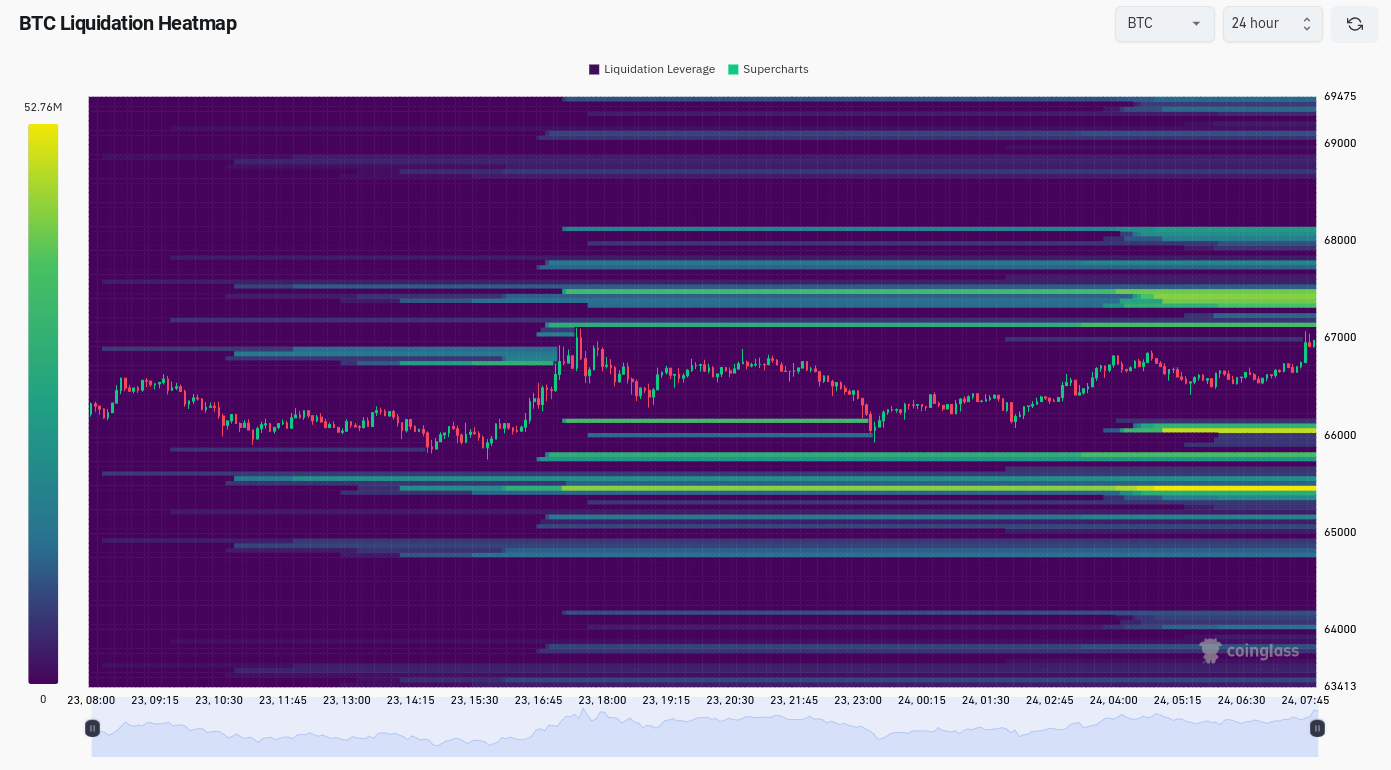

According to current figures from the blockchain data analysis platform CoinGlass, approximately $35 million worth of bid walls were absorbed at the daily close on Binance, with most of the selling liquidity now positioned between $67,000 and $67,500.

