BTC price is currently at $40,195 as the markets are recovering from yesterday’s low. The U.S. stock market opening time has become more significant for crypto investors this month. Spot BTC ETFs continue to attract intense interest, and a balance is beginning to form on the GBTC front.

Why is Bitcoin Rising?

After ETFs began trading, GBTC investors who had been expecting the reversal of a long-standing negative premium made massive sales. Knowing this, Grayscale kept its ETF management fee at a comparatively high 1.5%, which was significantly above its competitors who were charging fees below 0.3%.

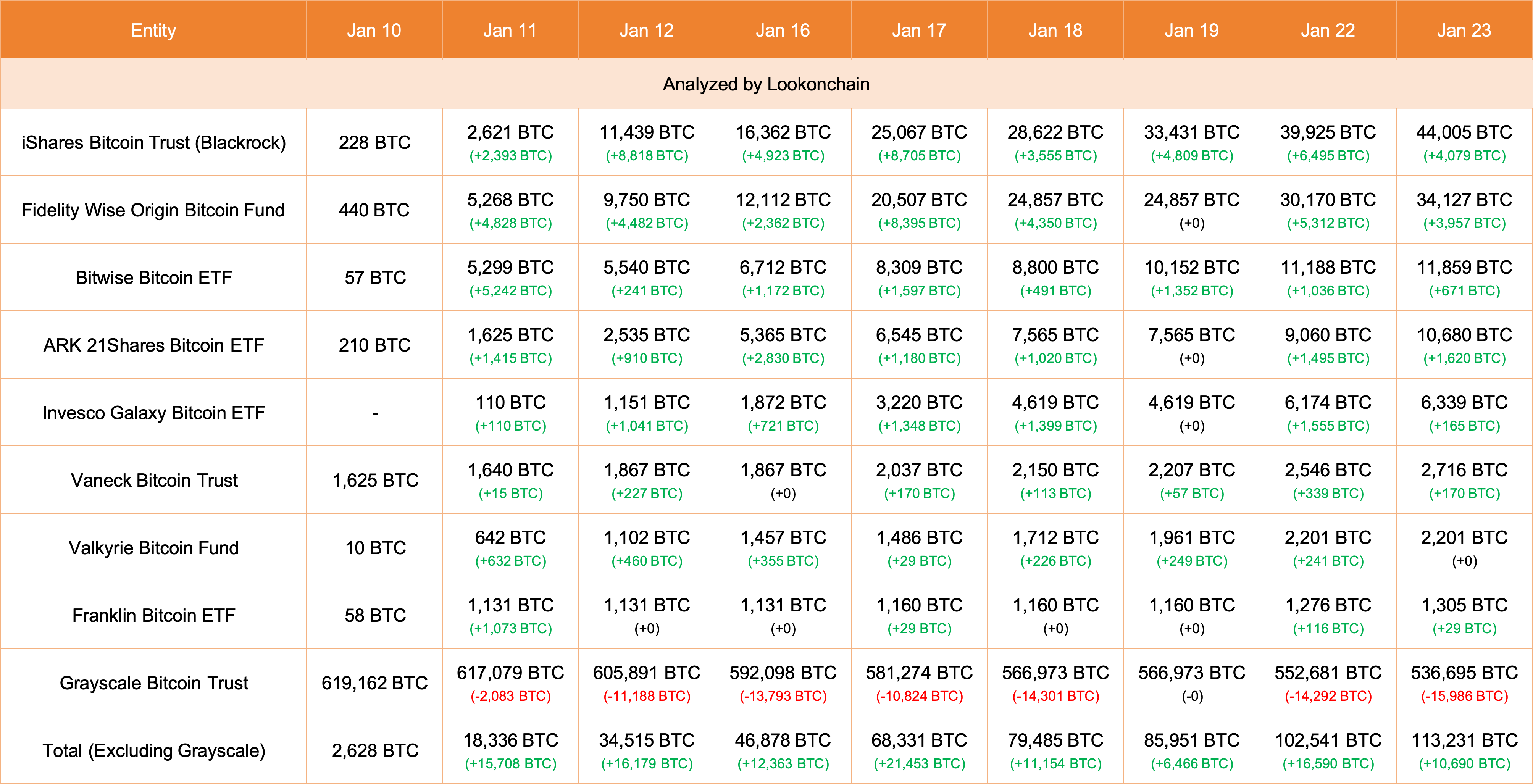

However, we now see that while demand for ETFs other than GBTC is increasing, their reserves continue to grow. As of yesterday’s market close, the total BTC reserves of ETFs, excluding GBTC, reached 113,231.

GBTC reserves started the day at 536,695, down from 619,162 on January 10th. Fortunately, we see the panic starting to subside as BlackRock and Fidelity alone have generated demand for around 80,000 BTC.

2024 Spot Bitcoin ETF Predictions

Experts predict that entries into spot Bitcoin ETFs will continue until the end of the year, leading to an increase in reserves. The total size of ETPs and other funds is currently at $30 billion. According to CoinShares experts, if this figure increases by 10%, BTC could reach a new peak between $50,000 and $60,000.

However, this figure should be much higher. At least the latest data indicates reserves of over 100,000 BTC in just a 10-day period, excluding GBTC, making this possible. It has not even been a full week of trading since the ETF approval. By the end of this week, spot Bitcoin ETFs will have completed their first full week of trading.

In the coming weeks and months, interest is expected to multiply as other asset managers add support for ETFs. Franklin, which manages over a trillion dollars in assets and is among the issuers, stated that it is still early days and that advisors will bring spot Bitcoin ETFs to more investors.