In September 2021, the price that exceeded $3 is now down 90% at $0.33. The bear market was challenging. The fundamental motivation for ADA Coin investors during the last bull season was a Cardano network that could rival Ethereum with its smart contract capabilities. However, despite several major updates, this did not happen.

Why is ADA Coin Rising?

The two-day Cardano Summit 2023 event held from November 2nd to November 4th was expected to have a positive impact on the price. And it did, pushing ADA Coin beyond the challenging $0.33 range. The fundamental motivation was fueled by the optimism supported by the potential approval of ETFs since October 19th.

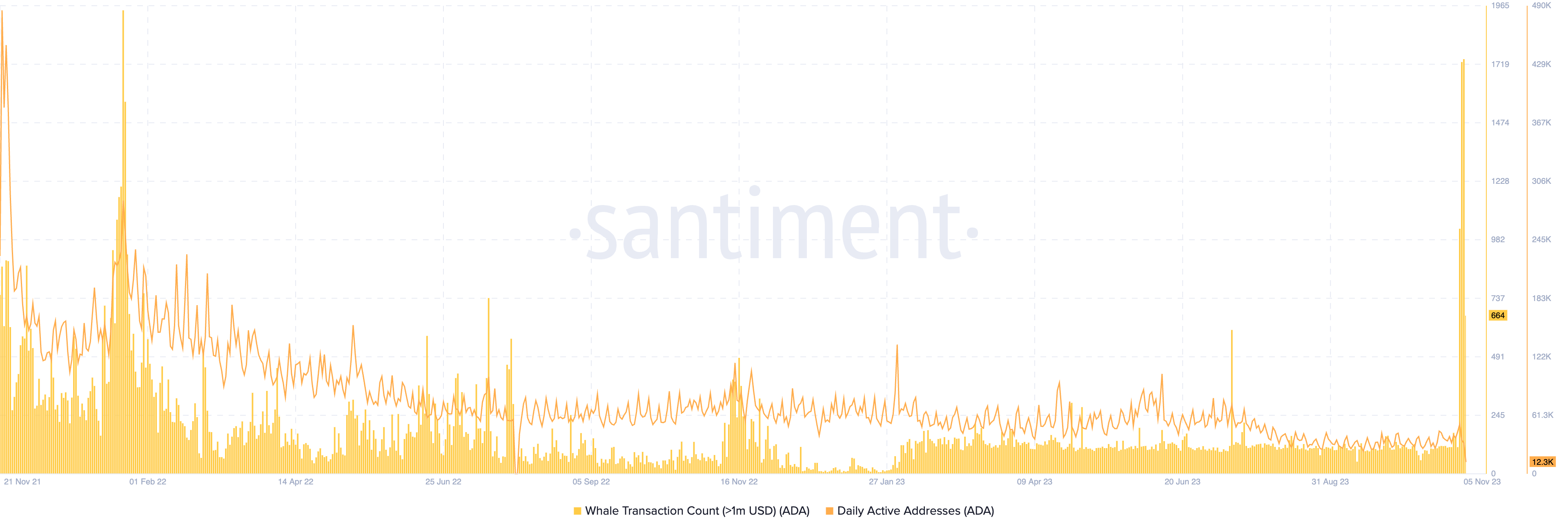

Although it did not attract much attention since the recent BTC rally, we have seen that the price of ADA Coin has gained about 40%. Along with the price, there has been a significant improvement in whale activity on the Cardano network. According to Santiment, the number of transactions exceeding $1 million reached 1742 on November 4th, reaching the highest level since January 2022. However, the daily active address count remains weak.

The increased whale activity along with the price indicates that senior investors are returning to accumulation.