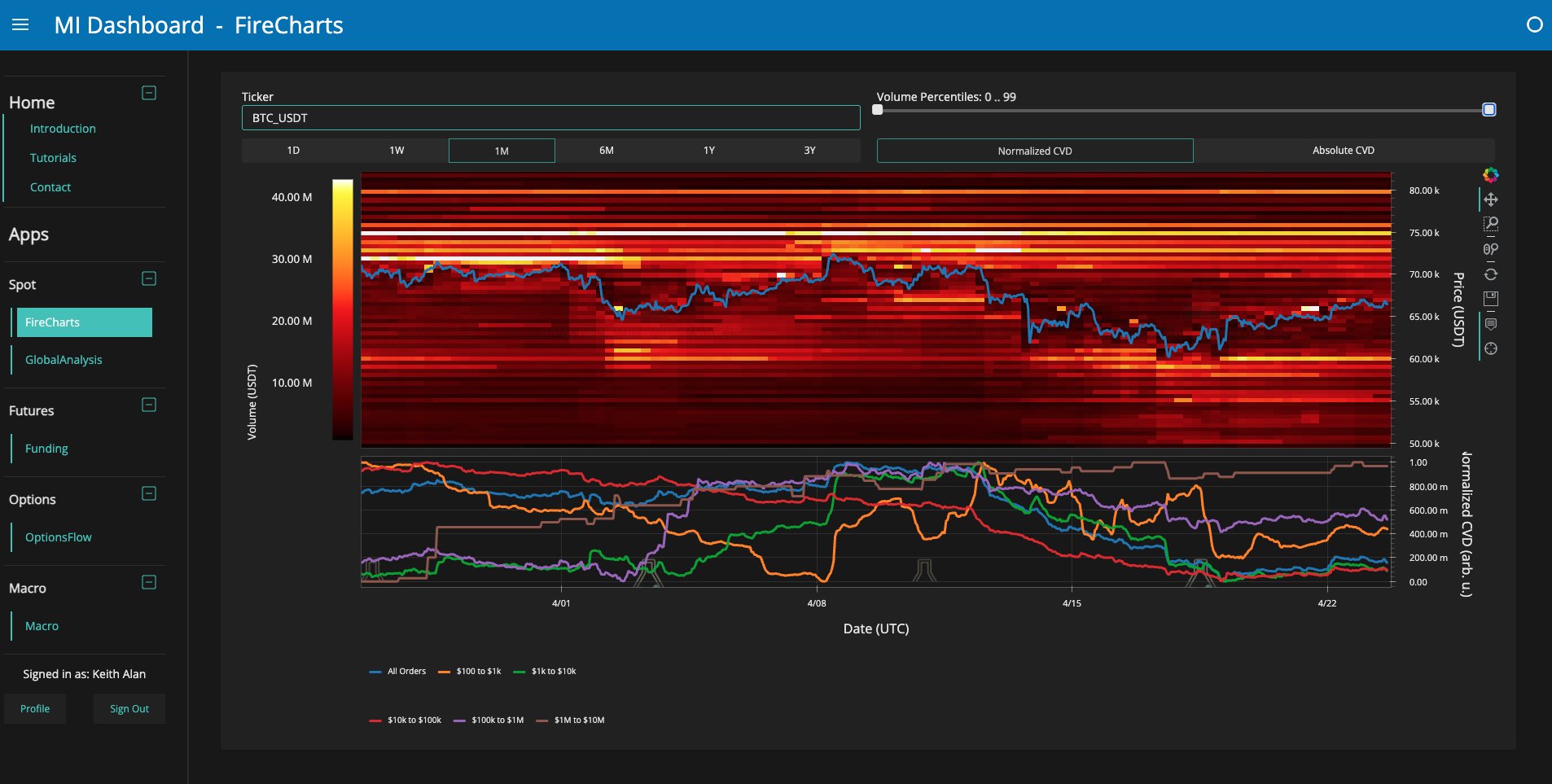

Trade source Material Indicators mentioned in a post that the 1-month view of the order book shows how dynamic changes in liquidity settlement affect the overall price movement. The NET effect of Bitcoin blocks, with liquidity demand moving downward and some bid liquidity blocks moving higher, narrows the active trading range approximately from $62,000 to $68,000.

An accompanying chart also displayed trading behavior among Bitcoin whale classes. Interestingly, unlike others, the $1-10 million order category increased risk until April. This contributes to current data from research firm Santiment, revealing FOMO now exists among wallets holding between 1,000 and 10,000 Bitcoins. Santiment shared through X:

“The key whale class holding 1,000-10,000 Bitcoins is supporting this rise, and this group has accumulated an additional 266,000 Bitcoins since the start of 2024. This represents an accumulation of 1.24% of the total supply.”

What’s Happening on the Bitcoin Front?

Meanwhile, trading firm QCP Capital suggested that crypto markets might enjoy a period of low volatility before any seismic changes occur. In the latest edition of New York Color market updates sent to Telegram channel subscribers, QCP described the situation as an unsettling silence:

“Bitcoin is right in the middle of the $60,000 to $73,000 range, and front-end Bitcoin volumes are approaching 60%. Last week we experienced the fourth Bitcoin halving event, and the market panicked as war broke out in the Middle East.”

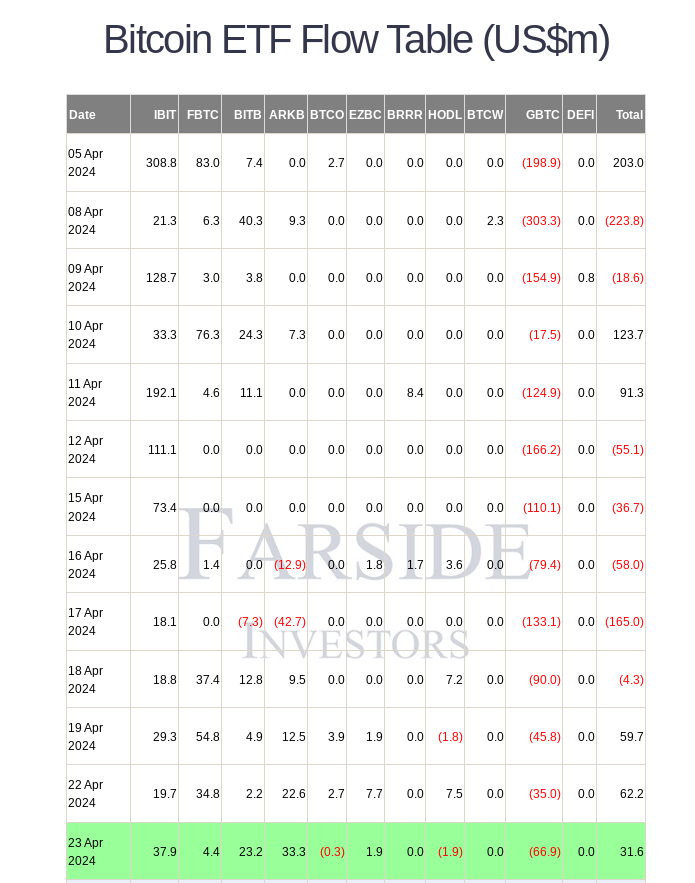

Analysts referred to a reset in Bitcoin funding rates and a slow but steady return of interest in the US spot Bitcoin exchange-traded funds, with BlackRock publishing entries for 70 consecutive days, indicating ongoing demand from TradFi, albeit at a slower pace.

Türkçe

Türkçe Español

Español