The Future of Cardano

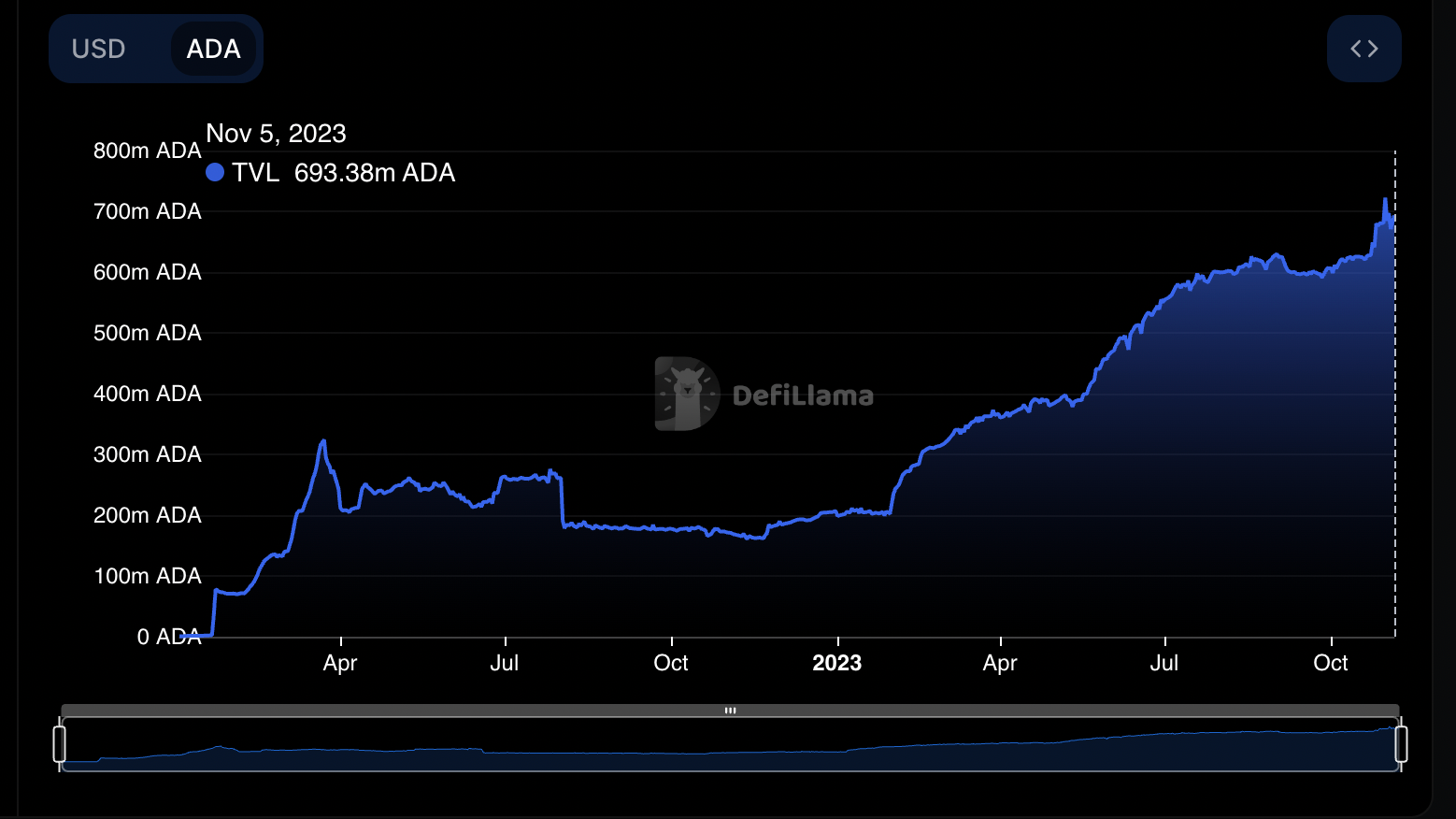

According to the data provided by DefiLlama, the total locked value (TVL) on the Cardano network reached a record level of 680.76 million ADA as of October 31st. The number of investors on the network, the density of active addresses, and the tangible value of assets on the network are important. If Cardano can sustain this recovery, it can continue to rise steadily. On the other hand, the adoption rate of ambitious initiatives that directly affect token prices, such as DJED stablecoin, should also increase.

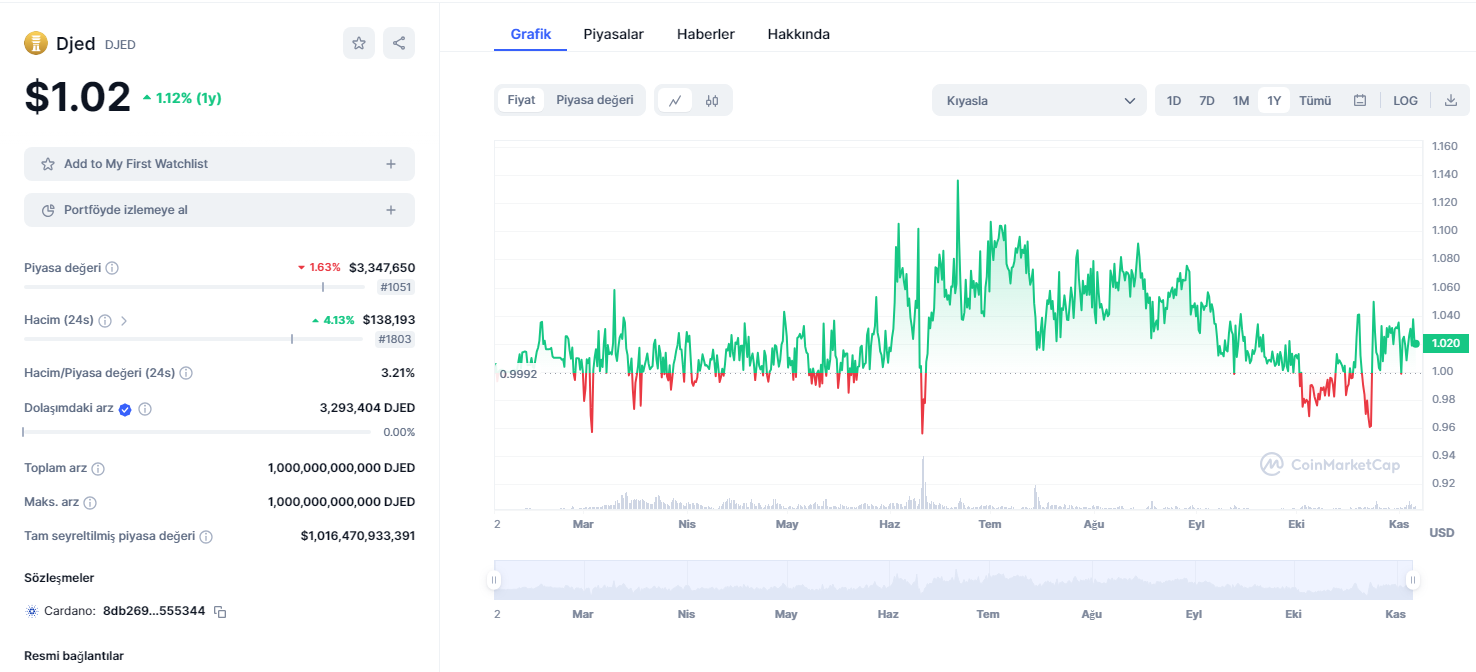

Although no one talks about it these days, every Cardano investor focusing on long-term goals should keep an eye on DJED data. At the time of writing, the stablecoin, which generates only $130,000 in daily volume, has a circulating supply of $3.29 million. The price is above $1, but both the volume and demand are very weak. If the Cardano DeFi ecosystem can grow, this stablecoin, which is overcollateralized with ADA Coin similarly to the mechanism between LUNA and UST, can be considered one of the biggest catalysts for the price.

Speaking of price, ADA Coin successfully broke out of the falling wedge formation on October 1st. Falling wedges are considered formations where the rise reverses. As a rule, the target of a rising wedge is equal to the maximum distance between the upper and lower trend lines.

Accordingly, the price of ADA Coin could reach $0.359 in the short term (if BTC doesn’t experience a sharp sell-off, at the time of writing, it dropped to the $34,740 range with a few sales).

Türkçe

Türkçe Español

Español